Peaking Oil Production: Sooner Rather Than Later?

Oil production will begin to decline in the near future. Beginning to prepare now will soften the blow to the economy.

World demand for oil continues to increase, but Earth’s endowment of oil is finite. Accordingly, geologists know that at some future date, conventional oil supply will no longer be capable of satisfying world demand; conventional oil production will have peaked and begun to decline. No one knows with certainty when peaking will occur, but a number of competent forecasters think it could be soon, which could result in unprecedented worldwide economic problems. Policymakers should be preparing now to ease the passage through this inevitable transition.

The peaking of world oil production has been a matter of speculation from the very beginning of the modern oil era in the mid-1800s. In the early days, little was known about petroleum geology, so predictions of peaking were no more than uninformed guesses. Over time, geological understanding improved dramatically, and guessing gave way to more informed projections. Nevertheless, significant uncertainty still exists.

Oil production optimists like to point out that for more than 100 years people have been claiming that world peaking would occur in the next 10 to 20 years. Of course, the older predictions were all wrong. But that does not mean that recent peaking forecasts are incorrect. Nevertheless, the history of incorrect predictions and the “boy who cried wolf” syndrome seem to have anesthetized analysts and decisionmakers worldwide to the fact that oil production will indeed someday peak. The boy was eventually eaten by the wolf.

Given this long history of failed forecasts, what convinces us that our foresight will be better? In brief, the quality of the evidence has improved immeasurably.

First, extensive drilling for oil and gas has provided a massive worldwide database, and current geological knowledge is much more extensive than in years past. Quite simply, we know much more. Second, various seismic and other exploration technologies have advanced dramatically in recent decades, greatly improving our ability to discover new oil reservoirs. Nevertheless, the oil reserves discovered per exploratory well have been declining worldwide for more than a decade. We are finding less and less oil in spite of vigorous efforts, suggesting that nature may not have much more to provide. Third, many credible analysts have recently become much more pessimistic about the possibility of finding the huge new reserves needed to meet growing world demand. Fourth, even the optimistic forecasts suggest that world oil peaking will occur in less than 20 years (see Table 1). Finally, we are motivated by the knowledge that the peaking of world oil production in the current energy and economic environment could create enormous disruption on a scale much greater than that experienced during the 1973 oil embargo or the 1979 Iranian oil cutoff.

Table 1.

Projections of the Peaking of World Oil Production

| Projected Date | Source of Projection | Background & Reference |

|---|---|---|

| 2006–2007 | Bakhitari, A. M. S. | Iranian oil executive |

| Simmons, M. R. | Investment banker | |

| After 2007 | Skrebowski, C. | Petroleum journal editor |

| Before 2009 | Deffeyes, K. S. | Oil company geologist (ret.) |

| Before 2010 | Goodstein, D. | Vice Provost, Cal Tech |

| Around 2010 | Campbell, C. J. | Oil company geologist (ret.) |

| After 2010 | World Energy Council | Nongovernmental org. |

| Laherrere, J. | Oil company geologist (ret.) | |

| 2016 | EIA nominal case | DOE analysis/information |

| After 2020 | CERA | Energy consultants |

| 2025 or later | Shell | Major oil company |

| No visible peak | Lynch, M. C. | Energy economist |

Calculating oil production

To project future world oil production, we need to estimate the combined output of oil reservoirs already in production, those found but not yet in production, and the yet-to-be discovered reservoirs. This is an extremely complex summation problem because of the uncertainties associated with the yet-to-be discovered and therefore unknown reservoirs. In practice, estimators use various approximations to predict future production. The remarkable complexity of the problem can easily lead to significant over- or underestimates.

Oil was formed by geological processes millions of years ago and is typically found in underground reservoirs of dramatically different sizes, at varying depths, and with widely varying characteristics. The largest oil reservoirs are called “super giants,” many of which were discovered in the Middle East. Because of their size and other characteristics, super giant reservoirs are generally the easiest to find, the most economical to develop, and the longest-lived. The last super giant oil reservoirs discovered worldwide were found in 1967 and 1968. Since then, smaller reservoirs of varying sizes have been discovered in what are called “oil-prone” locations.

The logic of world peaking follows from the wellestablished fact that the output of individual oil reservoirs rises after discovery, reaches a peak, and declines thereafter. Oil reservoirs have lifetimes typically measured in decades, and peak production often occurs roughly a decade or so after discovery. It is important to recognize that peaking does not mean running out. Peaking is a reservoir’s maximum oil production rate, which typically occurs after roughly half of the recoverable oil in a reservoir has been produced. The reservoir will continue to produce oil for decades at a declining rate. In many ways, what is likely to happen on a world scale is similar to what happens to individual reservoirs, because world production is the sum total of production from all of the world’s reservoirs.

