Who Will Set the Rules for Smart Factories?

Leadership in information governance will provide a first-mover advantage to the nation’s manufacturing sector.

Globalization and advanced technology have defined twenty-first century manufacturing, creating a hypercompetitive environment where continuous growth in productivity has become imperative—not just for the success of firms, but for their survival. Nowhere is this more apparent than in the movement toward smart manufacturing—defined by the National Science and Technology Council as “the integration of sensors, controls, and software platforms to optimize performance at the production unit, plant, and supply chain levels.” Such digital integration, facilitated by what is being called the Industrial Internet of Things, allows for real-time decision-making via data analytics, including the use of artificial intelligence (AI) techniques, such as machine learning.

A chorus of voices—from consulting firms, market research firms, manufacturers, and government agencies—believe that owners of smart factories will reap huge economic rewards from enhanced sensing and monitoring, seamless data transmission, new waves of automation, and analysis of big data. Some market forecasts suggest that these factors can produce $1 trillion in added value by 2025—which could translate into a doubling of operating profit for a typical manufacturing firm. In the minds of many, digitalization represents the next industrial revolution.

Getting there, however, won’t be easy. It will require massive investment in capital equipment, labor (new skills will be needed), and technology (R&D). And it will be shaped by information governance—norms of behavior for the creation, transmission, storage, analysis, use, valuation, security, and deletion of information. These norms of behavior—or rules—are still evolving. Drawn by the high stakes, leading manufacturing nations have come to the table to set the rules. Whichever nation prevails will provide its domestic producers with a competitive edge.

Elements of information governance

Before exploring what nations are doing, let’s first describe the key elements of information governance. They include, but are not limited to, technical standards, cybersecurity, data privacy, digital trade, and AI.

Technical standards are specifications, in the form of rules or guidelines, for materials, products, processes, or services (such as communication between machines, systems, hardware, and software). Standards often are based on technologies that embody intellectual property (IP). Without technical standards to govern the flow of information within and across a firm and its supply chain, smart manufacturing cannot happen.

Smart manufacturing will rely on highly integrated value chains, which will raise the stakes for cybersecurity. Value chains comprise the full range of activities that businesses go through to bring a product or service to their customers. The integration of information technology (IT) and operations technology (OT)—a necessity for the creation of smart factories—raises particular challenges. Most existing OT systems do not have the capacity to add cybersecurity protections without an adverse impact on production.

Smart manufacturing will involve the collection and management of personal information (on workers, customers, and suppliers), which is increasingly subject to local, state, federal, and international regulation. Data will become increasingly valuable as inputs and assets for manufacturing firms, which will reshape relationships between firms, workers, customers, and suppliers. This will require an emphasis on privacy. For example, the European Union’s (EU) General Data Protection Regulation (GDPR), which went into force on May 25, 2018, is having an impact well beyond that of its member states, and is inducing changes in the practices of global manufacturers.

Digital trade is a broad concept, capturing data flows across global value chains, services that enable smart manufacturing, and other platforms and applications. As nations create policies to benefit their domestic industries, international disputes over digital trade will become more frequent and consequential. Provisions governing digital trade can be seen in new trade agreements, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, a free trade agreement between 11 countries in the Asia-Pacific region.

The application of AI—using algorithms that find patterns in data and facilitating decisions based on those patterns—in a manufacturing setting is growing. AI is being used to design new products, train workers, create collaborative robots (cobots), enhance quality control, and optimize supply chains. Future applications may require modernization of outdated regulations and/or the development of new rules to address issues unique to AI-enabled goods such as autonomous vehicles, medical devices, and aerospace components. Norms for the application of AI (via regulation or standards or other means) will therefore impact smart manufacturing.

It is not difficult to foresee these elements of information governance shaping and limiting opportunities for smart manufacturing. Interoperability—which cannot be achieved without technical standards—is critical to the advent of the Industrial Internet of Things. Lax cybersecurity somewhere along a complex and multifaceted supply chain will create a vulnerability for manufacturers and therefore discourage investment in supply chain integration. Policies that limit the flow of digital information across national borders (e.g., data localization requirements) can and will become nontariff trade barriers.

