A Technology-Based Growth Policy

Monetary and fiscal policies to stimulate the economy are no substitute for the national research and development investment needed to spur productivity growth and create high-paying, high-skill jobs.

Talk to people in industry, academia, or government who are connected in some way with the advancement of science and technology and they will be able to connect specific advances in science to the emergence of new technologies and subsequent product or service innovations. And, among most economists who study the technology-based economy, no doubt exists as to the critical importance of this phenomenon.

However, making the extension from general anecdotes and descriptions to a broader and policy-specific economic growth strategy that would extend such benefits to the entire economy and, hence, have substantial impact on the standard of living has been a struggle. That is, the case for sufficient investment to meet the challenges of an expanding global technology-based economy has not been effectively articulated. As a result, the potential economic benefits for workers and the population as a whole are not being realized.

Similar policy failures have appeared in other industrialized nations. However, the problem of skewed economic growth and the resulting increase in income inequality have been particularly severe in the United States.

Goals of economic growth policy

Economic analysis demonstrates that the only path to long-term growth in incomes is to steadily increase productivity growth. This is because greater efficiency enables higher salaries and wages. In contrast, without adequate productivity growth, the resulting inefficient economy will suffer inflation, trade deficits (i.e., offshoring of jobs) and, as a consequence, little or no real (inflation-adjusted) income growth.

Responding to this mandate requires enlightened investment policies focused on the development and use of technology. The reason is straightforward—technology is the long-term driver of productivity growth.

Unfortunately, neither economists nor the broader economic growth policy arena has focused sufficiently on this investment mandate. The main reason is that, on the one hand, most economists do not understand and, hence, do not appreciate the nature of the central role of technology in economic growth, while, on the other hand, the science and technology policy community, while understanding technology’s central role, is not equipped to translate its understanding into the growth policy prescriptions needed to leverage productivity growth.

Achieving sustained growth in productivity requires an investment-driven economic growth strategy, centered on investment in four major categories of economic assets:

- Technology: The core driver of long-term productivity growth.

- “Fixed” capital: Hardware and software that embody most new technology and, thereby, enable its productive use.

- Human capital: Skilled labor capable of using the new hardware and software and associated techniques.

- Technical and institutional infrastructure: Public-private infrastructure to leverage the development and use modern complex technology systems.

Success then and now

In the most summary way, US economic growth history has consisted of a series of “revolutions,” which were worldwide in scope, but manifested themselves to a greater degree within the American economy. The first of these occurred from the late 1700s through the middle 1800s and was characterized by a transition from hand to mechanized manufacturing using water and steam power. The second revolution began in the late 1800s and extended into the first part of the twentieth century. It was dominated by mass production, powered by electricity. The specification and control of the multiple steps in production led to reduced costs (economies of scale). The third revolution began in the late 1900s has been characterized by automation, based on the widespread use of computers, which has led to more diversified and higher quality products and services (economies of scope).

The critical point for economic growth policy is the fact that in all three revolutions, the driver of the resulting massive change in the character of economic activity was technology. So, logically, as a society, we should be increasing research and development (R&D) spending to extend leadership in the current technology epoch and to prepare for the next one.

But, what complicates such transitions is the fact that technology by itself is not enough to generate and sustain high rates of output and income growth. In each revolution, new technology was implemented through almost a total replacement of the existing stock of physical capital (and, more recently, software, as well).

Further, during most of this period, the US educational system produced superior skilled workers and government invested in world-class infrastructure. The result of these four categories of investment was that the US economy had the fastest sustained growth in per capita income over most of this period.

In contrast to a productivity-driven economic growth strategy, the more recent US policy response to slow growth has been to rely on the Federal Reserve Board (the Fed) to provide more and cheaper credit through monetary policy initiatives. However, while flooding an economy with money can increase aggregate demand for a time, it does not rehabilitate an economy’s long-term competitiveness. Hence, the best it can do is pump up employment for a while before inflation sets in, which then forces the Fed to raise interest rates and throttle back economic activity. This cycle of ups and downs does little to increase incomes over time.

In contrast to business cycle fluctuations, which are largely the only appropriate target of monetary policy, underinvestment in productivity-enhancing assets is typically the cause of slow economic growth over time and therefore an alternative policy response is required. However, even though significant evidence exists that structural problems are the cause of prolonged poor rates of economic growth, there continues to be a lack of adequate investment in the four categories of economic assets cited previously.

