Tools That Would Make STEM Degrees More Affordable Remain Unexamined

Last fall’s update from the National Center for Science and Engineering Statistics once again warned that Black, Hispanic, American Indian, and Alaska Native students continue to be among the “missing millions” in science and engineering fields. Despite gradual gains among Black and Hispanic students, all four groups remain disproportionately underrepresented among those earning STEM degrees in the United States. The National Science Board and others have proposed various strategies to address the problem, but the expense of obtaining a STEM degree remains underexplored as a limiting factor.

Controlling for inflation, the cost of attending a public four-year college in the United States has more than doubled since the early 1990s. Concurrently, federal student loan debt has ballooned by over 200%, from $500 billion in 2007 to $1.6 trillion today, though the number of borrowers has only grown by 53% in that time. This surge in borrowing, coupled with nearly one-third of students defaulting on their loans, has not escaped notice. Many in media and policy spheres continue to sound the alarm and explore ways to help borrowers manage their student debt. Most of the federal focus has been on lowering debt borrowers have already accumulated; notably, last year the Biden administration launched its Saving on a Valuable Education Plan, which aims to cancel debt or reduce borrowers’ monthly payments through a number of executive actions.

The cost of attending a public four-year college in the United States has more than doubled since the early 1990s.

But reducing student debt in the long term—especially for marginalized populations—requires making college more affordable in the first place. Unfortunately, as evidenced by the growing student debt crisis, current policy tools used to manage the cost of tuition and fees across the ecosystem of US higher education are falling short. Building a more affordable and equitable path to higher education will require policymakers, researchers, and leaders in higher education to broaden the national conversation around existing options, and particularly their impact on underrepresented degree seekers.

The state of college affordability

Undergraduate student loan debt has become unmanageable for a wide swath of borrowers in the United States. Bachelor’s degree recipients borrow on average $41,300, with a median of $30,000. The median borrower still owes 92% of their loan four years after earning a bachelor’s degree, and nearly one-third of people who took out a student loan between 1998 and 2018 fell into default. As part of its emergency response to the pandemic, the US Department of Education suspended action on federal student loans that were in default as of March 13, 2020, until at least September 2024.

