How China Beat the US in Electric Vehicle Manufacturing

For 20 years, China’s government has pursued industrial policies that helped it become the world’s biggest producer of electric vehicles. Can the United States catch up?

The rise of China has been the defining feature of the twenty-first century global economy. In a globalizing marketplace, China’s low-cost labor became a huge attractor of foreign direct investment. This advantage, combined with a growing domestic market, increasing technological know-how, and world-class infrastructure suitable for shipping goods anywhere in the world, made China “the world’s factory.”

The benefits of China’s rise for the United States have been enormous. China was the 11th largest US export market in 2000; today it is the 3rd largest. About 2.6 million US jobs and $216 billion in US gross domestic product are linked directly and indirectly to the US-China economic relationship.

What is the right mix of domestic policy and international engagement for meeting the challenge that China presents to the United States?

Yet in the United States, even in today’s hyperpartisan politics, fear of China’s economic might and geopolitical ambition is shared by leaders of both parties. Countering China’s increasing prowess was a central focus of the Trump administration, and it will occupy the incoming Biden administration as well. In Congress, one can even hear emerging discussions of an “industrial policy” that will restore America’s competitive position.

What is the right mix of domestic policy and international engagement for meeting the challenge that China presents to the United States? Not only are there no easy answers, but successful policies will need to be tailored to particular industries, technologies, and market contexts.

Here, we focus on one important technology where US leadership has, in the past decade, been ceded to China: plug-in electric vehicles (PEVs) and associated supply chains. How did the United States lose out in this competition, what can be done about it, and what are the lessons for other areas of economically important innovation?

China has achieved success not through Western-style capitalism, but through a carefully orchestrated combination of opening up domestic markets while maintaining central-government control of firm behavior, reflecting what is often called “socialism with Chinese characteristics.” China’s industrial policies are laid out in Made in China 2025 (MIC 2025), a multidecade national strategy for the manufacturing sector, published in 2015, aimed at increasing China’s global market share, with emphasis on higher valued goods.

China’s approach to PEVs offers a valuable lens into its industrial policy. Widely seen as a disruptive technology because of the decades of dominance by the internal combustion engine, PEVs also offer a platform for autonomous vehicles, enhanced energy security, improved urban air quality, and slower global climate change. As with other important technologies prioritized under MIC 2025, PEVs and their supply chain have been the beneficiary of substantial governmental support.

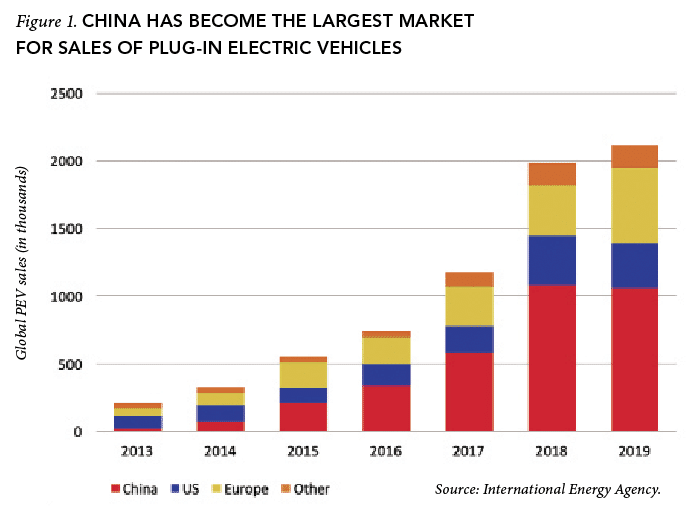

From 2010 to 2014, China trailed the United States in PEV market share, but it moved into the lead in 2015 and has widened its margin ever since (see Figure 1). Many factors contribute to China’s rise as the world’s top producer and consumer of PEVs and to China’s virtual dominance of the global PEV supply chain. But China’s public policies played a pivotal role. This raises two important questions for US policymakers: Which policies has China adopted to advance its industrial ambitions? And how can the United States counter China effectively while maintaining a fruitful trade relationship?

The rise of China’s electric vehicle industry

For decades, Chinese economic planners craved a domestic auto industry that was globally competitive, exporting vehicles and parts to countries around the world while also meeting the growing needs of Chinese consumers. China is openly envious of what Volkswagen did for Germany, what Toyota did for Japan, and what General Motors did for the United States.

China’s approach to plug–in electric vehicles offers a valuable lens into its industrial policy.

