Why the US Trails the World in Electric Vehicles

While US states and the federal government offer incentives for the purchase of EVs, they fall short of those offered in China and Norway. And EV chargers are harder to find.

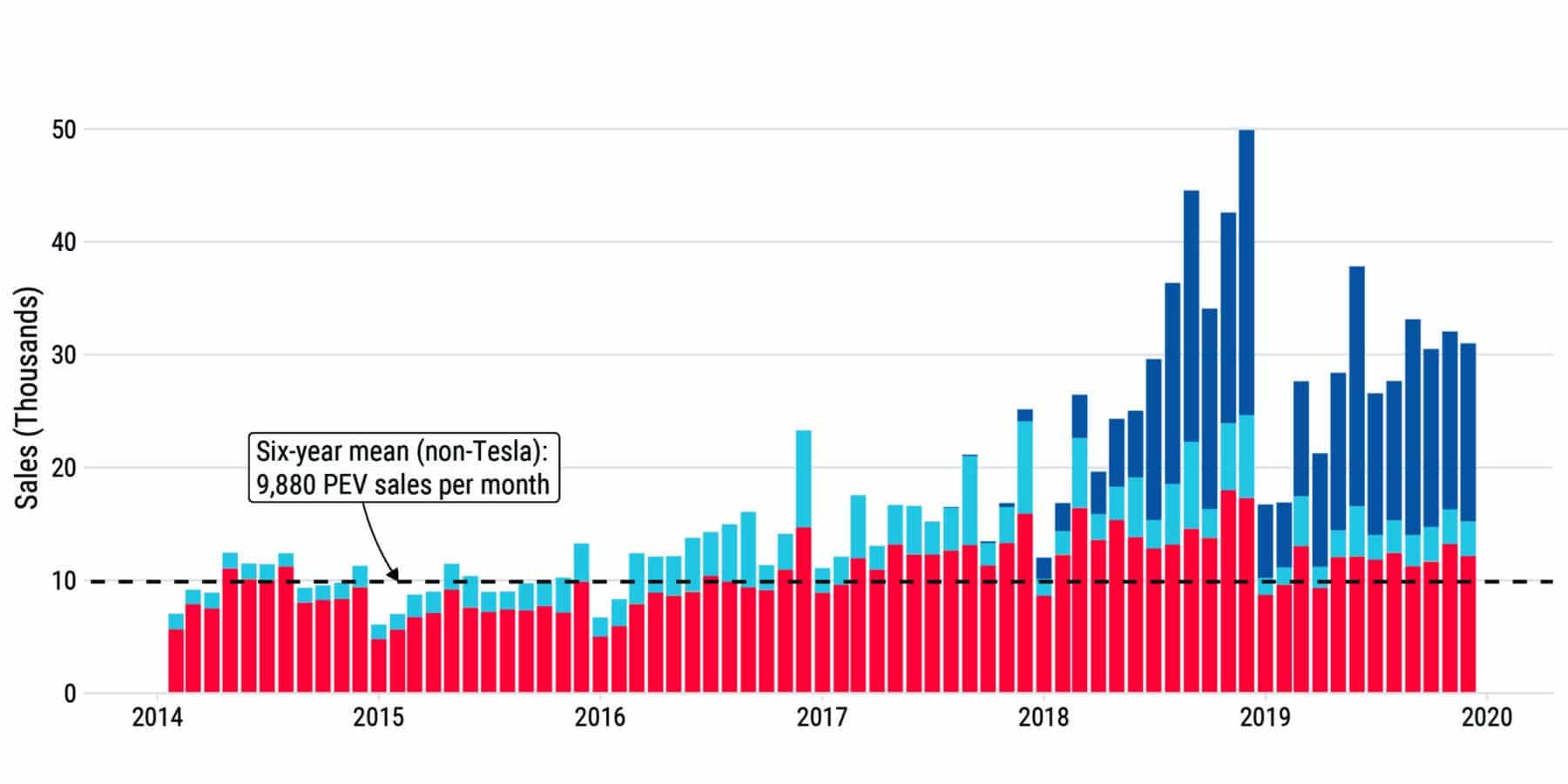

In 2019, 53% of all new plug-in electric vehicles (PEVs) sold worldwide were produced by Chinese automakers. In Norway, PEVs made up 55.9% of all new vehicles sold that year, and the rest of Europe is also quickly going electric—the PEV share of new car sales in France, Germany, and Sweden in October 2020 was 11.8%, 17.5%, and 36.2%, respectively. Yet in the United States, PEVs have remained a minor, niche segment, comprising just 2.1% of sales in 2018 and 1.9% in 2019. Although Tesla has experienced remarkable growth since the release of its Model 3 sedan in late 2017, PEV sales by the rest of the US auto industry have remained relatively flat for the past six years (see Figure 1). The list of factors contributing to slow PEV growth the United States is long and complex, and while some could be remedied by taking a page from the European or Chinese policy playbook, others may be more challenging to overcome.