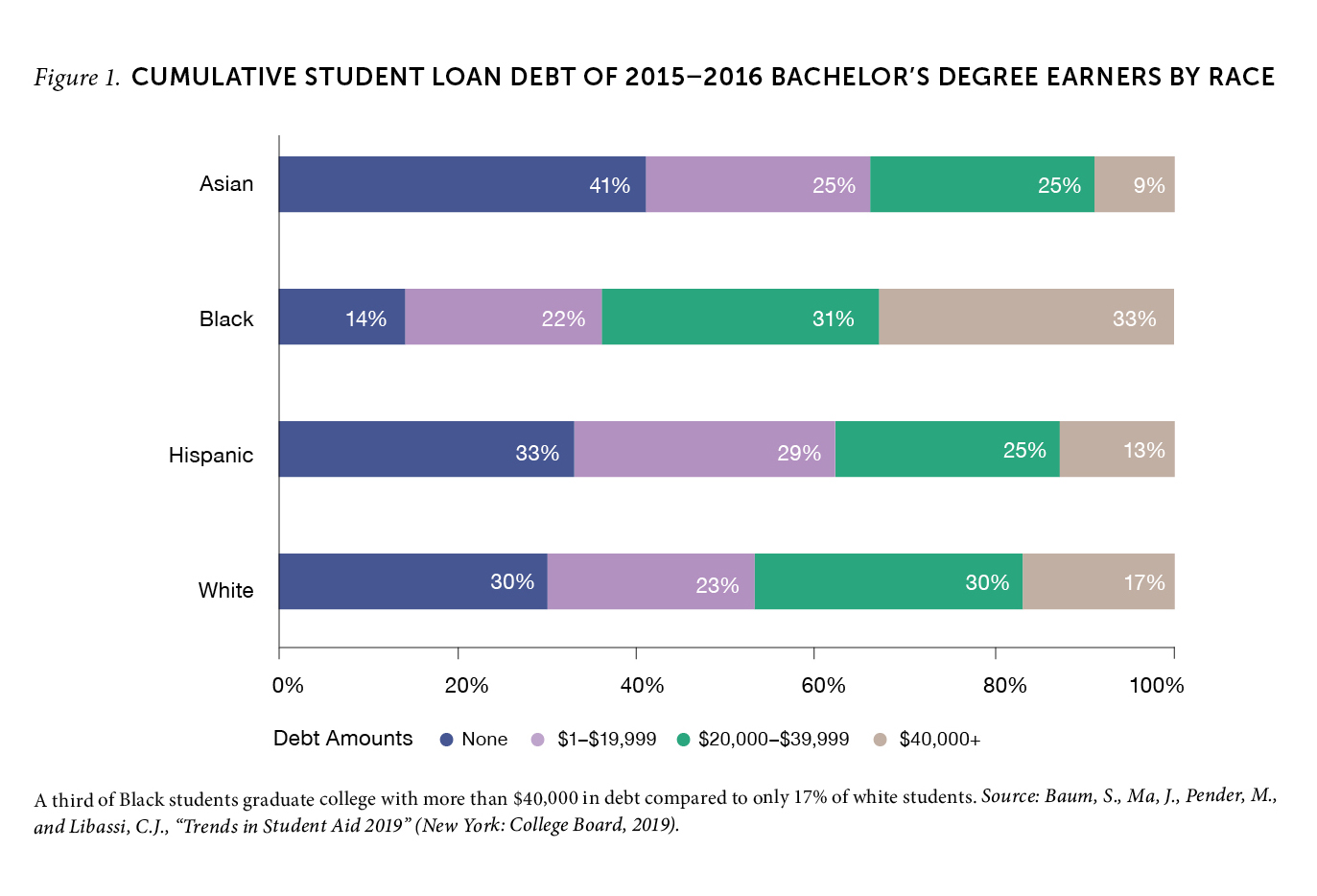

Student loan debt is uneven across racial groups. Figure 1 highlights a disparity scholars have found across various datasets and over time: that Black students rely on student loans at a substantially higher rate compared to their peers. Disparities continue when students enter repayment, as Black students not only borrow the largest amount for a bachelor’s degree, but also owe the highest amount four years after graduating. These realities are connected to the interlocking structural inequalities of anti-Black racism that make it more difficult for Black families to accumulate wealth and for Black students to access healthy environments and well-funded schooling.

