New Challenges for U.S. Semiconductor Industry

With many nations taking action to strengthen high-tech industry, the United States should take steps to maintain its critical leadership.

The United States faces a growing threat to its leadership of the world semiconductor industry. A combination of market forces and foreign industrial policies is creating powerful incentives to shift new chip production offshore. If this trend continues, the U.S. lead in chip manufacturing, equipment, and design may well erode, with important and unpleasant consequences for U.S. productivity growth and, ultimately, the country’s economic and military security. To address this challenge, U.S. industry and the government need to cooperate to determine their response.

As challenges tied to the industry’s move toward ever-smaller dimensions have intensified, governments in Asia and Europe have moved vigorously to coordinate and fund research in both product and process technologies. The scale of these efforts is unprecedented. A recent U.S. National Research Council report, Securing the Future, identified 16 major government-sponsored initiatives at the national and regional [i.e., European Union (EU)] level, a number of them receiving more than $100 million annually in support. Some have been inspired by the success of SEMATECH, the formerly U.S.-only consortium of semiconductor device makers widely credited with helping to pull the U.S. industry out of its tailspin in the late 1980s. What is odd is that although governments abroad have embraced consortia modeled on SEMATECH as a means of supporting national and regional industries, today the United States has no comparable publicly supported effort, even as the technological hurdles faced by this enabling industry continue to grow.

Compounding the heightened competition in research has been the dramatic increase in the cost of new fabrication facilities (fabs) that has accompanied growth in the sophistication and scale of manufacturing. The evolving economics of production have also spawned a new business model, the foundry, which may test even the most agile of the vertically integrated U.S. chip makers. Turning out integrated circuits under contract for firms that work exclusively in device design, including leading U.S. firms, foundries provide relatively low-cost products for “fabless” companies that need high-performance fabrication but are unable or unwilling to invest the $2 billion-plus it now takes to build a new plant.

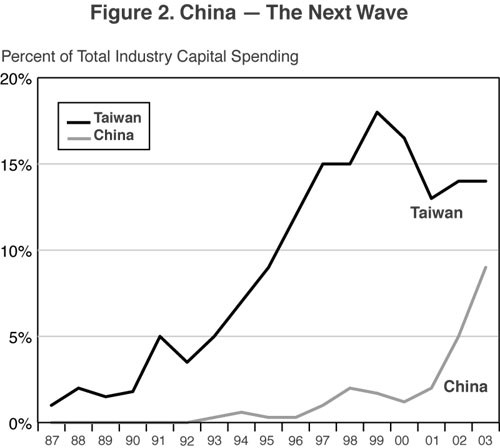

Until recently, most foundries were operating or planned for construction in Taiwan, where the government has aided the industry with a variety of measures that include generous tax breaks. Just in the past few years, however, China has stepped forward, matching Taiwan’s incentives and trumping them with a rebate of most of the value-added tax (VAT) on chips designed or manufactured in China. In a major shift, the Chinese semiconductor industry is now drawing massively on Taiwanese capital and skilled management, as well as attracting investments from the United States and elsewhere.

Key among the policy tools put to work by China, in cooperation with regional authorities in Shanghai and elsewhere, is highly favorable tax treatment for plants, equipment, and skilled personnel. Yet it is the rebate of the VAT for Chinese products that seems to be having the strongest effect on this capital-intensive industry. This measure may ultimately be declared in contravention of World Trade Organization rules, but for now construction of chip-fabrication capacity in China is projected to boom. Of paramount importance for the future of the U.S. semiconductor industry is the extent to which Chinese government policy will determine the location of the industry, and its supply base, before there is a U.S. response.

Why does the industry matter?

Some may ask whether it matters if the U.S. economy has a robust and growing semiconductor industry. The short answer is that it does. The semiconductor’s powerful impact on productivity growth in the U.S. economy, through improved information technologies and the industry’s own productivity gains, is now generally acknowledged. Drawing on work by economists such as Dale W. Jorgenson of Harvard University and Kevin J. Stiroh of the Conference Board, the Council of Economic Advisers’ 2001 Economic Report of the President described this impact as follows:

- “The information technology sector itself has provided a direct boost to productivity growth”

- “The spread of information technology throughout the economy has been a major factor in the acceleration of productivity through capital deepening” and

- “Outside the information technology sector, organizational innovations and better ways of applying information technology are boosting the productivity of skilled workers.”