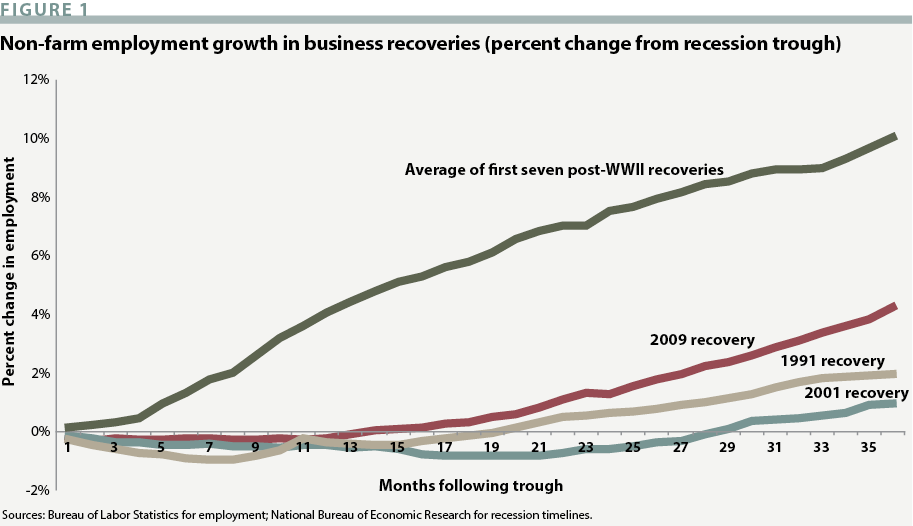

One indicator is the growing difficulty of the American economy to snap back from recessions, as shown in Figure 1. Very important is the fact that eight years after the last recession ended, we are only now beginning to see some modest increases in incomes, while income inequality has greatly expanded. These trends are occurring in spite of historic increases in credit by the Fed.

Particularly damning is the fact that real (inflation-adjusted) incomes for many workers have declined for decades. Real incomes determine ability to consume goods and services and the potential for increases in the standard of living. A Brookings Institution analysis of Census data shows that the median earnings for all workers was significantly lower in 2015 than in 2007 in a little more than half the major metro areas (52 of 94). Many more metro areas—71 of the 94—posted significant earnings declines among workers who possessed only some college or an associate’s degree. Going back even further, across several business cycles, Census data show that the real median household income in 2015 was 2.4% lower than in 2000. Real wages for manufacturing workers peaked in 1978 and have declined almost 9% since then.

The decline in the standard of living for less-educated American workers has become a major source of political dissent. This dissent is accentuated by growing income inequality. While structural decline has led to stagnant and even declining real incomes for many Americans, the most wealthy have been able to benefit from globalization by investing across the world’s economy.

The extent of income inequality is staggering. University of California-Berkeley professors Emmanuel Saez and Gabriel Zucman calculate that the wealth of the top 0.1% of US households equals the aggregate wealth of the bottom 90%. A critical point is that across the world’s economies, income inequality is inversely correlated with per capita income. More advanced economies—that is, those with a higher per capita gross domestic product (GDP)—tend to have less income inequality for the simple reason that their above average performance requires more skilled workers whose skills are not easily replicated elsewhere in the world and who are, therefore, paid more.

However, the US economy is an outlier in that it has a much higher Gini coefficient (the generally accepted metric for income inequality) relative to its per capita GDP when compared with the pattern for the rest of the world (the United States has the same Gini coefficient as Russia and China but a much higher per capita GDP). Income inequality implies the presence of relatively strong additional factors affecting income distribution within the US economy.

While many maintain exaggerated views of the capabilities of monetary policy, liberal political factions and a number of economists have looked instead to fiscal policy for “fixes,” mainly in various forms of more progressive tax structures or other forms of income redistribution. Thus, we see proposals for tax increases on the rich and tax breaks for everyone else, increases in the minimum wage, and more targeted initiatives such as free college tuition. Although any or all such proposals may have social merit, they are largely just additional mechanisms for demand stimulation and thus offer little in terms of enhancing long-term productivity growth.

US corporate income tax rates are among the highest in the industrial world and we only now appear to be getting serious about removing the differential tax on repatriated corporate earnings from other economies that have lower corporate tax rates (corporations bringing external profits back home are taxed on these profits at a rate equal to the difference between the two countries’ corporate income tax rates). Currently, $2.1 trillion in overseas profits are estimated to be sitting in foreign banks instead of being repatriated back to the US economy where they could be invested.

Finally, the drastically reduced ability of labor to bargain is indicated by Bureau of Labor Statistics (BLS) data showing that “work stoppages,” once a regular occurrence, have virtually disappeared due to the weakened position of lower-skilled workers from growing competition elsewhere in the world.

