Clean Power From the Pentagon

The Department of Defense’s research and innovation system is especially well-suited to advancing clean energy technologies in both the military and civilian sectors.

The Department of Defense (DOD) in 2019 will invest $1.6 billion in research, development, test and evaluation (RDT&E) that is directly related to energy. The magnitude of the investment reflects the importance of energy to the military mission. Everything the armed forces do requires energy, which is why DOD is the single largest energy consumer in the United States.

DOD’s investment in energy RDT&E also reflects the military’s characteristic pursuit of advanced technology as a force multiplier. DOD played a major role in the development of three of the most important energy innovations of the past 75 years—the nuclear reactor, the gas turbine/jet engine, and the solar photovoltaic (PV) cell—and it has been the driver for many major non-energy innovations as well, including radar, satellites, GPS, lasers, computers and semiconductors, robotics, artificial intelligence, and the internet.

Although DOD’s investments in energy RDT&E are driven by military needs, they have significant potential to catalyze civilian clean energy innovation, according to our recent report for the Information Technology & Innovation Foundation. DOD’s needs are more congruent with priorities for civilian clean energy innovation than is commonly recognized. Moreover, DOD’s approach to innovation is well-suited to energy technology and even addresses gaps in the efforts of the government’s prime agency for civilian energy matters, the Department of Energy (DOE).

Despite their overlapping technology priorities and complementary approaches to innovation, DOE does relatively little to leverage DOD’s investments in energy or its strengths as an innovator. This is a huge missed opportunity. As the United States strives to address such diverse energy innovation challenges as combating climate change and assuring long-term energy security, Congress and the Trump administration should make the most of existing federal energy investments by encouraging greater DOD-DOE collaboration.

Defense investments in energy innovation

DOD consumes energy for two broad purposes. The first is to support operations. Operational energy refers to the fuel used to power military platforms (e.g., aircraft, large drones, ships, tanks) and to run the diesel generators that produce electricity at contingency bases in places such as Iraq and Afghanistan. Increasingly, it also includes nonfuel forms of energy such as the batteries that power troops’ portable electronic devices.

The second use of energy is to support DOD’s roughly 500 enduring military bases, or “fixed installations,” in the United States and overseas. Installation energy consists largely of the electricity and natural gas used to power the 300,000 buildings located on these installations, with their two billion square feet of building space.

Because energy is essential to its combat mission, the military uses a lot of it. In fiscal year 2017, DOD consumed 708,000 billion British thermal units (Btus) of operational and installation energy, which is more than 75% of the federal government’s total energy consumption and about 1% of total US energy consumption.

With the goal of “enhancing mission effectiveness and reducing operational risk,” the military’s energy RDT&E investments are targeting five “warfighter opportunity areas.”

Soldier Power: This refers to the energy needs of individual foot soldiers and small troop units. These troops are positioned in remote areas, where conditions are harsh, and they suffer most of the combat casualties. Soldiers lug as much as 100 pounds of armor, ammunition, and water—and an increasing number of electronic devices. A soldier must carry enough batteries to power these devices for a standard 72-hour patrol, and the Army wants to extend the patrol to 144 hours. In addition to developing better batteries and wireless recharging technology, DOD is investing in the development of a broad range of other portable energy sources, including fuel cells, wearable solar PV, and devices to harvest kinetic energy created by the soldiers’ own motions.

Base Power: The energy challenge for contingency bases located away from fixed installations is to reduce their reliance on transported fuel—resupply convoys were the most vulnerable target for insurgent attacks in Iraq and Afghanistan—even as they meet the growing demand for electricity to power computers and communications equipment, 3-D manufacturing, and protective weaponry. In addition to addressing the outposts’ notoriously wasteful energy practices, the military is investing in alternative forms of energy, including wind and solar, fuel cells, waste-to-energy systems, and energy storage. DOD is also developing tactical (mobile) microgrids that will integrate renewable energy sources and allow diesel generators to operate more efficiently.

Fixed installations rely on a commercial grid but must maintain power to mission-critical loads during grid outages, which are becoming more frequent and severe in the United States due largely to weather events. As fixed installations provide more direct support for combat activity (e.g., flight control for foreign drone operations), they also face growing risks from physical- and cyber-attacks carried out via the grid. To make installations more energy secure, DOD is deploying renewable energy (largely solar PV) and demonstrating precommercial microgrid and storage technologies.