Put more succinctly, the semiconductor industry is U.S. manufacturing’s star performer. On the strength of a 17 percent annual growth rate, its output climbed from 1.5 percent of manufacturing gross domestic product in 1987 to 6.5 percent in 2000. In 1999, when it posted $102 billion in sales, it accounted for not only half the world market in its product but also for over 5 percent of manufacturing value-added in the U.S. economy, making it the manufacturing sector’s leader. It boasted 284,000 employees as of August 2001 and paid them an average hourly wage 50 percent higher in real terms than it had 30 years before–a remarkable achievement in light of the overall 6 percent real decline in manufacturing wages over the same period. And it provides the core of the $425 billion U.S. electronics industry.

Yet impressive as these figures may be, they represent only a small part of the semiconductor’s footprint, which dwarfs industry-specific trade, employment, and revenue figures. Indeed, the end of a two-decade slowdown in U.S. productivity growth that took hold in the early 1970s and that coincided with a significant erosion of the country’s industrial power can be traced to a sudden speedup in the rate of decline of semiconductor and computer prices. As Jorgenson has documented, after having been steady at 15 percent, the annual rate of these prices’ decline vaulted to 28 percent in the mid-1990s. U.S. labor productivity in the period 1995-1998 increased by 2.4 percent per year–a full percentage point higher than the average rate for the preceding five years–as investment in computer technology exploded and its contribution to growth rose more than fivefold. These trends have continued through the recent recession, with productivity gains of 9.4 percent on an annualized basis estimated for the third quarter of 2003.

Given semiconductor manufacturing’s prominent role in the U.S. economy as a source of value-added production, high-wage jobs, productivity gains, and wage growth, keeping the industry is clearly in the nation’s interest. And although U.S. clients of Asian foundries believe they can retain in-house chip design expertise in the absence of manufacturing, their negotiating position may shift as capacity tightens, and it is in any case dependent on effective intellectual property protection, which is currently problematic in China. More fundamentally, semiconductor manufacturing is a learning-by-doing industry. Having fabrication facilities in close proximity to R&D facilities is important for researchers and manufacturers alike.

Producing state-of-the-art integrated circuits requires a wide variety of interdependent skills, and these skills need to be honed constantly if they are to stay on the cutting edge. Until now, U.S. chip fabrication plants have anchored specialized industrial clusters that often include R&D labs and the facilities of semiconductor equipment and materials makers, which work closely with device manufacturers on technology development. Often with the aid of government support, such clusters have emerged in cities as diverse as Austin, Phoenix, Portland, Hsinchu, and recently, Dresden. They serve as magnets for human capital.

Sharply rising capital costs for 300-millimeter fabs, concomitant increases in the capacity of these fabs, and slower market growth will tend to limit the number of fabs constructed. Further, as the number of first-line fabs decreases and as competition grows for scarce top-level human resources, risks to the health and vibrancy of U.S. clusters grow as well. The redirection or dissolution of semiconductor production clusters in the United States would likely result in the loss of on-the-job training and shifts in career choices for engineers while reducing activity in associated industries, which are also high-value-added and R&D-intensive. This, in turn, could lead to the loss of learning skills needed for promising new sectors such as solid-state lighting and nanotechnologies, while at the same time calling into question the country’s ability to retain the current level of R&D capabilities.

U.S. labor pool, R&D waning

The pool of skilled labor available to the U.S. semiconductor industry already appears to be shrinking. The number of bachelor’s degrees in engineering granted annually by U.S. universities has been essentially static over the past decade and comes to only one-sixth of the combined total granted in China, India, Japan, South Korea, and Taiwan each year. Many foreign-born engineers are benefiting from first-class education at U.S. schools. As attracting skilled labor becomes an integral part of international industrial competition, these engineers are being offered significant inducements to return home, as are knowledge-rich engineers who now work in U.S. industry. China and Taiwan alike have deployed tax policy to enhance the attractiveness of working in their national high-tech clusters: Both nations effectively exempt stock options distributed as employee compensation and provide numerous other incentives to enhance the standard of living of engineers and managers who opt to work in what countries such as China see as a strategic industry.