Faced with such competition, the weakest and most destructive response from an economic welfare perspective is to erect trade barriers to protect inefficient domestic industries and their inadequately trained workers. Such a step locks in inefficiency and, hence, guarantees no growth in the standard of living in two ways. First, protectionism by removing incentives to increase productivity virtually eliminates any possibility of sustained increases in workers’ incomes while imposing higher prices on domestic consumers. Second, protectionism usually results in retaliation by other economies. Yet, populist segments of both political parties have viciously attacked the North American Free Trade Agreement and more recent trade agreements as “destroying jobs.”

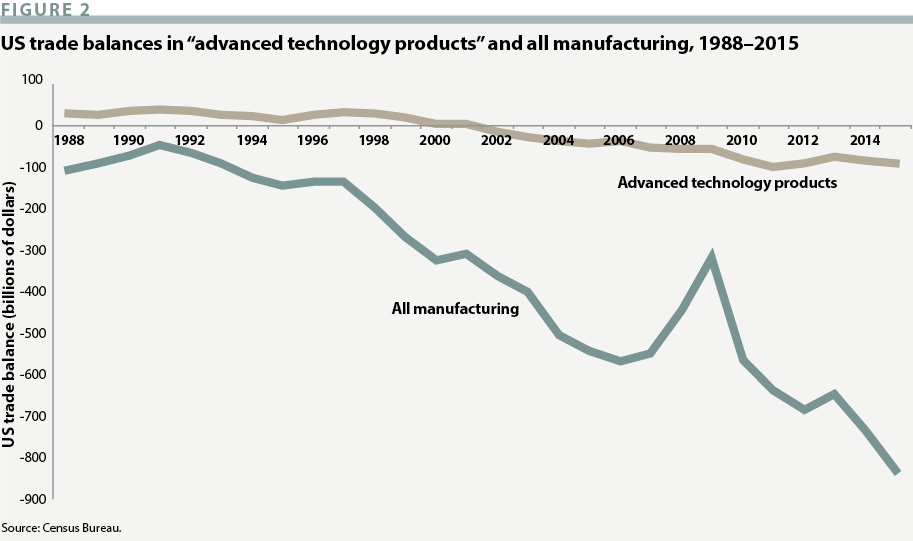

The seriousness of these policy failures is reflected in manufacturing trade deficits every year since 1975, with the size of the deficits growing steadily to $831 billion in 2015. This trend is demonstrated in Figure 2. Particularly important for future income growth is the “advanced technology products” trade balance, which turned negative in 2002 and continued to deteriorate to a record deficit of $100 billion in 2011 with little improvement since then.

In summary, it is traumatic for societies to accept the need to develop and implement new economic growth paradigms. Doing so presents societal risk of failure to successfully execute the new paradigm and individual risk of being left behind as others adapt more successfully. Part of this risk is the considerable time and resources needed to learn new skills, acquire new technology, and make associated investments in capabilities to use it, and, in many cases, different ways of doing business. Thus, defenders of the status quo look for excuses to avoid change by asserting that the economic problems are due to too much taxation and regulation, unfair trade practices by the rest of the world, and forcing higher costs on business from social objectives such as a higher minimum wage. Although these are real issues and need to be debated, they are often used as excuses for not dealing with the need for major change in economic structure and associated investment strategies.

In the end, failure to adapt leads to long-term decline in incomes. The resulting frustration eventually is manifested in populist movements that demand change with little idea as to the underlying nature of the problem. This leads to support for any politician offering change, whether or not the proposed change offers an effective long-term solution.

Thus, the only way forward is to determine the correct economic growth model and then build a consensus around it. Clearly, the excessive reliance on macrostimulation—monetary and fiscal measures—is not succeeding. Even the Fed’s economists have questioned the extent of the burden placed on monetary policy. And, fiscal policy, when used as a demand stimulation tool (basically running budget deficits), has not worked. Both provide short-term increases in demand, but that is followed by inflation as inadequate productivity growth forces higher prices for goods and services.

However, as discussed below, fiscal policy also has an investment component, which is an essential policy tool for expanding the technology-based economy. The distinction between the business cycle stabilization role and the investment role for fiscal policy has not been sufficiently made, but it is an essential step to a workable economic growth policy.

A structural problem

We are on the cusp of a fourth industrial revolution in which virtually all economic activity will be connected through the Internet. This so-called “Industrial Internet of Things” will create enormous increases in industrial productivity, but will also require substantial investment to effect the transition. Be assured that this time there will be considerable competition across the global economy.