Platform Power: Manned platforms—aircraft, ships, and ground vehicles—account for most of the military’s fuel consumption, and the largest energy RDT&E efforts are aimed at enhancing aviation propulsion. For nonnuclear ships and ground vehicles, DOD is shifting to hybrid-electric propulsion (i.e., electrification), primarily to facilitate the dramatic increase in onboard electrical equipment. A key challenge is the vehicles’ power distribution network, which—like a tactical microgrid—must ensure that individual loads (e.g., propulsion, computers, sensors, weapons) receive the electrical power they need when they need it. These networks in turn require improved technology for power electronics—the ubiquitous process of controlling the voltage or frequency of electrical energy and converting it from one form to another (e.g., AC to DC) to suit the load.

Autonomous System Power: Autonomous platforms, including unmanned aerial vehicles, ground vehicles, and underwater vehicles, are transforming the battlefield. As with manned platforms, DOD is embracing electrification for many of its unmanned systems. However, limits on energy technology hamper DOD from deploying large numbers of these systems and taking advantage of their full potential—particularly the capacity for long-duration operation in unique and challenging environments. RDT&E goals include better batteries, long-running fuel cells, solar-powered drones, and long-distance recharging of drones.

Weapon Power: This refers to the energy needs of directed energy weapons (DEWs) such as high energy lasers that emit beams of light or microwaves powerful enough to degrade or destroy a target. Once seen as futuristic “death rays,” DEWs are now viewed as tactical systems that could zap a swarm of drones or incinerate an enemy rocket at a fraction of the cost of a missile. DEWs are a high priority for DOD, but energy is the rub: they need energy systems with exceedingly high power levels, rapid recharge capability, and the ability to manage the waste heat generated by all that power.

Catalyzing civilian clean energy innovation

DOD’s mission-driven RDT&E already has contributed significantly to clean energy innovation and can be even more of a catalyst in the future. Military energy needs often parallel civilian clean energy priorities despite the difference in underlying goals. For example, climate hawks want to “electrify everything” to break the economy’s dependence on fossil fuels. DOD is embracing electrification too—but not to reduce its carbon footprint, rather because electronic equipment increasingly dominates warfare.

In addition to the congruence of military and civilian energy technology priorities, DOD’s mission-driven approach to innovation is well-suited to energy technology. Historically, commercial innovation has benefited directly from a variety of DOD practices, including investment in foundational science, technology, and engineering; pursuit of technologies for military use that find a commercial market once their costs come down (“spin-off”); investment in R&D to leverage and advance commercial technology (“spin in”); heavy reliance on technology demonstration and validation; and procurement of new technologies that offer potentially decisive advantages over existing ones, often at a price premium, at sufficient scale to jump-start the commercial market. The last two mechanisms (technology demonstrations and procurement at a price premium) are particularly valuable for energy innovators because of the complexity of energy technology and the importance of price competition in the energy market.

To appreciate DOD’s catalytic role, consider four technologies that are key to a clean energy future: solar PV, portable batteries, microgrids and stationary energy storage, and wide bandgap (WBG) semiconductors for power electronics.

Solar PV: This is a must-have for DOD, to enable longer missions for foot soldiers, extend unmanned aerial vehicles’ flight duration, and reduce contingency bases’ dependence on transported fuel. However, these and other military applications call for solar PV materials that are lightweight and flexible, whereas the dominant solar PV technology, silicon, is heavy and inflexible. Some niche and emerging technologies, including multijunction III-V and perovskite materials, show promise; but silicon’s cost advantage represents a major barrier to entry—a barrier reinforced by DOE’s policy focus on minimizing the levelized cost of solar electricity. (Levelized cost measures the average cost per unit of energy of a power source over its lifetime, which allows for comparison of generation methods with very different start-up and operation costs.)

DOD could be instrumental in prying open the market for solar PV and extending it to important new applications. DOD has long funded advances in III-V materials for use in space. Although III-V cells are significantly more expensive, their greater efficiency (roughly double that of silicon) more than offsets the higher cost when the surface area to be covered (e.g., a satellite) is small. With an eye to other applications, including space-based solar (capturing solar energy in space and transmitting it to Earth in the form of microwaves or lasers), DOD is supporting RDT&E to slash the cost to fabricate III-V materials. DOD is likewise supporting research on perovskites, organics, quantum dots, and other emerging solar PV technologies.