Oil is very difficult to find. It is usually found thousands of feet below the surface, and oil reservoirs normally do not have an obvious surface signature. Advanced technology has greatly improved the discovery process and reduced exploration failures. Nevertheless, oil exploration is still inexact and expensive. Once oil has been discovered via an exploratory well, full-scale production requires many more wells across the reservoir to provide multiple paths that facilitate the flow of oil to the surface. This multitude of wells also helps to estimate the size of the discovery’s “reserves”: the total amount of recoverable oil in a reservoir.

The concept of reserves is generally not well understood. Reserves are an estimate of the amount of oil in a reservoir that can be extracted at an assumed cost. Thus, a higher oil price outlook often means that more oil will be produced and the reserves will increase. But geology places an upper limit on price-dependent reserves’ growth. In well-managed oil fields, although estimates of reserves will rise with increases in price, the maximum increase is usually only 10 to 20 percent no matter how high the price.

Reserves estimates are revised periodically as a reservoir is developed and new information provides a basis for refinement. Indeed, reserves estimation is a matter of using inherently limited information to gauge how much extractable oil resides in complex rock formations that typically exist one to three miles below the surface. It is a bit like a blindfolded person trying to judge what an elephant looks like from touching it in just a few places.

Specialists who estimate reserves use an array of technical methodologies and a great deal of judgment. Thus, different estimators might calculate different reserves from the same data. Sometimes politics or self-interest influence reserves estimates. For example, an oil reservoir owner might state a higher estimate in order to attract outside investment or to influence other producers.

Reserves and production should not be confused. Reserves estimates are but one factor in estimating future oil production from a given reservoir. Other factors include production history, understanding of local geology, available technology, and oil prices. A large oil field can have large estimated reserves, but if the field is past its maximum production, the remaining reserves will be produced at a declining rate. This concept is important because satisfying increasing oil demand not only requires continuing to produce oil from older reservoirs with their declining production, but also finding new reservoirs capable of producing sufficient quantities of oil to compensate for shrinking production from older fields and to meet the steadily growing demand for more oil.

The U.S. Department of Energy’s (DOE’s) Energy Information Administration expects world oil demand to grow by 50 percent by 2025. If large quantities of new oil are not discovered and brought into production somewhere in the world, then world oil production will no longer satisfy demand. When world oil production peaks, there will still be large reserves remaining. Peaking means that the rate of world oil production cannot increase. It also means that production will thereafter decrease with time.

Oil is classified as conventional and unconventional. Conventional oil is typically the highest-quality, lightest oil, which flows from underground reservoirs with comparative ease. Unconventional oils are heavy and often tarlike. They are not readily recovered because production typically requires a great deal of capital investment and supplemental energy in various forms. For that reason, most current world oil production is conventional oil.

In the past, higher prices led to increased estimates of conventional oil reserves worldwide. However, this price/reserves relationship has its limits, because oil is found in discrete packages (reservoirs) as compared to the varying concentrations that are characteristic of many minerals. Thus, at some price, world reserves of recoverable conventional oil will reach a maximum because of geological fundamentals. Beyond that point, world reserves of conventional oil will not increase in response to price increases.

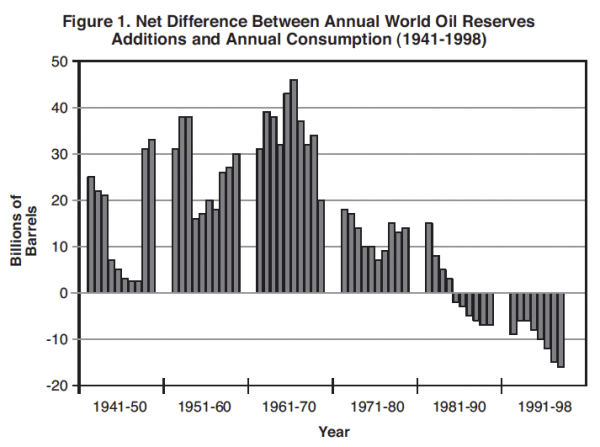

Because oil prices have been relatively high, oil companies have conducted extensive exploration in recent years, but their results have been disappointing. If recent trends hold, there is little reason to expect that exploration success will dramatically improve in the future. This situation is evident in Figure 1, which shows the difference between annual world oil reserves additions minus annual consumption. The image is one of a world moving from a long period in which reserves additions were much greater than consumption to an era in which annual additions are falling increasingly short of annual consumption. This is but one of a number of trends that suggest the world is fast approaching the inevitable peaking of conventional world oil production.

Source: Kjell Aleklett and Colin Campbell. Association for the Study of Peak Oil and Gas. www.peakoil.net.

