Global trends in R&D Spending

Several years of economic growth have benefited investment in science, technology, and innovation. Business investment has increased and consumer spending has rebounded. This has increased demand for innovative products, processes, and services, and with it demand for scientific and technical knowledge. Improved corporate profitability has paved the way for growing investment in intellectual assets, including research and development (R&D), human resources, and intellectual property.

Increased spending is found in most of the 30 member countries of the Organization for Economic Cooperation and Development (OECD), including the major industrialized countries of Europe, Japan, and the United States. Non-OECD economies are making a growing contribution to global R&D expenditure. The combined R&D expenditure of China, Israel, Russia, and South Africa was equivalent to almost 22% of that of OECD countries in 2005, up from 9% in 1995, and these countries attract a growing share of investment by foreign affiliates. Recent policy initiatives aim to enhance the attractiveness of these countries to foreign investment by improving their domestic innovation capabilities.

Growing R&D intensity

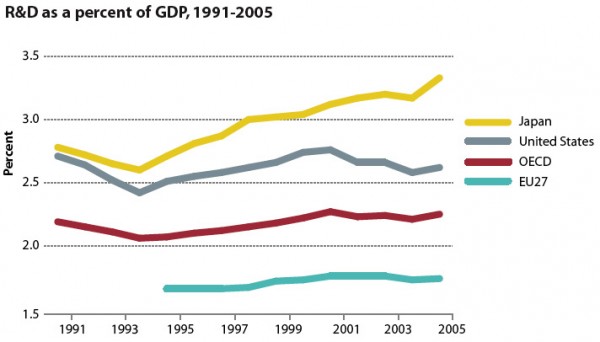

Total R&D spending in the OECD countries reached $772 billion in 2005, about 2.25% of GDP. R&D intensity reached 3.33% of GDP in Japan, and 2.62% in the United States in 2005. R&D intensity was lower in Europe, where only a few countries are on track to meet the European Union R&D target of 3% of GDP. Although Europe’s lower R&D intensity is partly linked to cyclical conditions, it is primarily due to structural factors, such as the small size of its information technology, manufacturing, and services sectors.

Sources: Data in these graphs come from OECD’s; Science, Technology, and Industry Outlook, 2006; Main Science and Technology Indicators, 2007–I; and the ANBERD Database, 2007.

Growing share of the global economy

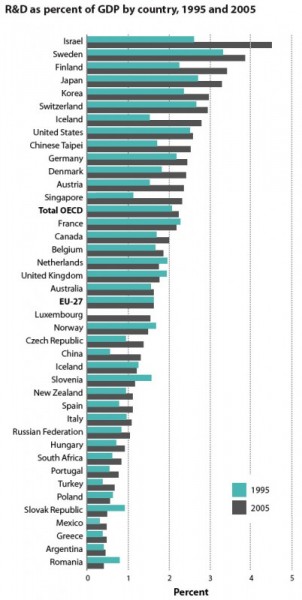

The richer countries are increasing their R&D intensity faster than are their less-affluent neighbors within the OECD. The largest gains were in Japan, Iceland, Finland, Denmark, Austria, and Sweden. Poland and the Slovak Republic saw declines. R&D intensities also grew in many non-OECD economies. Israel, Chinese Taipei, and Singapore, at 4.5, 2.5, and 2.4%, respectively, exceed the OECD average. Some major low-intensity countries such as Russian and China have increased spending quickly and are poised to continue.

Sources: Data in these graphs come from OECD’s; Science, Technology, and Industry Outlook, 2006; Main Science and Technology Indicators, 2007–I; and the ANBERD Database, 2007.

Business investment mixed

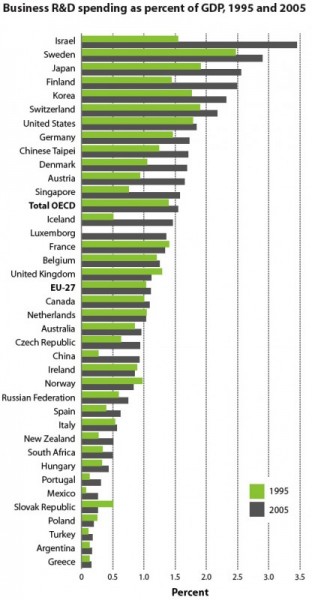

Business enterprises account for the bulk of R&D performed in OECD countries, and much of that R&D is financed by industry itself. Hence, as industry investments in R&D slowed in recent years, business-performed R&D stagnated also, mainly owing to slow growth in the United States and Europe. Exceptions where growth has been strong include Finland, Iceland, Denmark, Austria, Korea, and Japan.