In addition to supporting R&D, DOD can be a valuable early adopter of promising solar PV technologies. This is nothing new: although Bell Laboratories invented the silicon PV cell in 1954, government satellites represented the major market for solar PV until the 1970s. The military’s willingness to pay a premium for higher performance can give the new solar PV technologies an opportunity to grow and gain a commercial foothold, beginning with less price-sensitive applications such as device charging and building- and vehicle-integrated solar PV.

Portable batteries: As with solar PV, DOD wants to leverage the commercial market for portable batteries but cannot meet its requirements with the existing technology, largely lithium-ion batteries. For mobile missions (soldiers, manned platforms, and autonomous systems), where the goal is to extend duration and reduce weight, DOD needs batteries with a higher energy density and more rapid recharge rate. Safety is also critical, and lithium-ion batteries can explode if penetrated by a bullet or catch fire if charged improperly (indeed, the Navy will not allow them on submarines).

DOD’s “stretch goals” for battery performance are ones that commercial customers endorse but are not yet willing to pay for. To bridge that gap, DOD funds technical activity, often in partnership with industry, aimed at developing higher-performing batteries and improved manufacturing processes. From 2009 to 2012, DOD spent about $430 million on battery RDT&E—fully half the amount spent by DOE.

The military’s desire to buy commercial batteries, together with its needs-based approach to innovation, is a powerful combination. DOD’s large RDT&E investment—exploiting industry partnerships and extending to manufacturing—can help develop a new generation of batteries. And if the first products are priced for higher-end commercial markets, DOD can become an early customer, helping to finance their rapid movement down the learning and cost curves.

Microgrids and stationary storage: Advanced microgrids and large-scale stationary storage, together with on-site energy generation, can create a newfound capacity for fixed installations to manage local energy supply and demand on a routine basis and maintain mission-critical loads if the grid goes down. DOD has sought to further the development of microgrid and storage technology by using its bases as test beds for the demonstration and validation of pre-commercial systems. Since 2009, DOD’s Environmental Security Technology Certification Program (ESTCP) has funded 32 formal demonstrations of advanced microgrid technologies, many of which incorporate innovative storage solutions.

ESTCP’s demonstrations are key to overcoming impediments to technology commercialization and deployment. A microgrid’s performance is affected by site-specific factors such as the variability of loads and the penetration of solar PV or other intermittent renewable energy. Demonstrations allow vendors to validate their engineering designs and potential buyers to analyze system performance. General Electric’s microgrid controller went directly from a three-year demonstration at a Marine Corps base in California to the commercial market.

Similarly, the ESTCP demonstrations give vendors and base personnel hands-on experience with large-scale storage solutions—costly new technology that must operate in volatile electricity markets. Lack of independent data on technical and economic performance is a major impediment to the adoption of large-scale storage technology. The performance data collected in these demonstrations—information ESTCP makes public as a matter of policy—allows would-be commercial buyers to assess the risks and value to them.

Beyond demonstrations, DOD will play a key role as a technology customer. As an early adopter of promising microgrid and storage systems, the military will bear many of the nonrecurring engineering design costs, enabling vendors to offer commercial customers a lower price. And with 500 active-duty installations and hundreds of smaller National Guard bases, DOD is on track to be, in addition to one of the first, one of the largest customers for advanced microgrids and large-scale storage technology.

Microgrids are no less valuable to DOD’s contingency bases: by exploiting onsite energy sources such as solar PV and allowing diesel generators to operate at peak efficiency, tactical microgrids can reduce the need for transported fuel. As with catalyzing stationary microgrids, DOD can play a pivotal role in the commercialization and widespread deployment of tactical microgrids.

The potential market for microgrids in developing countries and remote parts of the developed world is vast, and the type of system needed (portable, easy to operate, and able to run in isolation from a grid) is identical to the tactical microgrid DOD is developing. Although the technology is not yet sufficiently refined or affordable to penetrate this market, DOD, as an early adopter and large customer, can facilitate that process, including through the development and dissemination of technical standards that will serve to increase competition and drive down costs.

