The US Shouldn’t Abandon the Nuclear Energy Market

As a pioneer in the nuclear power sector, the United States shaped the international regulatory regime that established norms and agreements to promote the peaceful use of nuclear energy. However, US competitiveness in the development and deployment of nuclear reactors within the commercial nuclear power sector is in decline, resulting in the erosion of its leadership in global nuclear safety and security. As a number of countries, including Germany, Belgium, Spain, and Switzerland, reconsidered their policy toward nuclear energy and planned the retirement of their entire nuclear fleet, an estimated 28 nations are making plans to add nuclear power to their energy portfolio. These nations view nuclear power as a way to increase their energy independence, address growing energy demands, and reduce greenhouse gas emissions. And with the US nuclear sector in retreat, these emerging markets now rely on Russia and China for advanced nuclear technology, training, and expertise, as well as favorable financial terms. This shift will likely create strategic disadvantages for the United States and its allies.

The US Senate recently reintroduced a bill aimed at spurring innovation and helping the United States reclaim its leadership position in the commercial nuclear energy sector. Through incentives and additional funding for the development of advanced reactors, the Nuclear Energy Leadership Act would create more certainty in the domestic market and support next-generation reactors able to compete with emerging technologies from Russia and China. In a hearing of the Senate Energy and Natural Resources Committee, Ashley Finan, executive director of the Nuclear Innovation Alliance, stated that “past participation in nuclear markets gave the United States leverage in influencing global nonproliferation, safety, and security norms; if we are not a major supplier, we cede that influence.” This shift from US-based reactor suppliers to those in Russia and China, in conjunction with a large-scale deployment of nuclear power plants in nations with very little experience with nuclear power, will lead to increased nuclear security and safety risks—both in those countries and on a global scale. How did we get here?

