Is Innovation China’s Next Great Leap Forward?

The United States is the world’s innovation leader, but it can no longer take its premier position for granted.

Innovation refers to the process of implementing new or improved technology and management practices that offer products and services with desirable performance at affordable cost. Innovation encompasses the entire pathway from early-stage idea creation through technology development and demonstration, and finally to late-stage production and deployment. Innovation aims at increasing consumer satisfaction, economic productivity, growth, exports, and jobs.

A number of significant indicators suggest that China’s innovative capability is increasing more rapidly than that of the United States, portending a weakening of the United States’ relative global competitive position:

- China’s total research and development (R&D) expenditures are growing faster than those of the United States, but China is at a lower absolute level.

- Many attribute China’s technical advances to illicit transfer of technology, theft of intellectual property (IP), and requiring transfer of technology from foreign firms operating in China, in violation of World Trade Organization rules

- China has adopted aggressive technology targets in key areas such as robotics, artificial intelligence, and digital learning, with the announced goal of surpassing US capabilities.

- China is increasing its investment in small and large high-technology US enterprises without allowing US firms similar investment opportunity in China.

- China’s intelligence agencies are expanding efforts to collect information from Chinese students doing research on US university campuses in areas relevant to China’s key technology

Do these developments add up to a real threat to US innovation leadership? And if so, what is an appropriate policy response. The sanguine view is that China’s innovative progress is the inevitable result of its economic growth and technological maturity and that market forces will cause the United States and other members of the Organisation for Economic Co-operation and Development (OECD) to adjust the balance of goods and services they offer in response. The harsher view is that the United States must adopt tailored protectionist measures to compensate for unfair trade practices until the two countries reach a negotiated agreement on stable and mutually beneficial market access, cross-border investment, and technology transfer.

This is not the first time the United States has appeared to lose global technical and innovative leadership. The Soviet Union’s 1957 launch of Sputnik, the world’s first artificial satellite, raised the specter that the United States was losing the “space race.” In the 1980s there was widespread concern that the United States had fallen irrevocably behind Japan in manufacturing, in areas such as autos, flat panel displays, and consumer electronics.

China has adopted aggressive technology targets in key areas such as robotics, artificial intelligence, and digital learning, with the announced goal of surpassing US capabilities.

In the case of Sputnik, the US government took prompt actions to build a significant civilian and military space capability. As a result, the United States has a competitive but not overwhelmingly dominant global position in space systems and, more important, in use of space systems for communication, precise geospatial location, navigation, and remote earth sensing.

In the case of Japanese manufacturing, the United States, Korea, and Taiwan quickly developed a broad array of competitive products such as Apple computers, CISCO communications hardware, and Microsoft software. In addition, Japan’s aging work force limits its ability to grow and adapt.

However, the present situation vis à vis China is more serious for two reasons. First, China’s rate of increase in economic activity and technical capability is greater than the rate of the United States and other OECD countries. Second, policy uncertainty, especially with regard to trade and climate, has slowed US private investment. The US’ vulnerability is due not to significant weakening of its innovation capability, but rather to China’s growing relative economic strength and emphasis on innovation in its economy.

Comparison of innovation trends must be seen in the broader context of US-China economic and political relations. Xi Jinping is now serving simultaneously as general secretary of the Communist Party of China, president of the People’s Republic of China, and chair of the Central Military Commission, without term. China seems to be reversing its slow but steady evolution to more democratic governance and reverting to a centralized party system with a single leader making all key decisions. Washington and Beijing are divided on many issues: tariff barriers, China’s actions in the South China Sea, its modernization of its military forces, difference over the status of Taiwan and Tibet, the importance of North Korean sanctions, and human rights violations. In this climate, differences related to innovation are amplified and more difficult to resolve.

What do the data say?

There are three sources for comparative country data that bear on innovation: the US National Science Foundation’s biannual Science and Technologies Indicators, the OECD’s series on R&D statistics, and the World Bank’s indicator databank that covers science and technology. These data share the shortcomings of uncertain data quality and reliance on purchasing power parity rather than market exchange rates to compare national efforts; add to that the caution of the late Lester Thurow, the influential economist and professor at the Massachusetts Institute of Technology: “Never believe a number coming out of China.”