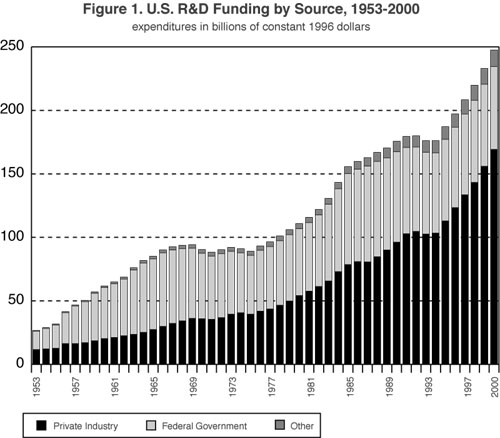

At the same time, although U.S. private R&D outlays have been growing at a robust pace overall, federal spending has not kept up with private-sector investment (see Figure 1). This is worrisome, since industry now finances far less long-term research than it did in the heyday of the large central corporate laboratories. And it is specifically in the electronics sector, where U.S. government and industry gave the world an example of constructive public-private cooperation in the formation of SEMATECH in the late 1980s, that U.S. policies have been running contrary to global trends. For example, some reports suggest that the annual support from the Defense Advanced Research Projects Agency, a major source of U.S. funding for long-term R&D in microelectronics, fell from about $350 million to about $55 million–a drop of around 85 percent–during the decade of the 1990s, just as these same industries were driving the growth and productivity of the U.S. economy.

Initiative shifting abroad

Contrasting with U.S. reticence to provide R&D support are the trends in Europe and East Asia, where national and regional programs are rapidly expanding in size and number as governments signal the importance they attach to their semiconductor industries and seek to address their growing technical challenges with substantial levels of direct and indirect funding. A prominent example, Belgium’s IMEC, draws annual funding from the Flanders regional government of $45 million. Conducting research under contract for European governments and for companies both inside and outside the EU, IMEC has become an international center of excellence for semiconductor manufacturing research.

The EU itself, hard on the heels of its four-year Micro-Electronics Development for European Applications (MEDEA) program (which drew one-third of its 2 billion-euro budget from government sources) has pledged twice as much for MEDEA-Plus, an eight-year program ending in 2009. Germany and France are contributing to research programs at the national level and seeking chip-related foreign investment. Advanced Micro Devices’ recent decision to build a manufacturing plant in Dresden indicates that they are having some success. And Japan’s commitment to a renewal of its industry has spawned at least seven large semiconductor research programs, four of which started in 2001.

Most recently, however, attention has shifted from research funding levels to investment in new fabs, and all eyes have turned rather abruptly toward China, where capital investment is growing rapidly (see Figure 2). In September 2002, four fabs were operating on the mainland, one was under construction, and another 10 were planned; Taiwanese interests were reported to be involved in six of the 10 that were in the planning stages and to have part ownership of the plant being built. These projects had already drawn resources earlier intended for investment in Taiwan itself, where, as of mid-2000, a remarkable 30 new fabs were seen going into production by 2010. Instead, Taiwanese semiconductor enterprises now have their sights set on the construction of no fewer than 19 new fabs on the mainland by the end of the decade, all of them foundries, whereas 10 fewer are to be built in Taiwan. This compares with four to five fabs proposed or underway in the United States. Meanwhile, South Korea has also begun making substantial investments in fabs. This de facto fusion of China’s and Taiwan’s industries is an important development and one that requires a vigorous and constructive U.S. policy response.

The stakes are substantial and are increasingly recognized in the technology community. For example, the President’s Council of Advisors on Science and Technology (PCAST) is finishing the first phase of a study reviewing the health of U.S. high-tech manufacturing. Noting the success of foreign governments in creating an attractive environment for the manufacture of electronics and semiconductors, George Scalise, the chair of the PCAST subcommittee on Information Technology Manufacturing and Competitiveness, points out that “U.S. high-tech leadership is not guaranteed.” He adds that “If we lose leadership and if we don’t have that as a driving force in our economy, then it is going to have an impact on the standards of living here. That is a reality.”