But China’s Ministry of Science and Technology sensed that China had little hope of competing with the United States, Germany, Japan, and Korea in the conventional auto market. The ministry’s 863 Program, an applied research and development program dating to 1986 and involving Chinese automakers, suppliers, universities, and independent laboratories, shifted its focus by 2006 to “New Energy Vehicles” (NEVs). This is China’s term for a category of vehicles that includes purely battery electric vehicles, plug-in hybrid vehicles, and hydrogen fuel-cell electric vehicles. China’s dream—which later became its industrial policy objective—was to leapfrog the established global automakers by securing a first-mover advantage on PEVs.

In 2000, the state of Chinese R&D on lithium ion batteries (LIBs) and electric drive systems was about 10 years behind Japan, considering both technology performance and cost. Over the next five years, China closed this gap to less than two years, primarily due to the 863 Program, the nation’s rise in consumer electronics, and the emergence of BYD Company Ltd., a successful battery maker for consumer products that entered the auto sector as a privately owned company in 2003.

A key feature of China’s advanced-vehicle policy was nationwide vehicle subsidies for PEVs. The combination of central government and provincial subsidies ranged from $10,000 to $20,000 per vehicle, depending on the city and the PEV design. The subsidy program was coupled with four important changes in auto-sector policy that boosted the fortunes of Chinese firms.

First, the central government “requested” that foreign automakers working in joint ventures with Chinese automakers share their PEV technology with the Chinese companies. The Obama administration complained that this policy violated the terms of China’s 2001 entrance into the World Trade Organization. China disputed the allegation, emphasizing that it was a voluntary policy. The United States never took the issue to the WTO.

Second, the central government, as well as provincial and city governments, made subsidies available only to companies assembling vehicles in China, which favored Chinese automakers. Foreign companies exporting PEVs to China, such as Tesla, were not only subject to China’s stiff 25% tariff on imported cars but also ineligible for PEV subsidies.

In 2000, the state of Chinese R&D in lithium ion batteries and electric drive systems was about 10 years behind Japan, considering both technology performance and cost. Over the next five years, China closed this gap to less than two years.

Third, Chinese automakers had to use an approved Chinese supplier of LIBs to qualify for PEV subsidies. Japanese and Korean battery producers, even though they were investing in Chinese facilities, were effectively excluded from the Chinese market for several years.

Finally, Chinese banks helped Chinese suppliers gain access to raw materials for producing LIBs and electric motors. China possesses some, but not all, of those key raw materials (e.g., lithium, cobalt, and neodymium). Chinese banks, working closely with the central government, enabled Chinese suppliers to acquire ownership interests in mines and processing facilities in Africa, Australia, Europe, North America, and South America. China has thus developed a vast network of influence over the most challenging links in the PEV supply chain, a distinctive advantage over lagging American and European competitors.

PEVs for the people

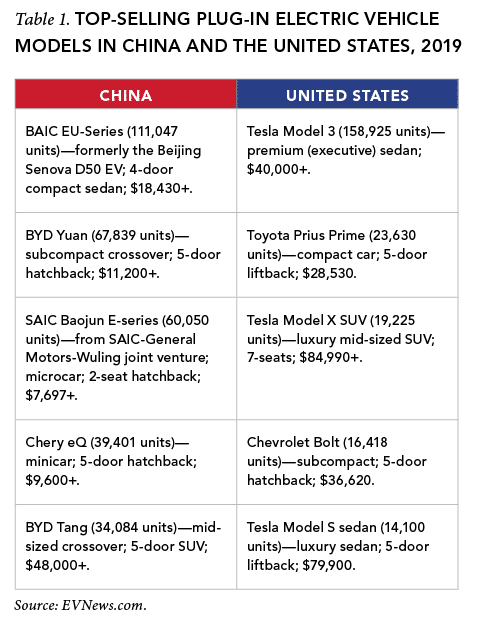

An additional factor that contributed to the development of China’s PEV market is a focus by manufacturers on small, affordable models, in contrast to the US market, where PEV sales are predominantly premium Tesla models (especially the Model 3 executive sedan). Table 1 compares the five PEV best sellers in China with the top five in the US market in 2019. The prices for the Chinese offerings—which cover a wide range of vehicle types—are after applicable vehicle subsidies; the prices for the US offerings are prior to vehicle subsidies that can reach $10,000, depending on vehicle manufacturer, vehicle price, location of sale, design features, and other factors. Preliminary data for 2020 show major moves by two new models toward the top of China’s sales list: Wuling’s $4,200 mini-EV, the cheapest EV in China (made in partnership with General Motors), and Tesla’s Model 3, now built in Shanghai.