Wide bandgap semiconductors. If their costs go down, WBG semiconductors have the potential to revolutionize power electronics. WBG materials such as silicon carbide and gallium nitride are more efficient than the silicon devices currently used, which allows for superior current control and reduces energy losses. DOD’s interest in WBG devices hinges especially on their potential to increase power density and conversion speeds while enabling power electronics components to be smaller and lighter. Here again, DOD can help advance their development and use by serving as an early adopter and customer.

Because of this technology’s potential to reduce worldwide energy consumption, the Department of Energy is devoting significant resources to the field, including support for PowerAmerica, a manufacturing innovation institute based at North Carolina State University. DOE’s initiatives, in turn, build on DOD RDT&E activities that go back nearly 50 years. In the 1970s, the Office of Naval Research (ONR) funded the initial university research on WBG physics, materials science, and engineering. In the 1980s, as WBG’s potential to revolutionize radio frequency (RF) applications such as military radars became apparent, DOD expanded its research support. In the 2000s, the Defense Advanced Research Projects Agency (DARPA) undertook a major program to accelerate improvements in WBG materials for power electronics as well as RF applications, and ONR/DARPA support led to the development of the WBG solid-state electronics systems used today. In 2013, DOD used its authority under the Defense Production Act to ensure that the United States had the capacity to manufacture WBG devices for RF applications. A major beneficiary of this support was Cree Inc., now a leader in commercial power electronics.

Having spun off WBG technology to DOE and commercial industry, the military is now poised to spin it back in: DOD’s next-generation platforms, including the Navy’s electric ship and the Army’s hybrid-electric combat vehicle, all require a level of performance in power electronics only WBG semiconductors can provide. Although WBG devices will be costlier than silicon devices for some time, DOD can play a critical role in the commercialization of WBG semiconductors, as it did with the first integrated circuits in the 1960s, through its willingness to pay a premium for performance. The scale of the military market for WBG devices will then allow device manufacturers to ramp up production and capture economies of both scale and the process of “learning by doing.”

Beyond these four key technologies, DOD RDT&E and procurement hold promise for advancing other clean energy technologies as well. These include:

Wireless power transmission: DOD wants to recharge drones remotely so they can remain aloft longer, and demonstrations using lasers are under way. The technology requires direct line of sight but can work at distances up to 6.8 miles. Long-distance wireless recharging will facilitate the electrification of ground vehicles, among other clean energy applications.

Fuel cells: Fuel cells’ ability to provide long-lasting power is valuable to DOD. The Navy and General Motors developed an undersea drone powered by a hydrogen fuel cell that can operate without recharging for more than 60 days; and the Navy’s fuel-cell-powered aerial drone can fly for 48 hours.

Building technologies: DOD has funded more than 130 on-site demonstrations of innovative energy technologies for the built environment, including such things as electrochromic glass and remote auditing tools. As the owner of 300,000 buildings, DOD has a direct interest in seeing these technologies commercialized and deployed.

Very small modular nuclear reactors: Fixed installations in remote areas are an ideal market for these greatly down-sized reactors, and DOD could aid their commercialization as an early customer. (By contrast, the use of such reactors on contingency bases, which DOD is exploring, would not facilitate their commercialization because DOD’s requirements are unique.)

Not all clean energy technologies are candidates for DOD RDT&E support, however. As one example, contrary to the view of many people, advanced biofuels would do little to help the warfighter. Fuel is a commodity that DOD purchases in global markets and accesses through commercial supply chains, and the development of biofuels would not affect price or availability except over the long term. Although getting fuel to the front remains a serious challenge, the risks are the same whether the convoy is transporting biofuels or petroleum. To be sure, DOD will purchase bioalternatives to petroleum as they become cost-competitive (it is already doing that on a limited basis). However, it is unlikely to invest significant RDT&E resources to develop them.

Interagency collaboration critical

Despite the magnitude of the military’s investment in energy RDT&E and its relevance for clean energy innovation, DOD and DOE have limited interaction with respect to energy technology. This is particularly unfortunate because the two departments have such complementary approaches to innovation, and closer collaboration would make DOE a stronger innovator. (It would also help DOD, but DOE stands to benefit more.)