The current sluggish trend in productivity growth does not predict the needed response to growing global competition. BLS data show that for the first 30 years after World War II (1948-1978), labor productivity in the US economy (nonfarm business sector) grew at a robust average annual rate of 4.1%. But then, as globalization set in, the average annual growth rate dropped precipitously to 2.6% over the next 30 years (1978-2008). At that point, the 2008 recession set in, and post-recession labor productivity growth (2008-2015) has dropped even more to an average annual rate of 1.3%.

However, it is important to note that in the 14-year period between 1993 and 2007, US labor productivity temporarily revived to grow at an average annual rate of 3.1%—faster than any other industrialized nation for this period. This relatively short, but strong, period of growth was the payoff for the previous decades of R&D spending on information and computer technology (ICT).

Most important from a policy perspective is the fact that labor productivity reflects workers’ contributions to the value of output. Hence, it is the basis for real wages that are paid to workers. Real wages are the important metric because they reflect purchasing power and, hence, workers’ standard of living.

However, for labor productivity to grow, workers must be increasingly skilled and have access to hardware and software that embody productivity-enhancing technologies. Thus, the ultimate measure of maintaining competitiveness over time is the rate of growth of multifactor productivity (MFP)—the effect on output of the combined productivities of both labor and capital. Again, in the first three decades after World War II (1948-1978), US economic superiority was reflected in a strong average annual rate of growth in MFP of 2.2%. But, in the following 15 years, 1978-1993, when globalization began to have significant impact, MFP growth fell to an average annual rate of only 0.4%.

As was the case for labor productivity, several decades of research on information technology began to pay off in the 1990s for overall productivity. For the 14-year period between 1993 and 2007, the annual rate of MFP growth tripled to 1.3%. But, since the Great Recession, 2007-2014, annual MFP growth has dropped to just 0.4% per year. This drastic decline is reflective of a poor rate of “private fixed investment” (hardware and software) through which most technology is used in economic activity.

These dramatically different trends over successive time segments have an explanation, which needs to be understood by our policy makers. The beginning of trade deficits in 1975 and the 1978 peak in real wages for manufacturing workers are coincident with the onset of serious globalization. In economic terms, “globalization” is a label for a “convergence” in which the number of economies that can absorb technology into their domestic economy and have trained their labor force to use it grows steadily, siphoning off global market shares and, hence, jobs from the leaders.

The impact on US manufacturing workers has been a labor arbitrage in which either jobs move offshore or American workers have to accept lower pay to bring their productivity-wage relationship closer to that of competing workers elsewhere in the world. Yet, survey after survey shows that corporations cannot find enough qualified workers for newer, more technical jobs, which, importantly, are also higher paying. Until American workers’ skills are upgraded to attract significant investment into the domestic economy, wages will be constrained and income inequality will remain unacceptably high.

The economic profession as a whole has not been much help here. Only a very few economists specialize in the role of technology in economic growth. And even some of this work ends up misleading policy makers. Robert J. Gordon, a noted economist focusing on productivity and economic growth, has correctly emphasized the enormous impact of the computer or “digital” revolution on productivity growth. However, he argues that we will never see another technology epoch this powerful again.

At least a few economists correctly see the relentless march of technology and the imperative to support it. The Economist, in a June 2016 special report on artificial intelligence (AI), stated that “AI is already useful, and will rapidly become more so.” Its imminent explosive impact is arriving after decades of false starts and promises. The National Science and Technology Council in the White House issued several reports in 2016 touting the emerging impact of AI.

Such patterns are typical of major new technologies and repeatedly fool contemporary observers with long gestation periods. Thus, as a society, it is not surprising that we have not grasped the core role of technology in long-term economic growth, and the fundamental fact that new technologies will always appear, at least somewhere in the world. If we want a higher rate of economic growth and the social benefits it produces, the following four categories of investment must be maintained at high levels.

The four investment imperatives

In place of the obsessive overemphasis on monetary policy, which is not even a growth policy tool, the US economy needs the following four-point investment strategy to grow productivity at rates sufficient to broadly elevate GDP growth and incomes.

Technology. R&D intensity (R&D relative to GDP) is a critical indicator of future economic growth potential because it reflects the amount of an economy’s output of goods and services that is being invested in technology to drive future productivity growth.