When MIC 2025 was published in 2015, it reaffirmed the pro-PEV policies implemented over the previous 10 years. It also marked an affirmation of pro-PEV policy by the nation’s new leadership, which assumed power in 2013. The central government’s original national goal was to put 5 million PEVs on the road by 2020—2.5 million battery electric vehicles, and 2.5 million hybrid electric vehicles. Like the state of California and the US federal government, China later dropped promotion of hybrids, and recast the national goal as 5 million NEVs on the road by 2020. The diminished interest in hybrids reflects the fact that such vehicles employ a mature technology and the reality that Japan had secured a first-mover advantage on hybrid-electric technology.

When China looked unlikely to achieve its 2020 targets, the government extended the national goals for PEV deployment and reframed them as annual sales goals. The next central-government goal was a 25% PEV market share by 2025, which corresponds to about 3 million to 4 million PEVs per year, 80% of which are expected to be produced by domestic Chinese automakers. PEV subsidies extended far beyond the original $15 billion figure floated by Chinese officials in 2010; independent estimates place the cumulative amount, through 2018, at roughly $60 billion. This figure includes vehicle subsidies, foregone revenue from tax breaks, subsidies for charging infrastructure, and governmental R&D.

Has China met its goals? Due to tariffs and other policies, PEVs tend to be assembled where they are sold, so new PEV sales are roughly equal to PEV production in China. In 2019, PEV sales in China were approximately 1.18 million units (80% battery electric and 20% plug-in hybrid), or about 5.5% of the country’s new passenger vehicle market. Though these numbers are far short of stated national goals, they nonetheless document China’s growing strength in this industry. By way of comparison, the 2019 PEV market shares were 1.9% in the United States (330,000 vehicles) and 3.6% in Europe (565,000 vehicles). In California, where government policies have promoted PEVs since 1990, the PEV market share in 2019 was 7.9%, comprising almost half of all PEV sales nationwide.

The end of subsidies?

China’s PEV policies challenge the norms of international trade. Subsidies for China’s PEV sector were focused almost entirely on companies headquartered in China. While all industrial subsidies are suspect from a free-trade perspective, the design of the Chinese PEV subsidies is even more discriminatory than the subsidies handed out by the Obama administration in 2009–2010 to Japan’s Nissan-Renault, the US start-ups Tesla and Fisker, and the US Big Three. Moreover, US consumer tax credits for PEVs are available to any automaker, regardless of where the company is headquartered or where its PEV assembly plants are located. China’s policy on approved battery suppliers, which appeared to be a direct outgrowth of MIC 2025, was a blatant effort to favor Chinese over Japanese and South Korean battery producers. In contrast, US subsidies to battery makers went to Asian firms (e.g., LG Chem of Korea) as well as US start-ups (e.g., A123 of Massachusetts).

The central government “requested” that foreign automakers working in joint ventures with Chinese automakers share their PEV technology with the Chinese companies.

In 2015, China announced that it would gradually phase out subsidies for PEVs between 2016 and 2020. Provincial and municipal subsidies must be phased out at the same pace as, and in proportion to, the central government subsidies. As the subsidies have been reduced, they have also been reformed to encourage advanced PEVs that have a longer all-electric driving range. And greater investment is being made in charging infrastructure, especially “fast charging” along highways that connect the country’s eastern cities.

The final termination of subsidies was recently delayed until at least 2022 due to an unexpected downturn in the Chinese auto sector, which began prior to the COVID-19 pandemic. The turbulence added by COVID-19 led to a relaxed goal of 20% PEVs by 2025 and could lead to a further extension of PEV subsidies.

The central government’s interest in curbing PEV subsidies reflects several factors that emerged in the 2015–2020 period: a government investigation found a significant amount of producer fraud in the subsidy program; the subsidies caused a proliferation of new small-scale PEV producers, which runs counter to the country’s consolidation objective in the auto sector; nonfinancial incentives (especially the PEV exemption from vehicle licensing restrictions in large eastern cities) proved potent in promoting PEV sales; and the Trump administration highlighted the subsidy program in a report on China’s unfair trade practices.