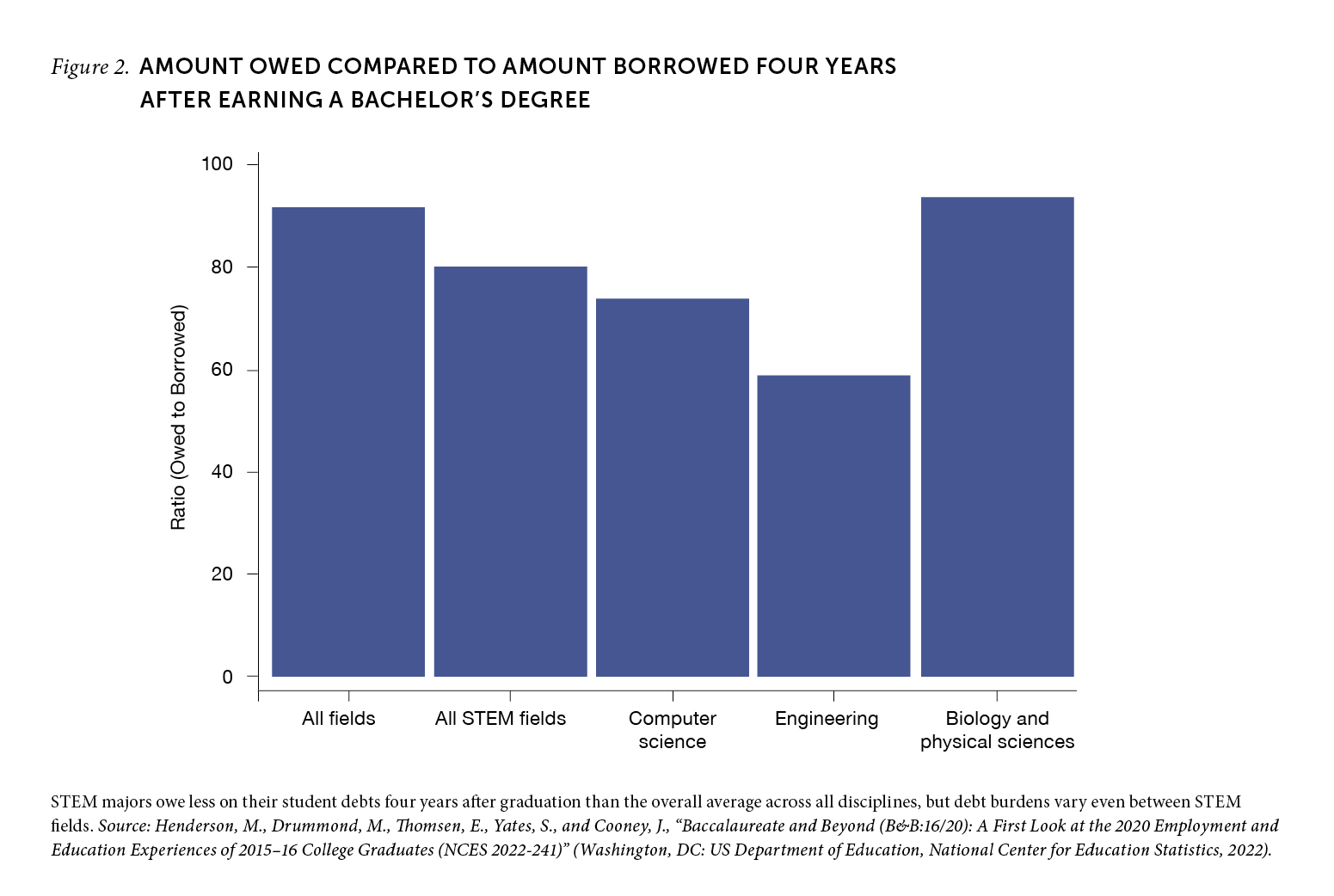

Recent data has also shown variation in loan repayment patterns by major, challenging the popular assumption that all STEM graduates have similar prospects after college. Though the median amount owed on student loans for STEM majors four years after earning their degree is 80%, this varies—from 59% for engineering to 94% for biological and physical sciences and agricultural sciences (Figure 2). These figures do not include the amount of additional debt students may incur in pursuit of further graduate education. Due to interest accrual, delayed repayment of undergraduate student loans can also result in greater debt burdens.