Incentives in the United States pale in comparison with the much more aggressive PEV policies in other countries.

Government policies have played a central role in establishing the early market for PEVs in most parts of the world, and to their credit, US federal and state legislatures have been some of the earliest to implement PEV incentives. At the federal level, the American Recovery and Reinvestment Act of 2009 introduced consumer purchase tax credits for different types of PEVs that increase proportionally with the vehicles’ battery capacity, up to a maximum of $7,500, with credits phasing out for any PEV model that surpasses 200,000 sales. Many states offer additional subsidies varying from hundreds to thousands of dollars, as well as other perks for PEVs, such as designated preferential parking and free use of HOV lanes with only one driver. Researchers have found that these policies have indeed contributed to rising PEV sales, with estimated increases of 2.6% to 11% in PEV registrations for every $1,000 in incentives.

But these incentives pale in comparison with the much more aggressive PEV policies in other countries. Take Norway, for example, where vehicle taxes are computed as a combination of several factors, including a vehicle’s weight and the amount of carbon dioxide and nitrogen oxide it emits, making larger, higher-polluting cars substantially more expensive than smaller, lower-polluting cars. In addition, PEVs are exempt from a 25% purchase value added tax, annual road taxes, and most parking fees and highway tolls. These heavily skewed tax policies make many current PEV models significantly less expensive to own and operate than most internal combustion engine vehicles without offering any direct purchase subsidies. But these policies are not cheap. A 2014 study estimated that the Norwegian government lost $8,100 in reduced tax revenue for each PEV sold. Using this figure, the government is estimated to have lost $1.62 billion in tax revenue for the approximately 200,000 PEVs registered in 2018 alone.

Policies in China—the world’s largest PEV market by far—are even more proactive. In addition to the central government PEV purchase subsides, which are similar to those in the United States, policies such as license plate restrictions and fees give local provincial and city governments enormous leverage to incentivize PEV adoption. In Shanghai, for example, buyers of a PEV can save as much as $15,000 on a license plate, which are allocated via auction. In addition, PEV drivers in many larger cities are exempt from restrictions such as “road rationing” policies that limit driving to only every other day.

Policies such as license plate restrictions and fees give local provincial and city governments enormous leverage to incentivize PEV adoption in China.

Not only are other countries outspending the United States on incentives, Americans on average may be less willing to adopt PEVs. A 2015 study estimated that subsidies for PEVs may need to be as large as $20,000 for an average American consumer to be equally likely to adopt a PEV over a conventional vehicle (all else being equal), whereas the same effect in China could be achieved with subsidies of $5,000 or less, or even without subsidies depending on the electric driving range. And few Americans even see a PEV on a dealer lot. According to a recent Sierra Club report, only one-quarter of dealerships nationwide are actively selling PEVs. And once US PEV drivers are on the road, they may have a harder time finding a place to recharge than do drivers in other countries. By 2018, China and Europe had deployed approximately 330,000 and 160,000 public chargers, respectively, compared with just 67,500 in the United States. Furthermore, approximately 36% of China’s chargers are “fast chargers” requiring only 15 to 20 minutes to recharge, compared with just 14% of those in the United States. (Conventional, or level 2, charging can take several hours, depending on the size of the battery pack.)

The success of the Chinese and European markets suggests that targeted policies can make a difference.

The incoming Biden-Harris administration, which has announced its intentions to make climate action a centerpiece of its policy agenda, will thus face an uphill battle in electrifying the automotive sector. Ironically, the outgoing Trump administration may have helped smooth out some of the existing friction. Its repeal of car pollution policies, refusal to extend the PEV tax credit, and trade war with China have motivated the establishment of a new lobbying group: the Zero Emission Transportation Association, or ZETA. The group, which has set a target of electrifying all new vehicles sold in 2030, comprises automakers, lithium producers (lithium is a key component of PEV batteries), PEV charging firms, and electric utilities, aiming to deploy every policy tool available to increase PEV adoption. It may provide the coherent voice and vision that has been lacking in America’s approach to moving away from the internal combustion engine.

The success of the Chinese and European markets suggests that targeted policies can make a difference. If the United States is to begin catching up in this environmentally and economically critical technology sector, it should embrace a more aggressive approach.