Sources: Data in these graphs come from OECD’s; Science, Technology, and Industry Outlook, 2006; Main Science and Technology Indicators, 2007–I; and the ANBERD Database, 2007.

Government steps up

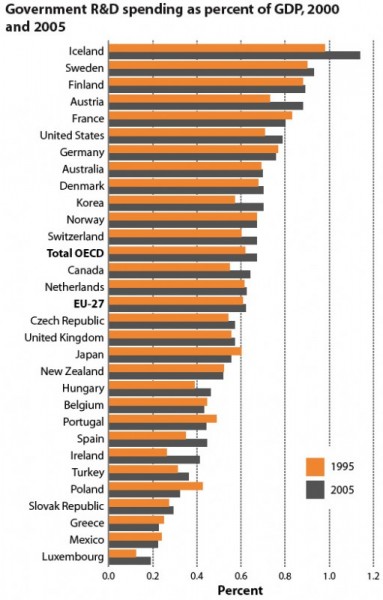

After falling as a percentage of GDP in the late 1990s, government budget appropriations or outlays for R&D (GBAORD) climbed 7% a year in the OECD area between 2000 and 2005, from $197 billion to $276 billion and from 0.63% to 0.67% of GDP. Largest percentage increases were in Luxembourg, Ireland, Spain, and Korea. The percentage fell slightly in Japan.

Sources: Data in these graphs come from OECD’s; Science, Technology, and Industry Outlook, 2006; Main Science and Technology Indicators, 2007–I; and the ANBERD Database, 2007.

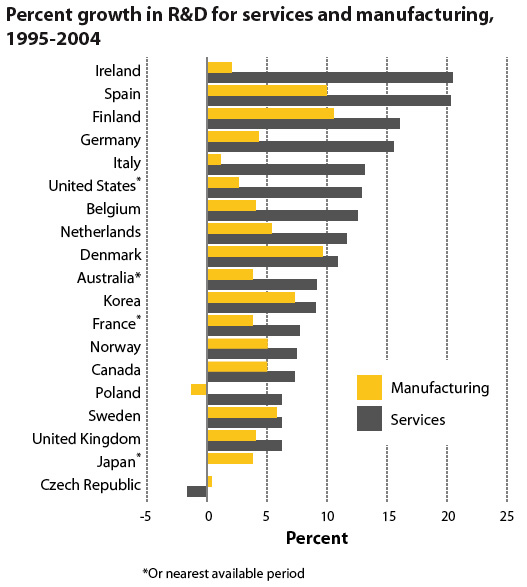

Service sector on the rise

Between 1995 and 2004, services sector R&D grew at an annual rate of 10.5%, compared to 4.6% for manufacturing. Services now make up one-quarter of total business R&D in the OECD, and more than one-third in Australia, Denmark, the United States, Canada, the Czech Republic, and Norway. Recent innovation surveys indicate that the share of innovative firms in some service industries—financial intermediation and business services in particular—exceeds that of manufacturing.

Sources: Data in these graphs come from OECD’s; Science, Technology, and Industry Outlook, 2006; Main Science and Technology Indicators, 2007–I; and the ANBERD Database, 2007.

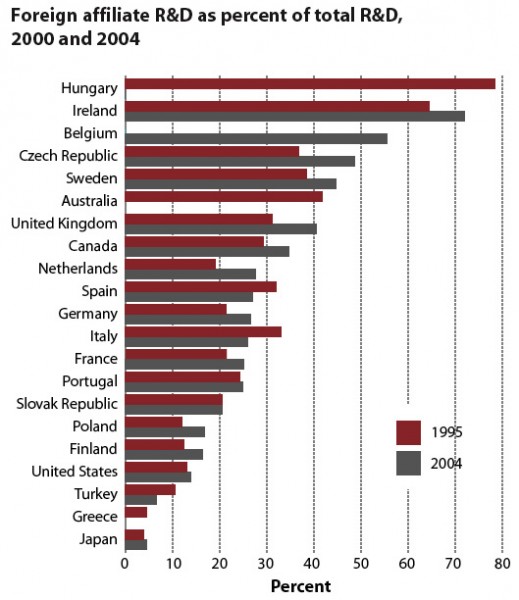

The flattening globe

In most OECD countries, the share of R&D performed by foreign affiliates has increased as multinational enterprises have acquired foreign firms and established new R&D facilities outside their home country. Almost 16% of business R&D in the OECD area was performed in foreign affiliates in 2004, up from 12% in 1995. Most R&D by foreign affiliates remains within OECD countries, but the regions of fastest growth lie outside the OECD area, in particular in Asia.

Sources: Data in these graphs come from OECD’s; Science, Technology, and Industry Outlook, 2006; Main Science and Technology Indicators, 2007–I; and the ANBERD Database, 2007.