In April 2018, the central government also announced a phasing out of long-standing requirements (since the 1990s) that compel foreign automakers, when working through joint ventures with Chinese automakers, to share factory ownership and profits with Chinese corporate partners. Starting in 2018, foreign automakers making PEVs in China were not required to work with a Chinese automaker. By 2022, the joint venture regulations for all motor vehicles will be scrapped. The new policy facilitated Tesla’s big entrance into the Chinese market, including construction of a huge new assembly plant in Shanghai’s free-trade zone to be supplied by Chinese and Korean battery producers.

When China looked unlikely to achieve its 2020 targets, the government extended the national goals for PEV and reframed them as annual sales goals.

In conjunction with the phase out of PEV subsidies, the central government announced a California-style “zero-emission vehicle” (ZEV) mandate starting in April 2018, and applicable to all automakers doing business in China. Each automaker, domestic and foreign, is required to earn credits selling PEVs. For 2020, the number of credits was required to equal at least 12% of a company’s annual sales of conventional vehicles. For example, if a company sold 100,000 conventional vehicles in 2020, it would have needed 12,000 credits. The number of credits earned for each PEV depends on whether it runs entirely on electricity (up to six credits) or is a plug-in hybrid (up to two credits). The required PEV credits are scheduled to increase steadily, reaching 18% in 2023. Significant further increases are expected through 2030. Much to the disappointment of the Japanese government and Toyota, conventional hybrid-electric vehicles receive zero credits in China’s scheme.

Despite its success in developing a strong domestic market for PEVs, China has not yet demonstrated that it can produce PEVs that will sell in the United States, Europe, or Japan. But China has demonstrated that it can dominate (or at least influence strongly) the global supply chain for PEVs, including LIBs, components, and raw materials. Chinese companies (e.g., BYD and battery maker CATL) will retain a competitive advantage globally because it will take their competitors substantial time and resources to compensate for the favoritism that Chinese companies enjoyed. In particular, the United States, Europe, and Japan have yet to muster effective policies to counter China’s coordinated supply-chain strategy.

US trade policy: carrying a small stick

China has implemented a suite of policies to help it become the world’s largest producer of not only PEVs but also key inputs to PEVs. Chinese companies now account for a plurality of the global production of each of the key inputs to LIBs: anodes, cathodes, electrolytes, and separators. Chinese companies also produce—or have ownership interests in—a majority of the raw materials and processing facilities at the beginning of the PEV supply chain.

Some of China’s pro-PEV policies—including forced technology transfer, domestic production quotas, and subsidies that favor Chinese companies—violate norms of international trade. In theory, then, China could be held accountable for such violations by its largest trading partner, the United States.

The United States, Europe, and Japan have failed to muster effective policies to counter China’s coordinated supply–chain strategy.

Yet enforcing accountability is difficult. China has not taken PEV business away from US firms and workers serving the United States or European markets, but instead has favored Chinese firms and workers in its huge and rapidly growing domestic market. Only after Chinese firms dominate their own market will they be in position to compete in the United States and European markets.

Policymakers seeking to counter policies and practices of another country are constrained by the available trade policy tools. For the United States, these include the World Trade Organization Agreement as well as domestic laws that allow for trade remedies (to address dumping, illegal subsidies, and temporary surges of imports) and limiting imports that threaten national security or violate US intellectual property law.

Several of these tools require showing that the level of imports is materially harming a US industry or threatening national security. But Chinese imports are not impacting the US PEV market. No harm, no foul—at least not yet. And US trade policies don’t have much applicability to China’s creative efforts to dominate its supply chain by capturing ownership stakes around the world in the raw materials and components used in PEV production.

The United States could bring a case against China under the WTO Agreement. Such a decision isn’t made lightly. Litigation takes years, consumes significant resources, and may ultimately require additional diplomatic pressure if China resists adverse WTO rulings. Importantly, even if the United States should win the case, the resulting penalty would not diminish China’s status as the leading global producer of PEVs. A further complication: the WTO Appellate Panel currently cannot act on such complaints. Ironically, it lacks a quorum due to long-held concerns from the United States and other nations about the delayed and ineffective nature of its dispute settlement and enforcement procedures.

This leaves only Section 301 of the Trade Act of 1974, which gives US policymakers the ability to pressure China with a broad range of tariffs, to use those tariffs as the basis for a bilateral negotiation over structural issues (e.g., its favoritism toward state-owned enterprises), and to enforce agreements resulting from those negotiations. No other statute provides US policymakers so much leverage to address market-distorting programs China may adopt.