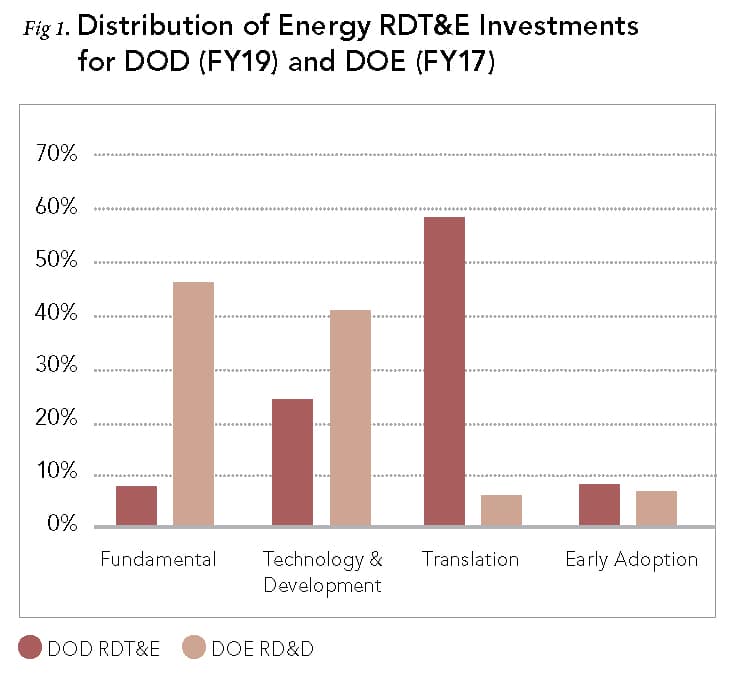

Figure 1 compares DOE and DOD in terms of the fraction of their energy RDT&E budgets that goes into different categories of innovation activity. DOE’s energy RDT&E budget (referred to in DOE as research, development, and demonstration, or RD&D) is devoted heavily to fundamental research, while DOD’s skews heavily to technology development and translation. Although DOE’s Advanced Research Projects Agency-Energy (ARPA-E) and some of the programs in the department’s Energy Efficiency and Renewable Energy organization support R&D that is more applied, their individual budgets are dominated by the energy budget of DOE’s Office of Science, which funds exclusively fundamental research.

A related difference between the two departments has to do with who performs the R&D. Fully 70% of DOE RD&D is performed in-house, by the national laboratories, while only 36% of DOD RDT&E is performed by government laboratories (both figures refer to total R&D, not just energy R&D). Stated differently, DOD directs more than twice as much of its RDT&E budget to universities and industry as does DOE. This general pattern holds true for basic and applied R&D, as well as DOD’s downstream system development activity, which is necessarily industry-dominated.

These statistics reflect qualitative differences in the two innovation systems. Most significant, DOD’s approach to innovation, including energy innovation, is driven by “demand-pull” in the form of requirements from the military customer. DOE’s approach, dominated by the Office of Science, can be characterized as “science push.”

In spite of their shared interests—and their history of collaboration on the design and testing of nuclear and conventional weapons—DOE and DOD have limited interaction when it comes to energy innovation. The two departments engage in little joint R&D planning, even on fundamental energy research and technology development. And DOE develops its applied energy RD&D strategies and road maps with an eye to civilian energy needs and thus places a major focus on price in the context of the commercial market.

To be fair, DOD made energy a high priority for RDT&E only a little over a decade ago, and in 2010 DOE and DOD signed a memorandum of understanding to enhance cooperation on energy security and clean energy innovation. The flurry of activity that followed produced several successful efforts, including a collaboration between DOD and DOE’s ARPA-E on a long-duration energy storage system suitable for grid as well as military applications.

But the lack of sustained collaboration remains, and can be explained by several factors. Although the departments’ memorandum of understanding had high-level support, it did not serve to motivate DOE and DOD program managers—individuals who were internally focused at the time given the agencies’ simultaneous ramp up of their energy RDT&E. Moreover, DOE’s Office of Science, both then and now, avoids consideration of research applications. In addition to the office’s internal culture (Nobel prizes won are seen as a measure of impact), this avoidance reflects the influence of those contractor-operated DOE laboratories that want to protect their research programs, as well as the views of DOE’s congressional authorizers and appropriators.