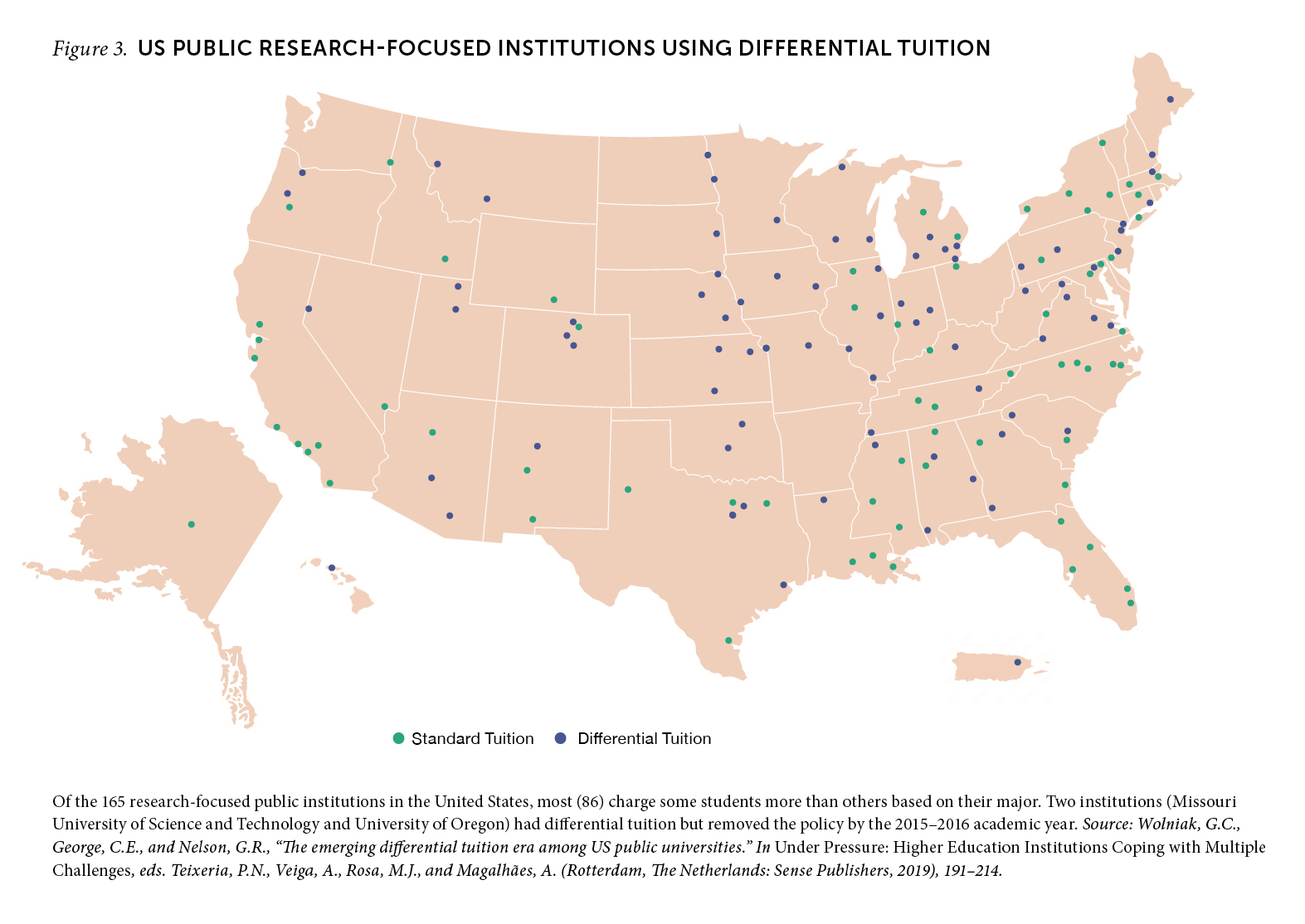

One relatively unremarked aspect of this analysis is that many public colleges and universities in the United States adjust tuition prices based on a student’s progress through higher education or by major, a practice called differential tuition. Public four-year institutions have a history of differentiating tuition based on in-state or out-of-state residence. They may also charge higher tuition or fees for certain majors based on the costs associated with educating students in these programs as well as the projected income of graduates. Figure 3 shows that by the 2015–2016 academic year, more than half of research-intensive public institutions in the United States used differential tuition, generally charging more for majors in business and STEM.

The fact that differential tuition may make a STEM major more expensive than a non-STEM major at some universities deserves more attention when considering how to make STEM degrees more affordable. For example, advanced, in-state students at the University of Maryland pursuing engineering and computer science degrees pay $1,500 more per semester than their peers enrolled in other disciplines (nearly 27% higher).

Of particular concern are the ways in which differential tuition may counteract efforts to attract and retain people historically excluded from STEM fields. Studies have shown that differential tuition policies have reduced the number of degrees awarded in majors with higher tuition, especially for women and students of color. Unfortunately, financial aid increases have been insufficient at offsetting these disparities, especially for low-income students.

A suite of unsustainable solutions

In addition to loans, most students rely on a combination of other federal, state, or local financial aid resources to cover the price of earning a bachelor’s degree. The majority of public and private institutions subsidize education expenses to some extent, and those with significant resources also offer grants large enough to guarantee that students from families below a certain income level will not incur loan debt to attend college. But in general, public US colleges and universities are more limited in their ability to help because tuition subsidies are determined, in large part, by state funding.