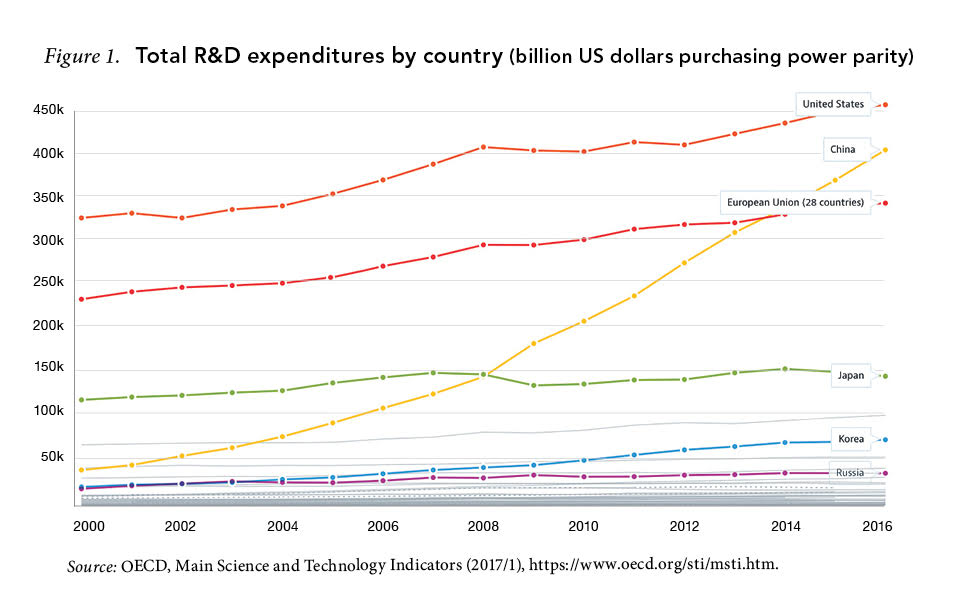

Total R&D expenditure is the indicator most frequently cited. China’s total R&D expenditure is increasing more rapidly than that of the United States but has not yet reached the US level. As illustrated in Figure 1, if the United States has reason to be concerned with this trend, certainly the European Union (EU) and Japan should have greater concern.