Nevertheless, Section 301 is subject to certain limitations. It would give US policymakers the ability to act unilaterally only in situations where China has not violated WTO Agreements. And the leverage provided by Section 301 is limited by the extent to which China accesses the US market. The Trump administration used Section 301 to impose tariffs on most Chinese imports. China responded by imposing its own tariffs on US imports, including agricultural commodities. China’s retaliatory tariffs in turn prompted farmers and companies concerned about the potential loss of sales to China to pressure US policymakers to remove US tariffs.

In principle, the most effective trade policy solution—one that is supported by many US allies—would be to create new norms of behavior negotiated by all trading nations.

China’s efforts to nurture its domestic PEV producers and suppliers are similar to efforts it has used—and continues to use—to dominate world commerce across a wide range of products and services, including steel, rare earth elements, solar panels, industrial robots, 5G telecommunications, and artificial intelligence. As in the case of PEVs, for such favored products and services, US trade policy tools typically become viable only after significant damage to a domestic industry. These tools thus fail to provide a mechanism to nurture the growth of robust American firms that can compete successfully in global markets against Chinese firms backed by the government.

What about engaging with China bilaterally to modernize international trade rules? The Trump administration took this approach in its so-called Phase 1 trade agreement with China, which led to a détente of sorts in the US-China trade war. Thus far, China is not complying. The agreement required China to purchase an additional $200 billion in US goods and services over two years. It is falling far short, according to the Peterson Institute for International Economics.

In principle, the most effective trade policy solution—one that is supported by many US allies—would be to create new norms of behavior negotiated by all trading nations. But this is a daunting task when consensus is needed among more than 160 countries, especially as China is quietly building strong allies among many developing countries around the world through its Belt and Road Initiative. Nor is China likely to withdraw any domestic policy or practice critical to its continued economic development.

US domestic policies: uncoordinated and inefficient

To date, US governmental programs directly aimed at boosting PEV manufacturing and sales in the United States have been limited in duration and scope, and have failed to create a predictable and attractive landscape for either consumers or producers. For example, Tesla and General Motors, the most innovative American firms, no longer qualify for national consumer subsidies. Similarly, Department of Energy subsidies and loans for PEV and component producers are mostly no longer available. And US policy has never offered much meaningful assistance to companies interested in mining and processing raw materials in the United States, even materials crucial to PEVs or national security.

Fuel economy and emissions programs, if sufficiently stringent, offer some boost to the PEV industry, and during the Obama administration, the Environmental Protection Agency set greenhouse gas emission standards for automobiles that corresponded to the national fuel economy standards. But the Trump administration relaxed those standards, lessening the regulatory pressure. Even if the Biden administration restores earlier standards, PEVs will not be the compliance option of choice because other fuel-saving measures on gasoline cars are more cost-effective. Moreover, DOE no longer offers subsidies for PEV charging infrastructure, and fewer than half of local and state governments are stimulating the development of charging networks. Without sufficient charging infrastructure, consumers will be reluctant to purchase PEVs; without consumer demand, industry will be reluctant to invest in infrastructure.

Overall, this grab bag of federal and state policies has been enough to spawn Tesla but not enough to stimulate the growth of a robust US PEV industry, let alone counter China’s more strategic and persistent efforts.

At the state level, California’s ZEV program, now known as the Advanced Clean Cars Program, requires manufacturers to earn specified numbers of ZEV credits, where full credit is given for sales of pure ZEVs (battery and fuel-cell vehicles) and partial credit for transitional ZEVs (plug-in hybrids). Hybrid electric vehicles no longer earn credits. Eleven other states have now adopted the California program, meaning that more than 30% of the US new vehicle market is now covered by a ZEV mandate. The state-level ZEV mandates have never been coordinated with federal performance standards for fuel economy and greenhouse gas control. For vehicle manufacturers, the state-level mandates are inefficient because compliance must be achieved separately in each state, even if a state is doing little to foster PEVs.

Overall, this grab bag of federal and state policies has been enough to spawn Tesla but not enough to stimulate the growth of a robust US PEV industry, let alone counter China’s more strategic and persistent efforts. Indeed, as Tesla grows, it is finding at least as much opportunity for production and sales in Asia and Europe as it finds in the United States.