Rise of Russia and China

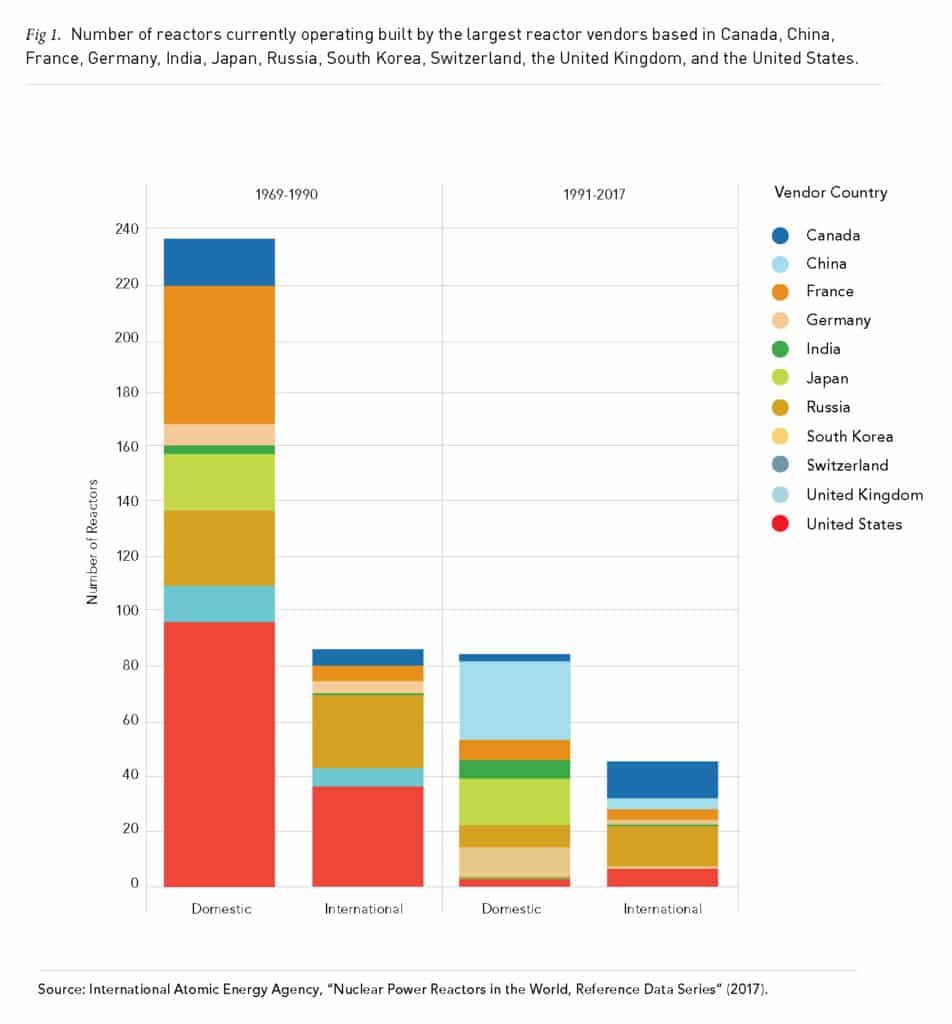

Between 1969 and 1990, 41% of the nuclear power reactors operating in the global nuclear fleet had been supplied by US-based vendors. Between 1991 and 2017, that number dropped to 8%, as interest in nuclear power began to wane in the United States because of the high capital costs and the increasing availability and affordability of natural gas. (See Figure 1.) Chinese and Russian vendors made up the difference and currently constitute a staggering two-thirds of all global reactor constructions. From 1991 to 2017, Russian vendors constructed 19 reactors for domestic and international markets. China still lags behind Russia in terms of reactor deployments to other nations, but Chinese vendors have connected 33 new nuclear power plants to its grid in the past 28 years and the nation is estimated to overtake the United States in deployed reactors in 20 years. China’s dramatic expansion in nuclear capacity and construction activity coupled with its ambitious Belt and Road Initiative shows that it is well positioned to supply other nations with reactors. Russia is constructing or has signed contracts with 11 countries to build nuclear power plants. China has built four reactors in Pakistan, and has announced an agreement to build a reactor in Argentina and an additional three in Pakistan. Currently, Russia and China are engaged in nuclear cooperation agreements with about 24 countries in Africa, the Middle East, South America, and Eastern Europe.

Emerging markets’ reliance on Russia and China for low-barrier, quick pathways to nuclear power can create several nuclear proliferation, safety, and strategic risks. Whereas the United States promotes a strong culture of nuclear security—for example, assembling a group of 40 nuclear experts from countries looking to adopt or expand nuclear capacity at the annual meeting of the Institute of Nuclear Materials Management in 2015—Russia and China have shown that they do not see value in these types of safety and security engagements. Their influence can therefore shift the attention of emerging markets away from the last area in which the United States still maintains some leadership. This will ultimately lead to future nuclear security and safety challenges in countries that may be among the most vulnerable in the event of an accident or security incident.

Nations that expand their nuclear capacity by working with US vendors are required to sign international nuclear safety agreements and adhere to additional safeguards as part of nuclear export controls outlined in the US Atomic Energy Act. But Russia seems willing to lower regulatory barriers to entry by not requiring host nations to sign some international nuclear safety agreements. Emerging markets relying on Russia and China incur their own national security risks as well. Many countries do not prioritize the threat of nuclear terrorism as part of their national security agenda, believing that nuclear terrorism is unlikely to happen within their borders. They also may implement inadequate security measures due to limited resources and weak regulatory structures. Emerging markets are vulnerable to regulatory capture: for example, if Russia drafts the nuclear regulations for a host nation that provide little domestic, independent oversight of safeguards and nuclear safety, it will have continual leverage over the host nation.

In Russia and China, nuclear vendors, engineering firms, and providers of fuel services are state-owned entities, which can offer favorable financial incentives, subsidies, and fuel services to host nations. China, for example, has lowered the financial barrier of entry by financing more than 80% of the cost of Pakistan’s reactors. Since 2006, Russia has implemented a $55 billion strategy aimed at becoming the largest global supplier of nuclear power. Currently, it strategically provides loan guarantees of between 49% and 90% of the total nuclear project cost, commits to taking back spent fuel, and relaxes certain regulatory safety and security requirements to mitigate costs for the host nation and to gain a competitive advantage in the global nuclear power arena. These incentives offered by Russian and Chinese firms mean that US-based firms will be unable to compete because they do not have the resources for similar financial incentives and are currently unable to produce more economically viable reactors.

A potential strategic risk also arises as countries that accept Russian or Chinese financing potentially subject themselves to so-called debt-trap diplomacy. If such countries are unable to repay debt on reactor projects, vendor nations can simply stop supplying, operating, or maintaining a reactor in order to gain leverage during a geopolitical crisis. In addition, the ability of the vendor nation to honor its agreement to take responsibility for used fuel for the life of the power plant is not guaranteed. If the vendor chooses not to honor the agreement, the host nation will be left scrambling to secure its spent nuclear fuel and find safe, long-term storage.