The challenge of speed

The impact of foreign government policies is indeed real and effective. Although the prospect of selling into China’s domestic market provides the long-term impetus to site manufacturing capacity there, it is the immediate impact of tax incentives, particularly the VAT rebate, that is so rapidly redrawing the map for semiconductor production. Perhaps surprisingly, there is not much of a gap between Taiwan and China in investment and operating costs. And it is important to remember that the capital-intensive nature of the industry makes labor–about 7 percent in the industry cost structure–a relatively unimportant factor.

This policy, which amounts to imposing a tariff on foreign-made wares, will be effective; at least until it is condemned by the World Trade Organization. But as long as it holds, China’s pull on new production will be powerful. By creating a “price umbrella” for semiconductors produced in China, the policy gives domestic manufacturers the option of either raising profits by increasing prices or undercutting imports to ensure greater capacity utilization and consequently lower unit costs.

The policy also influences the behavior of companies that buy semiconductors for incorporation into products made in China. “Our U.S. customers, who have either joint ventures or wholly owned subsidiaries in China, have indicated to us that sooner or later, we have to be there, because it costs them a lot in taxes to import our goods,” says a top executive of the Taiwan Semiconductor Manufacturing Corporation. Taiwan’s government is already putting into place measures designed to keep R&D, design, finance, logistics, and marketing–so-called “headquarters” functions–in Taiwan once manufacturing itself has crossed the strait to the mainland.

These policies have created a dilemma for some U.S. managers. Intel cofounder and chairman Andrew S. Grove was recently described by the Washington Post as “torn between his responsibility to shareholders to cut costs and improve profits, and to U.S. workers who helped build the nation’s technology industry.” Decrying the “policy gap” in Washington, Grove predicted that without government help in deciding “the proper balance between the two,” companies would come down on the side of their immediate obligations to shareholders. Their dilemma underscores a key point. Individual firms, particularly those that believe they must be present in the rapidly growing Chinese market, are poorly positioned to counterbalance the strategic industrial policies of a nation, especially one the size of China.

It is important to emphasize that, whatever is done, a significant portion of the semiconductor industry will inevitably locate in China. The current global distribution of production and research cannot and should not be frozen. But there is nothing inevitable about a wholesale shift in this key industry to offshore, not least because much of the current acceleration is the result of Chinese government policy. The goal of developing a strong national semiconductor industry is thoroughly understandable from the Chinese perspective. The question is, what should the United States do?

This is not the first time that the U.S. lead in semiconductors has been challenged. In the 1980s, the United States faced a similar challenge, which was met by an innovative policy mix, including the industry consortium SEMATECH and an effective market-opening trade agreement with Japan that stopped dumping in the United States and third markets, thereby helping companies such as Intel to reposition their production toward microprocessors, where U.S. design strengths proved decisive. These policy measures, combined with the innovative capacity of U.S. firms, laid the foundation for the U.S. industry’s growth in the 1990s, which in turn brought major benefits to the U.S. economy. Today’s challenge is not identical, but a cooperative response that involves U.S.-based firms, universities, and government can help the United States maintain its strong position in this industry. The steps that might be taken fall into three different but related areas.

Trade. The most pressing area is that of trade policy, where the United States needs to take immediate bilateral and multilateral action to end China’s discriminatory VAT “tariff.” Failure to act effectively on this issue would likely compromise the effectiveness of most other policy measures the United States might adopt. Bringing China into a rules-based trading system is a laudable goal, but the rules have to work for everyone, including U.S. manufacturing workers.

In addition, outmoded export restrictions on equipment available from foreign suppliers should be dropped to help ensure that the United States remains an attractive export platform in the global economy. Current trade policy has not kept materials out of China, but it has let firms based in other countries make sales that are blocked for U.S.-based companies.

Tax. Countries such as China and Taiwan have implemented substantial tax exemptions, which because of their scope and extremely low effective rates are unlikely to be emulated in a U.S. context. Congress can, however, take some concrete steps to retain manufacturing by U.S. firms–and their tax payments–within U.S. borders. One helpful step would be to reduce the schedule for depreciation allowances from five years to three years, which would more accurately reflect the actual life of semiconductor manufacturing equipment. More broadly, increasing U.S. demand through serious tax incentives for investments in information technology equipment and its manufacture could help increase growth and productivity in the U.S. economy while helping to anchor manufacturing here.