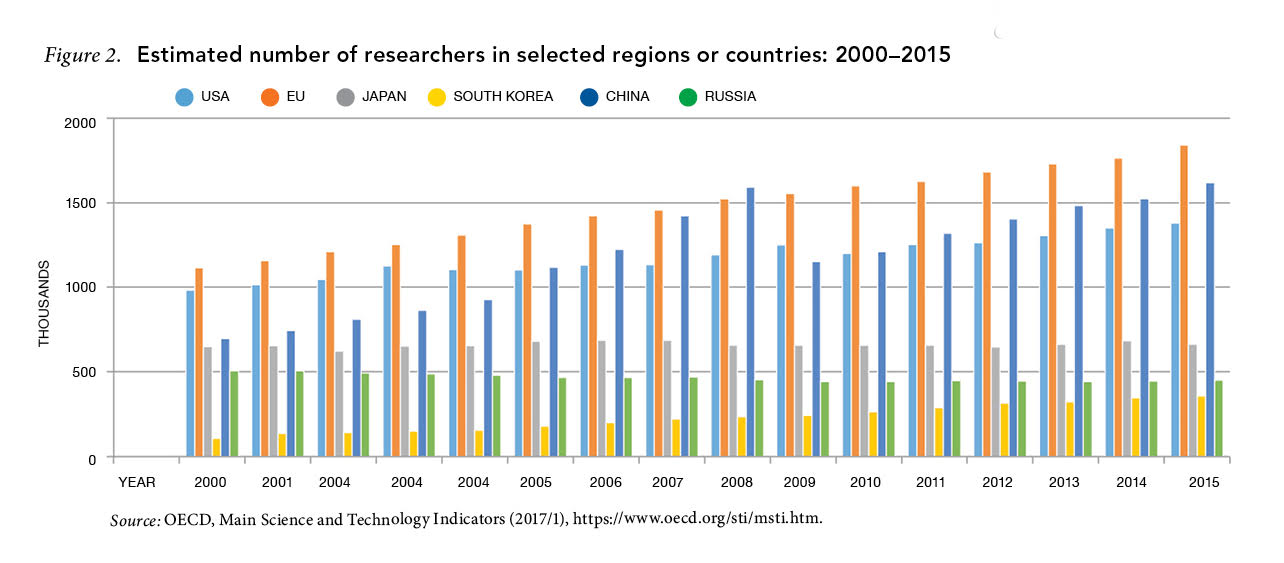

Other indicators of inputs to the innovation process are the size of the science, technology, engineering, and mathematics (STEM) workforce; expenditures on R&D plant and equipment; and the availability of venture capital. Figure 2 compares the size of the STEM workforce in several countries over time. China’s workforce exceeds that of the United States, and its rate of increase is greater; however, the EU has a larger workforce than either country. In 2014 China awarded about 1.65 million bachelor of science and engineering degrees, whereas the US total was about 742,000.

In 2015 the percentage of foreign workers in the US STEM workforce was approximately 30%, with India providing 20% and China 10% of that total. Labor market experts project that the US economy will need to rely on increasing numbers of foreign STEM workers because the US education pipeline is not large enough to meet anticipated demand. But one cannot predict with any certainty how many foreign-born scientists and engineers will want to study and work in the United States or how many that spend time studying and working in the United States will leave and take with them valuable knowledge that will then benefit other countries.

Regarding the second factor, relatively little data or analysis is available to compare the inventory and flow of expenditures on R&D plant and equipment of different countries. The R&D facilities inventory is probably higher in the United States and the EU than in China, but China’s annual expenditure on R&D facilities is rising and may now exceed the annual US expenditures. The balance of payment flows for intellectual property favors the United States by a factor of four, but payments to China are increasing.

Although measuring inputs is one way of understanding the innovation process, the most important consideration is outputs; in particular, identifying the factors that influence process efficiency in different countries. Technical micro output indicators such as patents, publication, citations, start-ups, and licensing agreements do not tie directly to the innovation capacity of a firm, industry, or nation, and they are even less useful for assessing the contribution that new technology or business practices makes to profitability or competitiveness.

Direct measurement of innovation capacity is difficult, but there have been several attempts to develop macro indicators, which have important qualitative features. The French international economics research center, CEPII, presents a thorough discussion of China’s 13th Five-Year Plan (2016-2020) and concludes: “The first and most important objective is the shift from capital accumulation-led growth to innovation led-growth in order to enhance total factor productivity (TFP) and release the huge potential of consumer spending.” Also, the McKinsey Global Institute has analyzed four different aspects of innovation—customer focused, efficiency driven, engineering based, and science based—concluding that “China has the potential to meet its ‘innovation imperative’ and to emerge as a driving force in innovation globally.”

The Asia Society’s Policy Institute in cooperation with the Rhodium Group tracks progress in China’s economic “reform” program in 10 clusters, one of which is innovation. The groups estimate innovation progress by the ratio of value-added output from “innovative” industries to total value-added industrial output over time and compare the trend in China to the trend in United States, the EU, and Japan. Over the past five years, China’s position has increased from 30% to 32%, while the United States, EU, and Japan have remained relatively constant at 34%, 37%, and 46%, respectively. The indicator is a crude measure because the portfolio of innovative industries is arbitrary, consisting of seven sectors, with equipment and communications, computers, and electronics comprising about 50% of the total. The share of innovative industry compared with conventional industry in Chinese exports has not changed dramatically during this period.

Innovation infrastructure

A country’s innovation performance depends strongly on its underlying innovation infrastructure, including:

- Education of scientists and engineers who will enter the technical workforce

- Industry/university/government partnerships

- Standards for materials, products, safety, and subsystem interfaces

- Established patent, publication, and intellectual property rights

- Tax treatment of R&D activities

- Export controls on technology transfer and on participation of foreign scientists and engineers in the R&D enterprise