Some of the potential risks associated with the new advanced reactors arise from the type of fuel they use. The higher operating efficiencies of advanced reactors are achieved using uranium fuel that has been enriched to 5%-20%, compared with conventional reactor-grade enrichment of less than 5%. (In enriched fuel, the proportion of the uranium-235 isotope that is useful for power production is increased from the naturally low level present in raw ore.) This type of fuel is currently used primarily in research reactors; if its use becomes more widespread, it could lead to increased proliferation risks. Experts believe that uranium fuel enriched to 20% (as it would be when utilized in some commercial advanced reactors) is three times easier to use than conventional reactor-grade fuel to produce weapons-grade uranium. To mitigate foreign dependency on fuel services in the future and maintain US competitiveness in the commercial nuclear market, the Nuclear Energy Institute is urging fuel suppliers to develop the enrichment and fuel fabrication infrastructure needed to support the newer type of fuel suited for advanced reactors.

The US Nuclear Regulatory Commission, however, has yet to develop regulatory guidance for material control and accountability due to the lack of active commercial development of an advanced fuel infrastructure domestically, and it is not clear if the United States is actively collaborating with the International Atomic Energy Agency to develop nuclear security guidelines and materials for advanced reactors. Therefore, in addition to the failure of today’s nuclear safety and security regimes to fully account for the risks posed by advanced reactors, their operation by emerging markets—with their limited experience implementing national institutional safeguards—is highly problematic.

The emerging prospect of small modular reactors promises additional proliferation risks. Such reactors have the benefit of flexible siting, but this also means they can be located in remote locations where safeguards are difficult to enforce, and the risk that reactor fuel can be diverted from peaceful to military purposes or to nonstate actors rises substantially. Reactors in remote locations present new challenges and require new security and safety regimes. For example, responding to a terrorist incident or quickly deploying United Nations inspectors to remote nuclear facilities would be severely hindered. The impact, likelihood, location, and severity of the proliferation risk looks very different depending on the experience of the country using the advanced technology. For emerging markets, these risks must be mitigated.

Renewed US leadership needed

Given the radically changed global nuclear environment, the United States needs to regain its leadership as a major part of the strategic interests for the nation and its allies. Toward this end, the United States needs to develop a strategic nuclear energy research, development, and security policy that focuses on the following key issues:

Reinvigorated funding for advanced reactor development. Since the late 1990s, the United States has spent $2 billion on research and development that, because of unfocused priorities guided by politics and short-term interests, resulted in no deployment of an advanced reactor. Since 1998, advanced nuclear programs have accounted for just 16% of the Department of Energy’s nuclear energy budget. To enable the United States to effectively compete with China and Russia and reclaim its leadership position, it is essential to pass and fully implement the Nuclear Energy Leadership Act and the Nuclear Energy Innovation Capabilities Act. China’s near-completion of an advanced reactor calls for an aggressive approach to the construction of advanced demonstration reactors by 2025 in order to make US-built reactors attractive and competitive in emerging markets.

Government support for reactor construction. The construction of nuclear power plants is risky and increasingly difficult to finance by traditional means, given the frequent construction delays and cost overruns. Whereas strong government support in China and Russia mitigates the risk of their vendors going bankrupt, no such protection exists for vendors in the United States. The Nuclear Energy Leadership Act helps to create some certainty in the markets by extending federal power purchase agreements to 40 years, using the federal government as an early adopter of new nuclear technology.

Updated regulatory environment. Within the Nuclear Regulatory Commission, the safety of the public and the environment is paramount. As new technologies come on the scene, older regulations become burdensome and outdated. These regulations should be reformed to reflect areas of both increased and decreased risk associated with the newer technologies—maintaining the safety and security of the public while not stifling the US commercial nuclear sector.

Continued training on nuclear issues. In conjunction with providing nations with options for competitive, safer, quality nuclear reactors, the United States should continue to sponsor training programs for nuclear personnel and define the best practices to ensure nuclear safety, security, and reactor quality, emphasizing its superior track record of nuclear security and safety over Russia and its experience over China. Through these engagements, the United States will maintain relevance in these international discussions by outlining the long-term consequences of weak nuclear security, and continue to strategically assert its influence until results of the Nuclear Energy Leadership Act and the Nuclear Energy Innovation Capabilities Act are fully realized.

Although Russia and China are currently capitalizing on the erosion of US leadership in the commercial nuclear power sector, the United States is well positioned to regain its leadership by leveraging its experience and nuclear security culture in the short term. In the longer term, with committed R&D funding and strategic government support, the United States can regain its competitive advantage as a market leader and continue to drive nuclear security and regulatory norms with the rigor these technologies demand. Within the added context of climate change mitigation, it is important to include nuclear power as a strategic component in the decarbonization strategy. Opposition to nuclear power domestically can allow less responsible countries to leverage their capabilities to export of nuclear technologies to vulnerable nations—along with their associated risks.