Different nations, different approaches

Economists have long observed that developing countries utilize industrialization as a tool for productivity and growth. Even wealthy nations seek to foster domestic manufacturing—by offering incentives for the production of goods with ever greater added value. Increasingly, they do this through public policies that promote innovation. A recent report from the Information Technology and Innovation Foundation documented 10 countries with national plans to digitalize their manufacturing sectors. Together, these countries dominate global manufacturing today—and they aim to maintain or elevate their relative position through smart manufacturing.

A close look at three leading manufacturing nations reveals very different approaches toward smart manufacturing and information governance. We label these approaches as managed (China), coordinated (Germany), and market-driven (United States) to reflect the government’s role toward its manufacturing sector. Table 1 summarizes the major differences in approach between these countries.

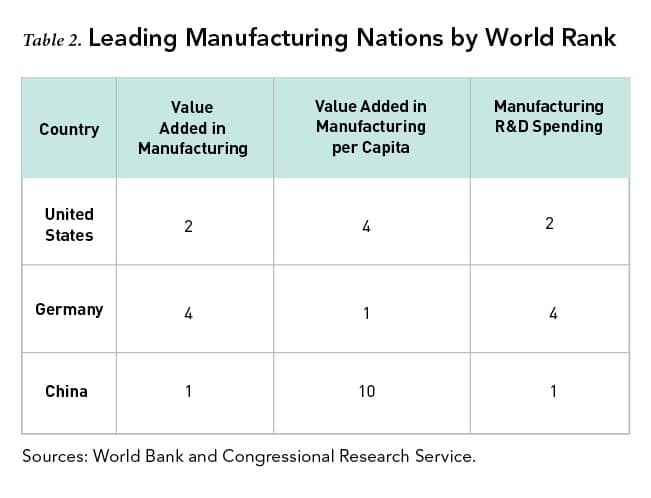

China’s managed approach. In 2011, China surpassed the United States to become the leading manufacturing country in terms of total value added (i.e., total sales less the total cost of purchased inputs, such as raw materials and electricity), but is just tenth in value added per capita because of its huge population. In terms of spending on manufacturing R&D, China leads the world. See Table 2.

China’s rise as a manufacturing country coincided with its admission to the World Trade Organization in 2001. However, China has come to recognize that the strategy that led to its success is neither sustainable nor desirable. It sees the threat posed by lower-cost production in developing countries (over the past decade, China’s labor costs have risen 10% per year, a consequence of its remarkable rise in labor productivity).

For China, it is imperative that its economy avoid the so-called middle income trap: when growth slows after a country reaches middle-income status. With smart manufacturing, China aims to lead in the production of the highest-value-added products, and it aims to get there quickly. As China’s president, Xi Jinping, recently noted, “The Fourth Industrial Revolution is unfolding at an exponential rather than a linear pace.”

China’s approach to smart manufacturing and its information governance can be characterized by several basic factors: a top-down approach in which government sets long-term performance goals and intervenes as necessary to achieve these goals; policies and practices that ensure Chinese firms become global leaders; and placement of individual rights as subservient to national goals. This approach can be seen most clearly in China’s long-term manufacturing plan, in its development of technical standards, in its new cybersecurity law, and in its approach to AI.

Made in China 2025. In 2015, China announced its Made in China 2025 (MIC2025) strategic plan. Inspired by Germany’s Industrie 4.0 strategic initiative, the plan is both broad in coverage (much of its content would benefit all of manufacturing) and narrowly targeted (covering 10 specific subsectors). It is supplemented by dozens of other policy documents, some of which are complementary (e.g., the Internet Plus Action Plan and the MIC2025 Major Technical Road Map) and others that are subsidiary (e.g., more than 70 provincial plans issued to align with MIC2025). MIC2025 is heavily supported with public funding—to a much greater extent than in either Germany or the United States.

Technical standards. China recognizes the strategic importance of global technical standards—and the IP embedded in such standards. In the beginning of this century, its manufacturing sector utilized standards based on intellectual property owned by foreign firms. This led the country to seek low royalty payments in exchange for market access. Over time, as its economy grew and its manufacturing firms became more sophisticated, China shifted its strategy. Its government participates actively in global standard-setting bodies that are of strategic importance. And it is aggressively writing standards for emerging technologies to benefit its own firms. It reportedly is “exporting” its own standards through its “Belt and Road” initiative.