- Access to venture capital

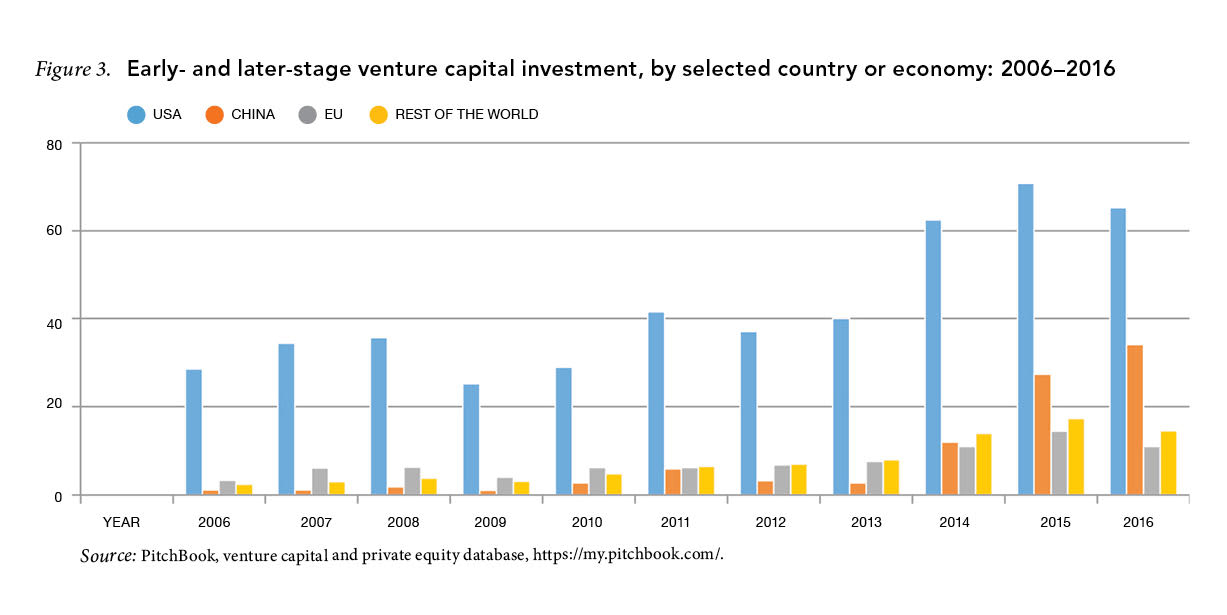

The US innovation infrastructure is the envy of the world, especially for early-stage R&D and for giving foreign students the opportunity to learn both the technical and entrepreneurial aspects of innovation. China has taken a number of steps to improve its R&D infrastructure, but it still lags the United States, the EU, and Japan. The United States also has a massive lead in private venture capital spending (see Figure 3).

In March 2016 China’s National People’s Congress ratified its 13th Five-Year Plan, which includes increased R&D spending by the Ministry of Science and Technology, National Natural Science Foundation, and Academy of Science to improve the science and engineering base as a means to strengthen the infrastructure that fosters innovation. It also provides guidance for a number of industry sectors and draws heavily on the July 2015 Made in China 2025 strategic blueprint to achieve global manufacturing leadership through innovation. The goal is to upgrade industry writ large, but the plan highlights 10 priority sectors: new advanced information technology, automated machine tools and robotics, aerospace and aeronautical equipment, maritime equipment and high-tech shipping, modern rail transport equipment, new-energy vehicles and equipment, power equipment, agricultural equipment, new materials, and biopharma and advanced medical products. China 2025 is supported by other documents, such as a very detailed blueprint for artificial intelligence announced by the State Council.

One cannot help but admire China 2025. It sets clear goals based on explicit strategic priorities and support mechanisms, and it lists 12 specific quantitative key performance indicators for measuring improvement between 2015 and 2025. Technology strategy documents issued by the United States do not compare. For example, the White House Impact Report: 100 Examples of Obama’s Leadership in Science, Technology, and Innovation, released in June 2016, recounts many valuable actions but no overall strategy and no comprehensive plan to strengthen federally supported innovation activities across the board.