During and after the Great Recession of 2008, financial support for higher education dropped significantly in most states. But it wasn’t the first time. States have regularly cut education funding during tough economic times, and although state funding has finally started increasing, and the average subsidy that institutions provide has started to grow, decades of underinvestment have left a mark on public higher education. Deferred maintenance in several key areas like building repairs and further tuition loss from the pandemic have kept the pressure on most institutions to make ends meet. What’s more, state funding has yet to reach pre-2008 levels, which may signal a political shift in how states prioritize funds for higher education. Within the last year, even states with multi-billion-dollar surpluses, like Wisconsin and West Virginia, have cut funding for public institutions.

States have regularly cut education funding during tough economic times, and although state funding has finally started increasing, and the average subsidy that institutions provide has started to grow, decades of underinvestment have left a mark on public higher education.

At the onset of the pandemic, some public and private institutions committed to freezing tuition at 2020 levels. Though tuition caps and freezes may score political points for appearing to improve affordability, several lines of evidence suggest instances of their adoption at the state or institutional level have done little to make college degrees more affordable—especially over the long term. First, caps are often set so high that their effect on student tuition charges is negligible. Second, research has shown that when tuition is capped, student fees rise—and when fees are capped, tuition rises, essentially negating any savings to individual students. Third, studies suggest that institutions may even reduce financial aid in the wake of tuition caps to keep net tuition revenue steady. And finally, evidence suggests that tuition rapidly increases when short-term caps end. As commonly structured in the United States, tuition caps do not have a consistent effect on student enrollment and do little to improve affordability.

A vision for affordability

The United States currently relies on a rough patchwork of policies and mechanisms to project the image of college affordability while actually depending on students to navigate huge variances in higher education costs. Inevitably, they’re often left to shoulder a debt burden that might follow them around for decades. Lessons from other countries on how to assemble the policy patchwork more deliberately—to actually lower student costs and subsidize tuition in targeted disciplines—may help.