Cybersecurity. China’s cybersecurity law, which went into effect in June 2017, is premised on cyberspace sovereignty—something China has long asserted with respect to the internet—and has been described as emphasizing security over the free flow of data and freedom of speech. Provisions of the law apply to “network operators,” defined as all businesses that manage their own data network (including email), and to “critical sectors,” which include energy, transport, water, financial services, and public services. It requires covered entities to store select data within China (data localization), prohibits information and data on Chinese citizens to be sent abroad without government permission, and allows Chinese authorities to conduct spot checks on a firm’s network operations (which could include providing source code). China has also issued data protection standards, modeled after the EU’s GDPR, that detail how individual consent can be obtained from Chinese citizens.

AI. China not only plans to lead the world in AI technology (by 2030), but also in AI governance through development of standards, including standards on ethical and social issues related to AI. In 2018, China created an AI road map that lists 23 critical near-term standards and 200 other standards that have been issued or are under development. The Chinese government plays an active role in writing AI standards.

China’s road to smart manufacturing faces a major hurdle: it will be very expensive, much more so than for Germany or the United States. There are several reasons. China has a larger manufacturing sector than Germany or the United States, so it will simply take more resources to transform it. A significant proportion of Chinese manufacturing is technologically deficient, so China has much farther to go to create smart factories than its major strategic competitors. Its managed approach necessarily has a higher failure rate (a higher percentage of bad investment decisions) than would a nation with a true market economy. And China must also change its product mix to suit foreign tastes: making three-wheeled minicars for its domestic market is not the same as making luxury and performance vehicles for export to the EU or the United States.

Can China achieve its long-term goals without leveraging significant foreign investment and foreign technology? Probably not. Can it continue to attract foreign capital absent reforms that accelerate the country’s transition to a true market economy? If not, then China faces a catch-22 of sorts: to achieve world-class leadership in smart manufacturing, it must reform the very approach that it is counting on to get it there.

Germany’s coordinated approach. Germany has long been a global leader in manufacturing. It is the world leader in value added per capita. It is fourth in manufacturing R&D spending. The share of its economy devoted to manufacturing is among the highest in the world and has remained remarkably stable over decades while those of other industrialized nations have waned. Its trade balance in manufactured goods is large and positive, making it an export-driven sector. The high quality of its products—consider machine tools—is both globally admired and the envy of its strategic competitors.

Key drivers of Germany’s success in manufacturing include a highly skill-intensive labor force; a rich network of policies and institutions (e.g., the research-oriented Fraunhofer institutes located throughout the country) that enable German companies to maintain high productivity; a high degree of entrepreneurship (embodied in its small- and medium-sized enterprises, collectively known as the Mittelstand, that form the backbone the country’s economy); and its strategic management of place, or Standortpolitik, in which each state, region, and city has a mandate with the responsibility to achieve and sustain economic prosperity. In Germany, it is up to the local community, working closely with the state and federal levels, to not only leverage and build on its strengths but also implement many of the key policies, such as the apprentice system, technical universities, translational knowledge institutions, and support of the Mittelstand.

All of these factors are reflected in Germany’s approach to smart manufacturing. Launched officially in 2013, Industrie 4.0 (inspired by the fourth industrial revolution) is designed to maintain the country’s position as a global leader in manufacturing through digitalization. The initiative is led by the German government, but includes manufacturing firms, trade associations, research institutions, labor organizations, and academia. One recent study reported 159 diverse organizations working in close collaboration with leading businesses.

Information governance to support smart manufacturing in Germany (and the EU) is characterized by an active role for government as coordinator, with significant input from citizens and the private sectors. This coordinated approach can be seen with respect to the country’s approach to technical standards, privacy and digital trade, and cybersecurity. Indeed, Germany can be considered the global leader in information governance for smart manufacturing.

Technical standards. Germany is ahead in the development of technical standards for smart manufacturing. Its Industrie 4.0 initiative supported development of the Reference Architectural Model for Industrie 4.0 (RAMI), which is a guide to standards and interoperability. Germany is aggressively pushing development of its standards, which are widely considered rigorous and comprehensive.

Privacy and digital trade. German Chancellor Angela Merkel said the EU needs to find its place between the United States, where personal data is easily privatized, and China, where, in her words, “the state has mounted a takeover.” Germany was the first EU country to adopt the General Data Protection Regulation, which went into force in May 2018. Under GDPR, EU citizens control how their personal data can be collected, used, and stored. Firms outside the EU face a choice: align with GDPR (under penalty of hefty fines) or be shut out of the EU market. Through GDPR, the EU is influencing cross-border data flows.