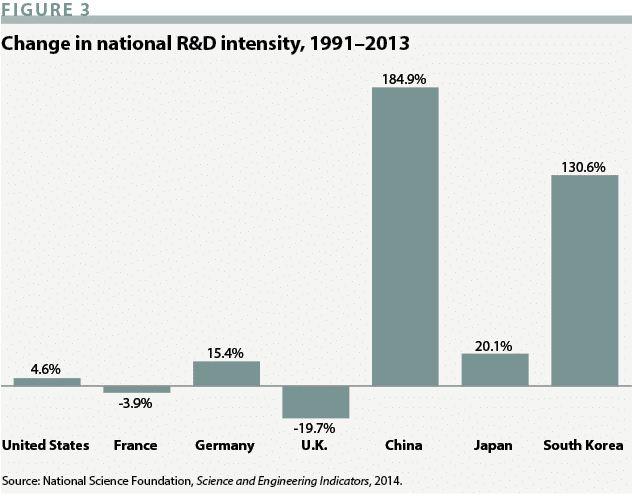

Figure 3 shows that the dominant position of the United States as a funder and performer of R&D has been steadily eroding. The United States now ranks 10th in the world in R&D intensity. We still account for one-third of the world’s R&D, but that means two-thirds of global R&D is now performed elsewhere.

A similar negative pattern is occurring for the federally funded portion of national R&D. The most important reason for more and the right kind of federal R&D spending is that investments in (1) technology, especially in its early phases of development, and (2) supporting technical infrastructure (“infratechnologies” and associated standards) have significant degrees of public good character. The concept of public good content in technology (as opposed to scientific) research is not new, but in the United States, the dominant target of such funding is to support social missions (defense, space, clean and domestic-sourced energy, etc.). Conservative factions have not bought into the concept that technology development for economic growth purposes has any substantive role for federal funding.

A particularly important target of federal spending is early-phase technology research that is designed to test proofs of concepts, or “technology platforms,” upon which industry bases the applied R&D leading to innovations. Although critical for the efficiency of subsequent applied R&D, such concepts, or platforms, are a long way from achieving commercially viable products and services. Companies, therefore, apply a large time-discounting factor to this research, making it less likely that they will invest in it. Moreover, the early phases of a new technology’s development entail considerable risk, which causes industry to further adjust downward the expected rate of return.

Further, such proof-of-concept technology research exhibits significant spillovers, meaning companies don’t get anywhere near all the intellectual property benefits from these early-phase R&D investments. Finally, the resulting technology platforms exhibit significant economies of scope with respect to potential markets, the set of which is usually broader than the strategic scope of even large firms. The combined impact of these “market failures” is inadequate expected rates of return for investors and, hence, substantial underinvestment by the private sector.

You would think that several decades of competitive erosion would have finally woken up politicians to the need for substantial R&D policy adjustments. However, federal government R&D spending, which funds much of the new technology platform research that starts new industries and leads to private-sector innovation, has declined 14% in real terms since the Great Recession.

Competing economies also provide greater incentives for corporate R&D. The Information Technology and Innovation Foundation (ITIF) estimates that the United States ranks just 27th out of 42 countries studied in terms of R&D tax incentive generosity. The bottom line is that R&D investment strategies in the United States are inadequate with respect to both amount and composition.

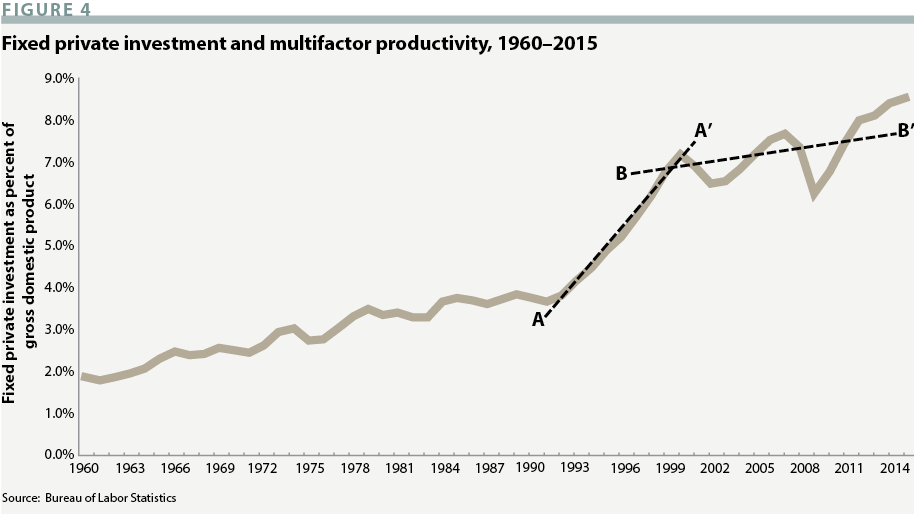

Fixed investment. Fixed investments (hardware and software) embody most new technology and, thereby, enable commercialization that leads to productivity growth. Figure 4 shows the dramatic changes in the rate of “fixed private investment” (hardware and software) on multifactor productivity growth.