Regular assessment. An in-depth assessment should be undertaken by a government/industry group to determine the challenges facing the U.S. industry, including the scope and impact of current measures by other governments in this sector. Information about other governments should include the level of expenditure and the impact of these policies on the U.S. industry, particularly the U.S. defense industrial base.

R&D. The productivity gains driving the U.S. economy are largely derived from applications of information technologies. These technologies in turn are based to a significant degree on continued progress in semiconductors. Yet the federal government cut support for physics, chemistry, and engineering through much of the 1990s. The trend now seems to be improving, but the lag effects of these cuts, as well as their cumulative impact on university research and the recruitment of new researchers, scholars, and students, are a genuine cause for concern. Some believe that we may be shortchanging future generations by failing to maintain the rate of investment that characterized the U.S. economy in the 1960s. Increasing R&D funding in universities and consortia for disciplines related to the industry would be one effective way to help anchor the industry, with its manufacturing expertise and its jobs, here in the United States.

Specific programs directed at basic research related to semiconductor technologies are also important. Securing the Future recommended that the Microelectronics Advanced Research Corporation’s Focus Centers, in which government and industry jointly support university researchers, be fully funded and, ideally, expanded. Inexplicably, this has not happened. While we are spending billions to improve U.S. security, it is important to remember that the foundations of U.S. military power rest in no small part on U.S. leadership in semiconductor-based technologies for communications, logistics, interception, smart bombs, and more. It is worth recalling that the February 1987 report of the Defense Science Board on Defense Semiconductor Dependency concluded that the erosion of U.S. capability in commercial semiconductor manufacturing posed a national security threat. If anything, the military significance of microelectronics as the decisive advantage for the U.S. warfighter has increased exponentially since the 1980s.

State initiatives. Interestingly, as the federal government has pulled away from forming partnerships with industry and even from simply funding existing programs, states such as Texas and New York have moved vigorously into this policy vacuum. They have made substantial investments, in collaboration with industry, to attract and retain semiconductor research facilities, to build centers of expertise, and to support university research and training programs in order to stay abreast of rapidly evolving technology. New York State’s Centers of Excellence Initiative, created by Governor Pataki, has attracted substantial industry and federal funding to create programs such as the Nanoelectronics Center in Albany, developed in partnership with IBM, and an even larger state/industry cooperative effort for the creation of SEMATECH North. Texas, partly in competition with New York, has redoubled its efforts with its new initiatives at the University of Texas at Dallas that are aimed at building a cooperative arrangement between university researchers and a new private chip manufacturing facility near the campus. These state-based efforts are unusual both in their scale and in the political commitment to ensure their financing even through the current economic and budgetary downturn. Given the resource commitments and limitations of state programs, the federal government might envisage implementing matching grants through which federal funds could “match” state and private-sector contributions to R&D facilities. Some of this is already happening. Direct federal obligations for science and engineering in New York have hit a new record at $1.82 billion, a development that underscores the wisdom of expanding the NSF budget. Cooperative approaches involving public and private financing and independent but focused university research can do much to support U.S. industry while training students to tackle the technical challenges of the future.

Above all, we need to recognize a few simple verities:

- The semiconductor industry is unique by virtue of its rate of growth, its enormous increases in performance at lower cost, and its implications not only for the economy as a whole but for national security.

- The rest of the world recognizes the benefits of the industry in job creation, productivity gains, and security enhancement, and many countries are making substantial investments to capture these benefits. Some of these actions (such as improving universities) are what national competition should be about; others, such as discriminatory tax regimes, need to be blocked immediately if long-term damage to the industrial fabric of the United States is to be prevented.

- The challenge is complex, and partnering among government, industry, and universities is one of the best ways to meet it. Enhanced R&D funding, active trade enforcement, and support for local and regional efforts to retain and strengthen clusters of semiconductor-related activities can help ensure a more dynamic and prosperous future for the U.S. economy and its citizens.