Cybersecurity. Germany is well known to have a disproportionate influence on the 28-member European Union, and this influence is evident on cybersecurity. The EU Network Information Security (NIS) Directive, recently enacted, is largely based on Germany’s own 2015 cybersecurity law.

Like GDPR, the NIS Directive, which went into effect in May 2018, is influencing the behavior of firms outside the EU. Global firms prefer to follow one standard of practice. Because the Directive is the first to define “minimum standards of due care” for critical infrastructure protection, firms that comply may obtain some legal protection from lawsuits alleging mishandling of personal information.

The German approach to smart manufacturing, however, does have its Achilles’ heel: its high-tech sector cannot compete with global leaders such as the United States. To some observers, Germany intends to compete by creating the rules that other countries must follow. Regarding AI, the emerging EU approach has been defined as “ethical AI,” to differentiate it from leading efforts elsewhere (e.g., China and the United States). Germany’s AI strategy will feed into the EU plan, which aims to secure a global foothold by positioning it somewhere between the contrasting US and Chinese approaches. The United States and China, however, enjoy advantages of scale, which is a huge advantage in AI (but perhaps less so in a well-controlled, relatively predictable manufacturing environment). Can Germany (and the EU) carve a leadership role in AI through governance, as it has with privacy and cybersecurity?

United States’ market-driven approach. The United States is the world’s second-leading country in terms of manufacturing value added and fourth in terms of value added per capita. It is second in terms of manufacturing R&D spending.

US global leadership in manufacturing, which emerged in the decades following World War II, is a subject of much debate. Although the manufacturing share of real gross domestic product (GDP) has remained relatively constant for decades—a good thing—productivity growth since 2004 has been sluggish or even negative in many subsectors—a source of worry.

The US approach to smart manufacturing can be characterized by a preference against government mandates and a reliance on markets and private-sector leadership. Compared with Germany and China, this approach has the advantage of not committing too early to a particular legal prescription that may fail in the marketplace. The US approach is most evident in its Manufacturing USA program, standards development, the creation of voluntary frameworks for cybersecurity and privacy, digital trade, and posture on AI.

Manufacturing USA. Congress enacted legislation in 2014 to address concerns about the decline in US manufacturing competitiveness (exemplified by a sharp drop in manufacturing employment in the first decade of this century and by sluggish productivity growth since 2004). The Reinventing American Manufacturing and Innovation (RAMI) Act ratified the creation of Manufacturing USA, a federal program to support collaborations between government, industry, and academia through new institutes that would center on particular advanced technologies. The aim was to bridge the so-called valley of death in precompetitive manufacturing technologies and allow domestic manufacturers to more fully reap the rewards from government-funded R&D.

Inspired by Germany’s famed Fraunhofer Institutes, the US program currently comprises 14 institutes that are geographically dispersed. Each institute has a federal agency sponsor and is managed by a third party, often a nonprofit entity set up through a university. Each institute focuses on a particular set of related technologies. Smart manufacturing is the focus of the Digital Manufacturing and Design Innovation Institute (DMDII), based in Chicago, which is sponsored by the Department of Defense (DoD), and the Clean Energy Smart Manufacturing Innovation Institute (CESMII), based in Los Angeles, which is sponsored by the Department of Energy. Federal funds are approved for a five-year period for each institute. The federal funding level is typically $70 million to $110 million per institute, matched or exceeded by funding from private industry and other nonfederal sources, with a minimum 1:1 cost share. To date, the federal-nonfederal ratio exceeds 1:2.

Technical standards. The United States does not have a formal national strategy with regard to smart manufacturing standards other than to facilitate innovation and allow the best solution to emerge. But there are active initiatives from multiple groups and organizations, including government organizations, such as the National Institute of Standards and Technology (NIST); organizations focused on standards development, such as Underwriters Laboratories; research institutes, such as DMDII and CESMII within Manufacturing USA; and individual companies. In general, the United States encourages a voluntary, consensus-based approach where government agencies participate when invited by industry. The lack of a single driving national strategy does not provide the same level of certainty for investment as compared with the standard-setting approach of China or even Germany.