Specifically, when decades of R&D in information technologies by both government and industry finally reached commercial viability in the 1990s, industry dramatically increased its investment in this area to take advantage of this productivity-enhancing technology, as shown in Figure 4 by the steeper slope AA’. As pointed out previously, the accelerated investment resulted in a significant increase in the rate of multifactor productivity growth. However, without subsequent major new technologies and sufficient domestic investment incentives, the rate of corporate investment declined notably in the 2000s and multifactor productivity growth declined as well, indicated by BB’.

In its place, companies yielded to pressures from Wall Street to deliver short-term benefits to investors. For example, in the period 2009 to 2014, US domestic corporate R&D spending totaled roughly $1.5 trillion. However, during this same period, companies in the Standard and Poor’s 500 Index were estimated to have spent $2.1 trillion on stock buybacks. While such buybacks provided short-term benefits to corporate managers and shareholders in terms of higher per-share earnings, they soaked up corporate funds and thereby contributed significantly to a decline in the growth rate of corporate investment.

Skilled labor. BLS data show that in all but one of 71 technology-oriented occupations, the median income exceeds the median for all occupations. In 57 of these occupations, the median income is 50% or more above the overall industry median. So, a policy imperative is to increase domestic worker skills to levels that are not easily accessible elsewhere in the global economy, thereby forcing companies all over the world to choose the US economy as the preferred investment location. Further, a stronger US advanced technology sector will increase exports and thereby enable the US dollar to be stronger, which, in turn, will enable all US wages, not just in export-oriented sectors, to be higher in real terms, as the price of imports will decline.

Unfortunately, virtually every survey and testimonial by corporate executives confirms that community colleges and universities are not turning out the right mix of skilled workers. In a 2014 survey by the Business Roundtable, 97% of the responding CEOs said the skills gap threatens their businesses. A significant number of CEOs said they are having difficulty finding workers with computer and IT skills, advanced quantitative knowledge, and even basic science, technology, engineering, and mathematics (STEM) literacy. A 2015 study by Deloitte and the Manufacturing Institute estimates that over the next 10 years, 3.5 million new manufacturing jobs will be created, but the skills gap will prevent 2 million of them from being filled.

One would logically expect that the supply of skilled labor would eventually adjust to meet shifts in demand. In fact, some community colleges, with help from grants from the Labor Department, have revamped curricula in consultation with local industries to adjust the skills mix of the local labor pool. However, this is not being done at close to the level needed, and other economies are continually upgrading their education and training programs, thereby creating a moving target.

Further, The Economist points out that the United States spends about one-sixth the average amount of other industrialized economies on retraining labor in trade-impacted industries. Thus, retraining of existing workers whose skills are inadequate for competing in global technology-based markets is well below levels in competing economies. STEM curricula are being developed and implemented in some public school systems, but the average penetration rate is low and the variance across states is high.

The imperative for drastically updating the US educational system is underscored by major efforts in other economies to upgrade both production and research skills. For example, northern European economies have had comprehensive vocational training programs for decades. China’s World Class 2.0 project has the objective of increasing the research performance of China’s nine top-ranked universities, with a goal of having six of those institutions ranked within the world’s top 15 universities by 2030.

Industry structure and supporting infrastructure. The complexity of modern technologies means that supply chains have become a more important policy target than individual industries. Vertical integration of suppliers and their customers (adjacent tiers in the supply chain) is required to make sure performance specifications are adequately developed and the interfaces between components of a technology system are fully and efficiently functional.

Passage of the Revitalize American Manufacturing and Innovation Act of 2014, which authorized a National Network for Manufacturing Innovation (now called Manufacturing USA), is a beginning. However, the size and scope of the resulting Manufacturing Innovation Institutes (MII’s) is way too small. Instead of the current nine MII’s, there should probably be around 50. Congress authorized this program but refused to fund it, forcing the Obama administration to fund the current MII’s using existing R&D agency funds.

Funding these few MII’s through the Department of Defense and the Department of Energy means that the portfolios of research projects will reflect those agencies’ needs to a significant extent. This current US R&D strategy of relying on mission-oriented agencies is fine for them, but it is not optimal for economic growth more broadly.