The U.S. experience

The United States was endowed with huge reserves of petroleum, which underpinned U.S. economic growth in the early and mid-20th century. However, U.S. oil resources, like those in the world, are finite, and growing U.S. demand resulted in the peaking of U.S. oil production in the lower 48 states in 1970. With relatively minor exceptions, U.S. oil production in the lower 48 states has been in continuing decline ever since. Because U.S. demand for petroleum products continued to increase, the United States became an oil importer. At the time of the 1973 Arab oil embargo, the United States was importing about a third of its oil. Currently, the United States depends on foreign sources for almost 60 percent of its needs, and future U.S. oil imports are projected to rise to 70 percent of demand by 2025.

By examining what happened in the lower 48 states, we can gain some insight into the effects of higher oil prices and improved technology on world oil production. The lower 48 are a useful surrogate for the world, because it was one of the richest, most geologically varied, and most productive areas up until 1970, when production peaked and started into decline. In constant dollars, oil prices increased by roughly a factor of three in 1973–1974 and by another factor of two in 1979–1980. The modest production upticks in the mid-1980s and early 1990s are probably responses to the 1973 and 1979 oil price spikes, both of which spurred a major increase in U.S exploration and production investments. The delays in production response are inherent to the implementation of large-scale oil field investments. The fact that the production upticks were moderate was due to the absence of attractive exploration and production opportunities because of geological realities.

Beyond oil price increases, the 1980s and 1990s were a golden age of oil field technology development, including practical three-dimensional seismic analysis, economic horizontal drilling, and dramatically improved geological understanding. Nevertheless, lower 48 production still trended downward, showing no pronounced response to either price or technology. In light of this experience, there is good reason to expect that an analogous situation will exist worldwide after world oil production peaks: Higher prices and improved technology are unlikely to yield dramatically higher conventional oil production.

Wildcards

There are a number of factors that could conceivably affect the peaking of world oil production. Factors that might ease the problem of world oil peaking include:

- The pessimists are wrong again, and peaking does not occur for many decades.

- Middle East oil reserves are much higher than publicly stated.

- A number of new super giant oil fields are found and brought into production well before oil peaking might otherwise occur.

- High world oil prices over a sustained period (a decade or more) induce a higher level of structural conservation and energy efficiency.

- The United States and other nations decide to institute significantly more stringent fuel efficiency standards well before world oil peaking.

- World economic and population growth slows, and future demand is much less than anticipated.

- China and India decide to institute aggressive vehicle efficiency standards and other energy efficiency requirements, significantly reducing the rate of growth of their oil requirements.

- Oil prices stay at a high enough level on a sustained basis that industry begins construction of substitute fuels plants well before oil peaking.

- Huge new reserves of natural gas are discovered, a portion of which is converted to liquid fuels.

- Some kind of scientific breakthrough comes into commercial use, mitigating oil demand well before oil production peaks.

On the other hand, factors that might exacerbate the problem include:

- World oil production peaking is occurring now or will happen very soon.

- Middle East reserves are much less than stated. Terrorism stays at current levels or increases and concentrates on damaging oil production, transportation, refining, and distribution.

- Political instability in major oil-producing countries results in unexpected, sustained, world-scale oil shortages.

- Market signals and terrorism delay clear indications of peaking, delaying the initiation of mitigation actions.

- Large-scale, sustained, Middle East political instability hinders oil production.

- Consumers demand even larger, less fuel-efficient cars and SUVs.

It is possible that peaking may not occur for a decade or more, but it is also possible that peaking may occur in the very near future. Public and private policymakers are thus faced with a daunting risk-management problem. On the one hand, mitigation initiated soon would be premature if peaking is decades away. On the other hand, if peaking is imminent, failure to initiate mitigation soon will have very significant economic and social costs for the United States and the world. The two risks are asymmetric. Prematurely initiated mitigation would result in a relatively modest misallocation of resources. Failure to initiate timely mitigation before peaking will result in severe economic and social consequences.

To repeat, peaking does not mean that the world has run out of oil. Rather, it is the point at which worldwide conventional oil production will no longer be able to meet demand. At peaking, unless adequate substitute fuels and transportation energy-efficiency policies have been implemented well in advance, the price of oil will increase dramatically with severe adverse national and international economic consequences.

The world has never faced a problem like this. Without massive mitigation more than a decade before the fact, the problem will be pervasive and long-lasting. Previous energy transitions (wood to coal and coal to oil) were gradual and evolutionary; oil peaking will be abrupt and discontinuous.

Mitigation options

Oil peaking is a liquid fuels problem, not an “energy crisis” in the sense that the term has often been used. Motor vehicles, aircraft, trains, and ships simply have no ready alternative to liquid fuels. Non-hydrocarbon-based energy sources, such as solar, wind, geothermal, and nuclear power, produce electricity, not liquid fuels, so their widespread use in transportation is at best decades away. Accordingly, mitigation of declining world conventional oil production must be narrowly focused, at least in the near term.