Cybersecurity and privacy. Currently, the United States does not impose requirements for cybersecurity on US manufacturers. Firms wishing to conduct due diligence with respect to cybersecurity can look to NIST’s Cybersecurity Framework, guidance from the Federal Trade Commission (FTC), and the DoD’s Deliver Uncompromised initiative.

The NIST framework was born out of private-sector resistance to a mandatory approach imposed either by legislation or regulation. The Obama administration empowered NIST to partner with industry and develop a voluntary, risk-based framework that would be based on industry best practices and that could be applied to firms of all types (not just manufacturing). First developed in 2014 and most recently revised in April 2018, it sets a floor for cybersecurity.

The FTC has the authority to create rules to block “unfair or deceptive acts or practices” by companies doing business in the United States. Thus far, the commission has acted only in reaction to bad practices: it has levied penalties against companies whose cybersecurity practices do not match their advertising or those that operate in critical infrastructure sectors.

Spurred by reports of serious vulnerabilities in its supply chain, especially by small firms, the DoD is taking steps to raise cyber standards by requiring its top-tier contractors to ensure that lower-tier suppliers are adhering to best practices. Its most recent effort, the Deliver Uncompromised initiative, aims to build on the three pillars of sourcing (price, delivery, performance) by adding a fourth pillar, security.

On privacy, NIST has begun development of a voluntary framework for privacy protection, modeled after its risk-based cybersecurity framework. It is unclear how influential this framework may be, given the first-mover advantage enjoyed by the EU with its mandatory GDPR.

Digital trade. President Trump has pushed for better trade deals to enhance US manufacturing, arguing that “careless and unfair trade deals” are partly at fault “for the diminished state of American manufacturing today.” He continued: “These deals have severely disadvantaged American exports. My Administration, however, will right these wrongs and ensure a level playing field for American manufacturing going forward…. American drive, ingenuity, and innovation will ultimately win.”

Perhaps the clearest indication of this sentiment can be found in the Trump administration’s effort to replace the North American Free Trade Agreement (NAFTA). The proposed (though not yet officially adopted) version is called the United States, Mexico, and Canada Agreement (USMCA). USMCA reflects not only the US approach to smart manufacturing but opposition to the approach of China. The agreement includes a commitment by all parties to ensuring the free flow of information, making large government data sets publicly available (which will advance AI), protecting source code and algorithms, and striving for consensus-based technical standards. It also includes provisions to address mechanisms used by China to foster its domestic manufacturing sector, including the use of state-owned enterprises (emphasizing transparency), currency manipulation (prohibited), data localization requirements (prohibited), and trade agreements with nonmarket economies (consultation with the other USMCA signatories is first required).

AI. The Trump administration is making US leadership in AI a priority. The president created a select committee on AI under the National Science and Technology Council, and he convened a White House summit in the spring of 2018 to highlight the administration’s actions. These actions include prioritizing funding for R&D, removing regulatory barriers to innovation, training the future US workforce, achieving strategic military advantage, leveraging AI for government service, and leading international AI negotiations. Most recently, the president issued an executive order to ensure interagency coordination on AI, including a NIST plan for AI standards development and an Office of Management and Budget plan for regulation.

The US market-driven approach can be seen as promoting innovation, but it has also drawn fire. Critics contend that the United States is ceding leadership in information governance to other countries or regions of the world. Their argument is that global firms, which adhere to a common standard to guide their far-flung operations, are heavily influenced by the most stringent requirements in those nations in which they operate or wish to operate. Experienced policy-makers and advocates know that “policy abhors a vacuum” and that “you can’t fight something with nothing.” To some, the United States—with its “hands off” approach—runs the risk of losing in the race to establish rules for information governance. And losing would carry a heavy weight. Leadership in information governance will provide a first-mover advantage to a nation’s manufacturing sector. Firms that have the most experience operating under a set of norms have a competitive advantage over competitors subject to a steep learning curve.

Lack of federal leadership on information governance is already causing problems domestically. Federal inaction has led individual states to impose their own rules (e.g., California has developed its own regulations to protect personal privacy), creating a patchwork of state laws that create friction for interstate commerce.