As a comparison, Germany, with a GDP less than a fifth of the United States, has 67 Fraunhoffer Institutes. Although not equivalent in research mission to MII’s (their focus is on more applied R&D than the MII’s), the size and scope of this German program reflects far greater emphasis on productivity growth and is tied into a comprehensive German economic growth strategy for advanced manufacturing. Further, funding these few MII’s through the Department of Defense and the Department of Energy means that the portfolios of research projects will significantly reflect those agencies’ needs.

In terms of industry structure, horizontal integration (cooperation by firms in the same industry) has, until recently, been frowned upon by policy makers steeped in neoclassical economics due to the purported negative implications for competition. However, the market failures identified previously make a strong case for cooperation in the development of technology platforms and infratechnologies due to their public good content. Thus, competing companies (in the same industry), while conducting their own proprietary R&D as in the past, increasingly participate in joint (precompetitive) research, using regional industry consortia (“innovation clusters”) to conduct early phase proof-of-concept technology research.

Another reason for promoting regional and sectoral clusters of firms in high-tech supply chains is the reality that modern technologies are complex systems. For example, automobiles used to be a modest set of hardware components: engine, drive train, suspension, and the like. However, for at least a decade, cars have contained numerous subsystems for which electronics is a central element. These subsystems are controlled and connected to each other by as many as 100 microprocessors in some models.

Efficiently developing such technological systems requires coordination and efficient interfaces among a large number of companies making up the automotive supply chain, who are necessarily undertaking progressively larger shares of automotive R&D. The inherent complexity means that co-location synergies among component suppliers and system integrators are significant.

This and many other evolving patterns of industrial development mean that multiple component technologies must be developed based on somewhat different areas of science and engineering. Thus, single companies, even the largest ones, cannot develop all components. Further, all components must advance at some minimum rate for system productivity to be realized in a time frame driven by global competition.

Finally, overall economic efficiency is increased by the fact that regional “innovation clusters” offer a large and diversified pool of skilled labor to draw upon. Workers can move among companies much more efficiently as labor needs shift. Toyota recently announced that it would invest $1 billion over the next five years in the development of AI and robotics. The company chose the mother of innovation clusters, Silicon Valley, as the location for this research because of the unparalleled availability of the needed research talent.

More typical are communities such as Greenville, SC, which is a fast-growing site for advanced manufacturing, largely supporting the automobile and aerospace industries. Greenville Community College has been upgraded and restructured to train workers for high-tech jobs. Workers who once made $14 per hour in low-skilled service jobs now make $28 per hour in high-tech manufacturing plants. Yet, the national economic growth problem is that Greenville gets a lot of attention because too few others like it exist.

The growth strategy

The solutions for economic recovery and growth being pushed in this country—general tax and regulatory reductions—are simplistic and naïve. They ignore the complexity of the assets underlying the successful modern economy. In fact, it is differences in economic asset accumulation strategies that distinguish successful economies from the rest.

Economists have touted the “law of comparative advantage” for 200 years. The basic premise underlying its conceptualization has been that global economic welfare is maximized if each economy produces the products and services in which it is relatively more efficient. Note that this means economy A may have an absolute efficiency advantage in two products compared with economy B, but both economies are better off if economy A specializes in the product for which it has the greatest productivity advantage over economy B and let economy B produce the other product.

For most of the past century and a half, such comparative advantages were relatively stable over time, being based on endowed resources within each economy such as land, minerals, and labor skills—all of which changed slowly. Even technology evolved at a snail’s pace, making technological change largely a nonfactor.

Today, the intrinsic character of the law of comparative advantage has changed dramatically. The growing dominance and pace of new technology development means that comparative advantage can and is being created by competing economies on a regular basis, as opposed to being taken as a static condition. Further, the public-private nature of technology assets means that governments now compete against each other as much as do their domestic industries.

Yet, populist movements that have arisen in the United States and other industrialized nations are the antithesis of adaptation to the broadening and deepening global technology-based economy. The major change since the first Industrial Revolution is the increasing dynamic through which old jobs are lost, but through productivity growth resulting from the emergence of new technologies, new jobs will be created. Most important, these new jobs are higher skilled and will, therefore, pay more.

Yes, the labor content per unit of output will be lower, at least in manufacturing, which gives rise to the fear of lower employment. However, greater comparative advantage in trade will expand market shares, which means more of the high-skilled, high-paid workers will be needed. The United States accounts for less than 5% of the world’s population. This means over 95% of consumers live outside this country. So, we want to restrict trade?