Getting serious about PEVs: 10 recommendations

PEVs are certain to be a growing component of the global vehicle mix in the years ahead. Will the United States cede this emerging area of innovation, industrial expansion, and economic growth to China? China’s industrial policies have not yet had a significant effect on the US PEV market, but China’s growing technical capacities, market strength, and dominance of key supply chains are likely to threaten the ability of US manufacturers to compete globally, and perhaps even domestically, in the coming decades. Given the limitations of US trade policy, lawmakers need to consider policies that can advance domestic production and support the PEV supply chain.

In order for the United States to recharge its nascent PEV industry, two types of policies are necessary. One focuses on making PEVs attractive to consumers in the face of low US fuel prices and America’s long-range driving patterns. The other focuses on making the United States a competitive place to assemble PEVs, manufacture LIBs and their components, and mine and recycle the raw materials critical for batteries and electric motors.

To make PEVs more attractive to consumers, the federal government and the states need to take several steps:

- Raise the price of gasoline through a national carbon tax or higher gasoline taxes, because higher fuel prices encourage sales of PEVs.

- Restrain the growth of electricity prices through use of affordable natural gas and renewables, since higher electricity prices discourage PEV sales.

- Remove federal tax breaks and subsidies that keep the price of oil and gasoline artificially low.

- Extend and focus purchase incentives for PEVs on the vehicle categories that dominate the US market: pickup trucks, SUVs, minivans, and crossovers.

- Remove regulatory barriers to the build-out of the recharging infrastructure in cities as well as along the highways that connect US metropolitan areas.

- Create nationwide exceptions from state-level dealer licensing laws that block or discourage start-up and established automakers from selling PEVs directly to consumers.

On the supply side of the PEV market, a variety of steps could be taken to boost the nascent US PEV industry:

- Replace the fragmented and inefficient state-level ZEV mandates with a single national ZEV program, perhaps similar to what China has adopted, thereby reducing compliance costs for automakers and building a national market for PEVs.

- Coordinate the federal fuel-economy and greenhouse gas emissions standards with the new national ZEV mandate (e.g., by making the ZEV mandate an incentive- based program that rewards manufacturers that go beyond the minimum requirements for fuel economy and emissions reductions in the federal programs).

- Streamline the burdensome and time-consuming federal, state, and local permitting requirements imposed on companies seeking to produce or recycle raw materials, components, and LIBs domestically.

- Provide a temporary period of minimum prices for companies seeking to mine raw materials, process materials, or produce components in the United States in direct competition with dominant government-backed Chinese producers.

The development of the US PEV industry will also require substantial federal R&D. Achieving advances in battery and electric-motor technology, including fuel-cell technology, should be a high priority. Social science advances are also needed to better understand how consumers make buying decisions and specifically how the concept of “total cost of ownership” plays into consumer thinking. If consumers do not give much weight to energy savings when purchasing a vehicle, then PEVs are unlikely to garner significant market share absent massive government subsidies of the magnitude seen in Norway, where consumers actually save thousands of dollars when purchasing a PEV instead of a gasoline vehicle. Norway is the only nation in the world where PEVs constitute more than 50% of the new-vehicle market.

If international trade laws ensured free markets throughout the world, then it might not be necessary for the United States to enact such strong industrial policies in support of the US PEV industry. However, there is no evidence that the global community will soon adopt and enforce stronger international trade laws that compel China to respect principles of free trade.

Insofar as the United States wants to compete with China in the supply chain for PEVs, US policymakers must counteract China’s dominance of the raw materials and components that define the supply chain. Both the Obama and Trump administrations took modest steps in this direction, but those steps have been feeble compared with China’s policies. The Biden administration and Congress need a bipartisan approach to durable legislation that protects investors and workers in the US supply chain from efforts by the Chinese government to drive US start-ups out of business. China has already demonstrated its willingness to use price manipulation against foreign competitors, for example by manipulating export quotas on the rare earth element neodymium, which is crucial for electric motors. Given China’s large influence on global markets throughout the PEV supply chain, firms will be reluctant to invest in the US supply chain until the US government offers some degree of protection from China’s anticompetitive behavior. More broadly, China’s industrial policy poses unique challenges to international and US trade policies. Available policy tools are ill-suited to countering China’s ability to create entirely new industries through nonmarket means. To address this problem, the United States should engage all of its trading partners, including China, to develop norms of behavior that reject the most egregious practices. Even so, progress on the trade front will be slow and limited. Until this international process produces effective results, the United States has no choice but to pursue industrial policies that are not typical of a country that cherishes free-market capitalism.