Policies for improvement

Before we offer policy recommendations, we make an important presumption. The approach that a nation takes to foster domestic manufacturing—managed, coordinated, or market-driven—will not change. The choice of approach reflects a mix of cultural, social, and political forces over time. It is shaped and informed by national systems of innovation, and these systems tend to change slowly.

Within its chosen approach, however, a nation can and will change its strategy—to respond to the actions of its competitors (Made in China 2025 was influenced by Industrie 4.0 and Manufacturing USA); to political pressures (the election of President Trump elevated in priority US scrutiny of China’s trade policies); and to its own evolving capabilities in manufacturing (elements of Germany’s Industrie 4.0 are first being applied to its favored and world-class automotive and machine tool industries).

How should the United States alter its strategy toward information governance to best ensure leadership in smart manufacturing? We offer three sets of recommendations: current initiatives that demonstrate US leadership should continue, the federal government should better leverage its power as a purchaser of manufactured goods, and the National Research Council (NRC) should convene a committee to develop policy recommendations.

The current initiatives that should be continued are:

- Congress should reauthorize Manufacturing USA (otherwise its federal funding might cease). The institutes created under this umbrella program to focus on smart manufacturing are working on the cutting edge of technology development and are almost certain to yield major advances. And aside from their technological roles, the institutes engage in important and pressing information governance issues, such as standardization.

- Congress should enact the proposed USMCA so that the United States can engage and shape the global landscape on information governance and digital trade.

- The Office of the United States Trade Representative (USTR), which oversees trade negotiations with other countries, should continue to bring cases to the World Trade Organization when other nations create rules for information governance that act as nontariff trade barriers (e.g., data localization requirements).

- NIST should continue developing a risk-based approach to privacy, which will represent an alternative to (and perhaps an improvement over) GDPR.

The federal government should leverage its power as a customer to propagate norms of behavior for business. Specifically, DoD should leverage its supply chain to advance smart manufacturing. A significant share of domestic manufacturing is defense-related. Historically, DoD has played a big role in the development of technologies and products that have advanced the US economy and benefitted US firms. DoD can and should use its leverage to make the defense supply chain a leader in smart manufacturing, starting with cybersecurity.

The NRC should convene a committee to develop policy recommendations to advance smart manufacturing in the United States. As part of its review, the council should take a hard look at the strategic actions of other nations, especially China and Germany; the degree of coordination among federal government agencies; and governmental options to accelerate private-sector investment. Each is critical.

The actions of China and Germany are purposeful—to create information governance that will drive smart manufacturing and benefit their domestic industries. The actions of the United States, in contrast, represent a laissez faire mindset that, to some observers, seems complacent given the progress being made by its strategic competitors. An NRC review should consider the pros and cons of alternative strategies that the United States could employ.

Some aspects of information governance have received significant attention from federal agencies (e.g., USTR on digital trade). However, given the number of federal agencies with a stake in smart manufacturing, more holistic attention is called for. For example, the US plan for leadership in advanced manufacturing, released in October 2018, mentions smart manufacturing but emphasizes technological innovation and fails to acknowledge the role of information governance. President Trump’s manufacturing council, which might have played an important role, was disbanded—for political reasons—soon after it was established. The NRC should recommend specific steps to improve interagency coordination and US leadership.

In her 2014 book, The Entrepreneurial State, Mariana Mazzucato documented many successful examples where the government reduced financial risk for the private sector, including in the development of technologies such as the smartphone and breakthrough drugs. The government—as reducer of risk and purveyor of certainty—thus plays a huge role in facilitating and shaping innovation. The NRC should consider this and the full range of options that the government might employ to facilitate private-sector investment in smart manufacturing.

The need for collective action is clear and growing. As technological capabilities expand, progress in smart manufacturing will increasingly be shaped by information governance. And just as firms prefer to operate where tax and regulatory policies improve their bottom line, firms are likely to preferentially invest where information governance is most favorable. As a consequence of these investment decisions by individual firms, global value chains—and the economic power they wield—will shift. The nation that leads in information governance will give its domestic producers a competitive edge.

Of the different approaches to smart manufacturing being taken by the United States, China, and Germany, it is not yet clear which will prove most fruitful. Thus, the United States must not paint itself into the proverbial corner. Future US actions should be informed by the strategic behavior of other nations, the degree of coordination among federal government agencies, and the best use of governmental resources to accelerate private-sector investment.