Our research identified a number of currently viable mitigation options, including increased vehicle fuel efficiency, enhanced recovery of conventional oil, and substitute liquid fuels from heavy oil/oil sands, coal, and remote natural gas. All would have to be initiated on a crash basis at least a decade prior to peaking, if severe economic damage is to be avoided worldwide. Such a massive, expensive program before obvious market signals are evident would require extensive government intervention and support.

Government-mandated improved fuel efficiency in transportation proved very important after the 1973 oil embargo and will be a critical element in the long-term reduction of liquid fuel consumption. The United States has a fleet of more than 200 million automobiles, vans, pickup trucks, and SUVs. Replacement of even only half of these with higher-efficiency models will require 15 years or more at a cost of more than $2 trillion, so upgrading will be inherently time-consuming and expensive. Similar conclusions generally apply worldwide. Improved fuel efficiency, particularly for light-duty vehicles such as pickup trucks and vans, holds great promise for longer-term reduction of gasoline and diesel fuel consumption.

Enhanced oil recovery can help moderate conventional oil production declines from oil fields that are past their peak. The most promising recovery process is miscible flooding with carbon dioxide, a technology in which the United States is the leader.

Unconventional oil will play an increasing role in meeting world demand for petroleum products as conventional oil production wanes. The most attractive of the unconventional sources are heavy oil/oil sands, liquid fuel from natural gas, and liquid fuel from coal. All are commercially available. Heavy oil/oil sands are very viscous, tarlike oils, the largest deposits of which exist in Canada and Venezuela. Production costs are much higher than for conventional oil, because significant quantities of process energy are required to extract and refine the oils, which are of lower quality and are expensive to refine. Worldwide, large reservoirs of natural gas exist far from ready markets. One method of bringing that “stranded gas” to market is via Fisher-Tropsch (F-T) synthesis to create clean liquid fuels. This technology has been improving rapidly and is now being commercially implemented on a large scale to bring remote natural gas to market. It remains to be seen how these optional uses will balance out. The United States and other countries have substantial resources of coal, which can be converted to liquid fuels with commercial and near-commercial technologies. The front-running process for producing liquid fuels from coal involves coal gasification, followed by synthesis of liquid fuels using the F-T process. The resultant fuels are extremely clean and require no refining.

Two other mitigation options are of potential interest but are not currently commercially viable: oil shale and biomass. The United States has vast resources of oil shale, and the government briefly funded an effort to develop this resource after the oil shocks of the 1970s. The resource cannot be ignored and justifies renewed R&D. Ethanol from biomass is currently used in transportation, not because it is commercially competitive but because it is mandated and highly subsidized. Biodiesel fuel is a subject of considerable current interest, but it too is not yet commercially viable. Again, a major R&D effort might change the biomass outlook.

Government push needed

In slowly evolving markets, industry normally responds to changes in timely ways. In the case of the peaking of world oil production, the scale of mitigation will be unlike anything yet experienced in energy markets. Even crash programs to implement all available commercial and near-commercial mitigation options will require industrial efforts beyond anything that has happened in more than 50 years. Furthermore, effective mitigation will require massive, expensive efforts a decade or more before market signals become obvious. Those circumstances demand decisive action by governments worldwide, but the burden of mitigation will fall on industry. Because of the need for urgent action, governments will have to provide support, incentives, and facilitation in ways that are only dimly understood today. Among the options for action are the following:

First, governments must seriously consider requiring much higher fuel economy for all transportation vehicles, especially light-duty vehicles. Because the time required for retooling, production, and market penetration is so long and the expenses extremely high, it is difficult to imagine meaningful change without strong government mandates.

Second, massive industrial mobilization for the production of substitute fuels and expanded enhanced oil recovery will involve huge financial commitments and large risks. Industry is unlikely to move on the scale and schedule required without government mandates and protections. Policies such as minimum price guarantees, loan guarantees, and tax credits are among the possible options.

Third, although it is hoped that environmental protection is not compromised in the massive mitigation efforts required, it will necessary for governments to expedite permitting and regulatory reviews. Countries that do not minimize barriers are likely to be at a comparative disadvantage relative to countries that facilitate approval of new facilities. If decisions are delayed until peaking occurs, substantial oil shortages and rapidly increasing oil prices will result in the kinds of economic distress that occurred after the 1973 oil embargo, or worse. Under those conditions, people will be much more concerned about their own well-being and much more likely to demand rapid mitigation, which could well lead to the erosion of some environmental protections. Thus, timely initiation of mitigation policies will also help protect the environment.

A history of repeated and erroneous predictions of oil peaking may have given false assurance and convinced many policymakers that such predictions can now be safely discounted. However, recent peaking forecasts rest on a much more robust geological foundation, and we cannot ignore the fact that worldwide additions to reserves have been falling short of consumption for roughly two decades. The risks of delay are dire. Prudent risk management calls for early action.