With its focus on potential high-impact technologies, ARPA-E is DOD’s most willing partner, and several joint projects are currently under way, including one on the use of WBG semiconductors in shipboard power conversion. Outside of ARPA-E, however, DOE agencies and laboratories seem largely to pay lip service to collaboration with the military. In practice, the DOE labs tend to see DOD as a potential checkbook rather than a valuable test bed or a useful source of demand-pull. And the armed services are themselves standoffish, wary that “collaboration” is a euphemism for DOD footing the bill.

Precisely because DOD and DOE approach innovation differently, greater collaboration holds the promise of significant synergy. DOE, in particular, stands to benefit: by its nature, it lacks the internal market that makes DOD such a powerful engine of innovation, and it is routinely criticized for the lack of uptake of its research results by commercial firms. A partnership with DOD in areas where the military’s needs are aligned with those of commercial users would introduce much-needed demand-pull into DOE’s R&D process.

Several elements of DOD’s approach to innovation are particularly valuable in an energy context. First, energy technology does not move directly from small-scale development to the market; vendors need to demonstrate their technologies at scale, under realistic conditions. Whereas opportunities for such learning by doing are rare in the energy sector, DOD, with its energy needs and reliance on technology demonstrations, represents a unique resource. Second, because energy is a commodity, new entrants often have to compete solely on price—a major hurdle given that the earliest versions of innovations are typically characterized by high capital and operating costs and limited reliability. With its large internal market, DOD plays a much-needed role as an early adopter that values mission-relevant performance over price.

DOD’s approach to innovation can complement DOE’s in another way. Congress frowns on DOE “picking winners and losers” among competing technologies—a constraint that reflects, among other things, the power of large, well-established industry incumbents looking to maintain dominance. DOD, by contrast, routinely picks winners and losers based on mission considerations. By working more closely with DOD, DOE can gain the cover it needs to make politically unpopular choices.

To capture potential DOE-DOD synergies, the departments need to collaborate in two areas. The first is R&D planning. DOE should factor DOD’s energy needs and its strengths as an innovator into the strategies and road maps it develops for both its fundamental and applied RD&D. Where DOD has unique energy needs, this process is not appropriate. But in the many areas in which DOD’s needs are aligned with those of commercial users, DOE’s planning process should take into account DOD’s large internal market and its role as an early adopter.

The second area for collaboration is the execution of DOE’s applied programs, including batteries, stationary storage, microgrids, solar, manufacturing, and small modular reactors. These programs can all benefit from an active partnership with DOD—one that includes engagement with DOD end users to understand their needs, to identify specific opportunities to collaborate, and to implement demonstration projects that the private sector is unlikely to sponsor but are necessary to build experience and confidence in new technologies.

To take DOE’s battery technology programs as an example, collaboration on fundamental R&D could combine DOD’s stretch goals (high energy density, rapid recharge, and improved safety) with DOE’s highly specialized research capabilities such as exascale computing and genome modeling of battery materials. Collaboration on late-stage R&D should target DOD end users as an early adoption market.

DOE’s solar program is another strong candidate for collaboration with DOD. Though this program is supporting early-stage research on perovskites and other new PV materials, its driving policy goal of reducing the levelized cost of solar electricity strongly favors low-cost silicon. DOD’s demanding requirements can provide a pathway to new PV materials that can compete with silicon. Recent engagement between DOE and DOD on lightweight, flexible solar PV is a promising start.

A changing energy landscape

The military relies on energy for everything it does, and it consumes much of that energy in combat settings, where it is extremely costly—in human lives as well as dollars—to obtain. Realistically, future military platforms and capabilities will require more, not less, energy. DOD energy needs are changing as well as growing, and these changing mission needs—to electrify the battlefield and deploy distributed and portable power generation, smart energy networks, improved energy storage, and wireless power transmission—are yielding new technologies that, it turns out, can also make important contributions to large-scale decarbonization of the civilian energy sector.

The lack of collaboration between DOE and DOD is a weak link in this serendipitous process, and a significant wasted opportunity. If the complementarities between these agencies could be exploited effectively, it would have enormous benefits for the nation and the world. The United States needs to use every weapon in the energy arsenal to fight climate change. Congress needs to ensure that DOE and DOD work more closely together to advance common goals in energy technology and exploit the opportunities for mutual gain hiding in plain sight.