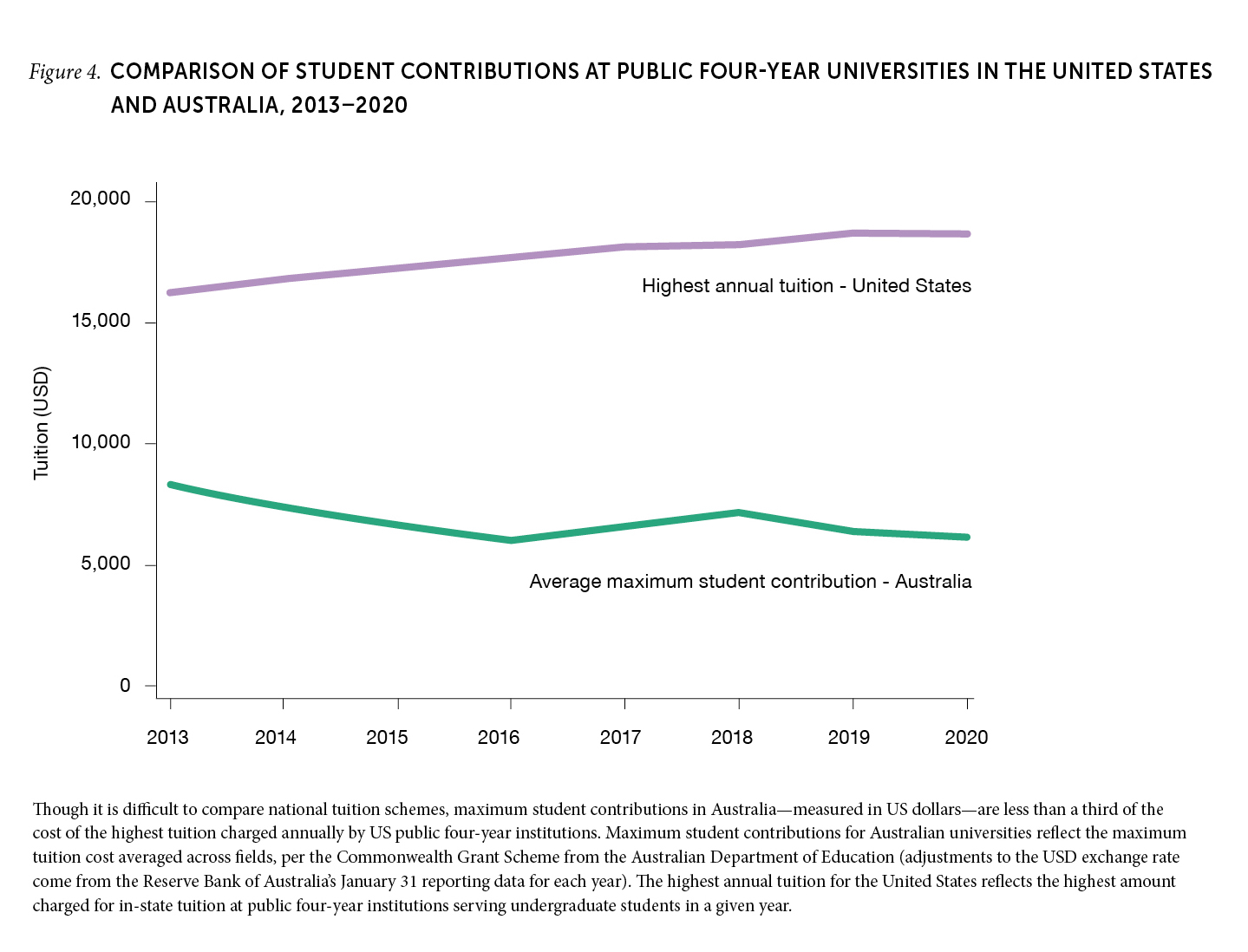

Australia’s Commonwealth Grant Scheme combines permanent tuition caps with differential tuition and government subsidies. The government sets caps on the amount of tuition students can be expected to contribute for different majors and provides supplementary government contributions based both on the cost to educate a student in a given major and the government’s prioritization of the major’s importance. For example, in 2014, students pursuing a mathematics major at any public institution would have a maximum student contribution of A$8,613 with a government contribution of A$9,782. In the same year, engineering majors had the same maximum student contribution, but the government contribution was A$21,707—more than twice as much.

Figure 4 shows the significant difference in tuition rates at public four-year institutions in the United States versus Australia. In recent years, the highest annual tuition at public four-year institutions in the United States is nearly three times as much as the average maximum student contribution in Australia. The highest annual tuition in the United States is still almost twice as much as the highest student contribution in any discipline in Australia.

Another lesson can be drawn from efforts to improve college affordability in the United Kingdom. The UK government capped tuition for all domestic undergraduate students and, at the same time, reduced funding for higher education. Universities and colleges have coped with the situation by cutting courses and programs, slashing faculty and staff compensation, and increasing enrollment of international students paying higher fees. To some extent, the tuition cap, implemented without complementary public support for higher education, has created a trade-off between educational quality and affordability—a reminder that tuition caps alone will not automatically create a more stable higher education sector.

Instituting country-wide tuition caps in the United States would require Congress to craft new policy under the auspices of the Higher Education Act. Several questions would need to be addressed in order to design such a policy: Whom should the caps benefit? Who will set it? How often should it be reset? Should the cap be different depending on the major or number of classes taken? Should the cap be the same for all states? How might caps affect financial aid and student borrowing, and how should that influence their design? These and other issues need to be rigorously examined to see how and whether tuition caps could feasibly help the United States create a more affordable pathway to college.

Experts on college affordability, tuition setting, and other related topics in higher education should convene to examine the value of tuition caps as a policy, particularly within the context of bringing the missing millions into STEM disciplines. Since most public university subsidies come from state coffers, federal efforts alone are unlikely to solve college affordability. And yet there are no clear policy tools available to ensure that states contribute their due for higher education. The decentralized nature of US higher education conceals useful information from researchers, decisionmakers, and policymakers—like the national average tuition increase for STEM degrees under differential tuition. Higher education leaders, especially in STEM fields, should be invested in creating spaces for ongoing conversations about real changes in college affordability as another avenue for removing barriers to STEM education and careers.