What opponents of trade agreements such as NAFTA are really saying is that they are afraid that the economy cannot compete or cannot muster the national discipline to adapt to foreign competition. They, therefore, fight to protect increasingly noncompetitive industries and their low-paying jobs.

Any gain from protectionism would be short lived. Because domestic substitutes for imports would be more expensive due to lower productivity, average wages would have to fall to compensate, and our standard of living would fall. There is not a single example in the history of the world’s economy where protectionism resulted in a higher standard of living. Inefficiency pays less, not more.

With respect to the fear of job losses from automation, major technological epics have occurred for centuries, and each time some economies adapt and some do not. One point is unassailable: technological change will never cease, but its pattern is “lumpy,” which means economic and social upheavals will occur. We are getting a double dose, as the global technology-based economy is rapidly expanding to include a growing number of nations, while new digital technologies are radically changing both industry and society.

The United States has responded to a degree. The Manufacturing USA program implements new institutional research mechanisms (the precursors to innovation clusters) that address the transition phase of R&D from science to proof of technology concept and then provide efficient technology transfer to the embedded supply chain. State and urban initiatives using incubators and accelerators are very helpful in both increasing technology commercialization efforts and attracting venture capital funding to small high-tech firms.

However, these responses to date have been limited and uneven across the US economy. So, the question is can we adapt with the necessary scope and depth? When the Russians put a man into Earth orbit for the first time, we didn’t withdraw from the space race and pass a law forbidding other countries from flying spacecraft in low-Earth orbits over our country—the equivalent of the current support for protectionism. Instead, America responded to President Kennedy’s challenge to put a man on the moon in less than a decade, which the nation did with the greatest systems engineering achievement in history.

The forthcoming Industrial Internet of Things, or “Industry 4.0” as it is called in some other countries, is a major revolution that will require huge investments in information and communications technologies. The combination of automation and digitalization will require that these investments be integrated and managed by an advanced infrastructure that spans product systems and post-sale updating of system components. Such a dynamic extension of current product-service supply chains will give new meaning to the concept of technology life cycles and will require a huge upgrade in supporting infrastructure.

The major policy problem is that investment in new technologies has too long a time horizon and too much technical and market risk to be spurred by lower interest rates on loans, as much of the economic policy community seems to think is the case. The required investment stretches out over many years and exhibits risk and capture profiles that are beyond the capacity of the limited risk and high discount rate tolerances of corporate investment criteria.

The World Economic Forum correctly characterizes the nature of future competitiveness as the set of institutions, policies, and factors that determine the level of productivity of an economy, which, in turn, determines the level of prosperity. We can achieve higher rates of economic growth and raise middle-class incomes, thereby reestablishing growth in our standard of living, by challenging ourselves to make the required investments in the four categories that I’ve described here.

The United States has a history of success in technology development and deployment by providing support for new technology platforms, which over an extended period have yielded new high-growth industries. And grass-roots efforts in a variety of industries through initiatives by state and local governments further demonstrate the essence of the needed resolve and resourcefulness to compete in the evolving global economy. What is missing is the national coordination and provision of resources to make the needed transition of sufficient scope and efficiency to grow national productivity at the required pace.

Gregory Tassey is a research fellow at the Economic Policy Research Center at the University of Washington.

Recommended reading

Martin Neil Baily, “Productivity should be on the next president’s agenda,” Brookings Report: 11 Ways the Next President Can Boost the Economy, The Brookings Institution; available online: https://www.brookings.edu/research/how-to-rev-up-productivity.

Alan Berube, “Middle-skilled workers still making up for lost earnings,” The Brookings Institution (19 October 2016); available online: https://www.brookings.edu/blog/the-avenue/2016/10/19/middle-skilled-workers-still-making-up-for-lost-ground-on-earnings

Nanette Byrnes, “Learning to Prosper in a Factory Town” MIT Technology Review (18 October 2016).

Daniel E. Hecker, “High-technology employment: a NAICS-based update,” Monthly Labor Review (July 2005): 57–72.

Emmanual Saez and Gabriel Zucman, “Wealth Inequality in the United States Since 1913: Evidence from Capitalized Income Tax Data,” Quarterly Journal of Economics 131, no. 2 (2016): 519-598.

Shawn Sprague, “What Can Labor Productivity Tell Us About the U.S. Economy?” Beyond the Numbers 3, no. 12 (May 2014).

Gregory Tassey, “Rationales and Mechanisms for Revitalizing U.S. Manufacturing R&D Strategies,” Journal of Technology Transfer 35, no. 3 (2010).