Expert commentators have recognized the threat implicit in China 2025. The Center for Strategic and International Studies notes the challenge presented to multinational corporations in the priority sectors. The American Institute of Physics warns the United States is at risk of losing global leadership to China. A Council of Foreign Relations blog is titled “Why Does Everyone Hate Made in China 2025”? The US Chamber of Commerce subtitles its review of Made in China 2025 as “Global Ambitions Built on Local Protections,” asserting that it “aims to leverage the power of the state to alter competitive dynamics in global markets in industries core to economic competitiveness.” The US government’s US-China Economic and Security Review Commission’s analysis has the provocative title “China’s Technonationalism Tool Box: A Primer.”

The unanimous message is that China is adopting a predatory economic policy that presents threats to the US economy and national security, including:

- IP cyber theft and illegal technology transfer

- Restricted access of foreign firms to China and requiring foreign firms operating in China to transfer technical know-how to China, violating World Trade Organization rules

- Unfair trade practices, including providing subsidies to key high-technology priority industry and dumping key products in export markets at prices below domestic Chinese prices and costs

- Nontraditional collection of advanced technology that targets professors and students in US universities and research centers

A number of official US reports address these threats. The Office of the US Trade Representative issued a report in March 2018: Findings of the Investigation into China’s Acts, Policies, and Practices Related to Technology Transfer, Intellectual property, and Innovation. The 180-page report catalogs a wide range of Chinese actions that are “unreasonable or discriminatory and burden or restrict US commerce” and justify further investigation and response. China has made some efforts to address these concerns. In 2017, Chinese Premier Li Kequiang announced, “We will fully open up the manufacturing sector, with no mandatory technology transfers allowed, and we will protect intellectual property.” Also in 2017 China’s State Council released Several Measures for Promoting Foreign Investment Growth, which contains 22 measures that are aimed at increasing foreign investment and optimizing the utilization of foreign capital. As Martin Feldstein, a former chair of the Council of Economic Advisers and now a professor at Harvard University, has noted, these expressions of intent have not eased concern.

In another illustration of concern, the National Bureau of Asian Research established the Commission on the Theft of American Intellectual Property (IP Commission), chaired by former Director of National Intelligence Admiral Dennis Blair and Ambassador Jon Huntsman Jr., which issued a report in 2013 and an update in 2017 on the extent of US loss of IP as the result of a range of China’s illicit activities, including cyber-enabled means. The IP Commission’s latest report estimates that the annual cost to the US economy from IP theft to be between $225 billion and $600 billion, with “China being the world’s principal infringer.” Whereas other nations commit industrial espionage against the United States, China’s activity is more extensive and better organized at exploiting stolen information and data in its domestic economy.

The IP Commission’s latest report estimates that the annual cost to the US economy from IP theft to be between $225 billion and $600 billion, with “China being the world’s principal infringer.”

On February 13, 2018, Director of National Intelligence Daniel R. Coates released at a Senate Intelligence hearing a statement titled “World Wide Threat Assessment of the U.S. Intelligence Community.” Among its observations, it states: “China, for example, has acquired proprietary technology and early-stage ideas through cyber-enabled means. At the same time, some actors use largely legitimate, legal transfers and relationships to gain access to research fields, experts, and key enabling industrial processes that could, over time, erode America’s long-term competitive advantages.”

At the same hearing, FBI Director Christopher A. Wray was much more explicit about China’s threat to US universities and from the more than 50 Chinese Ministry of Education Confucius Institutes on US university campuses. Asked by Senator Marco Rubio (R-FL) to comment on “the counterintelligence risk posed to U.S. national security from Chinese students, particularly those in advanced programs in the sciences and mathematics,” Wray responded: “I think in this setting I would just say that the use of nontraditional collectors, especially in the academic setting, whether it’s professors, scientists, students, we see in almost every field office that the FBI has around the country. It’s not just in major cities. It’s in small ones as well. It’s across basically every discipline. And I think the level of naïveté on the part of the academic sector about this creates its own issues. They’re exploiting the very open research and development environment that we have, which we all revere, but they’re taking advantage of it. So one of the things we’re trying to do is view the China threat as not just a whole-of-government threat but a whole-of-society threat on their end, and I think it’s going to take a whole-of-society response by us. So it’s not just the intelligence community, but it’s raising awareness within our academic sector, within our private sector, as part of the defense.”

The record clearly establishes extensive Chinese illicit technology transfer behavior. Anyone with US national security experience does not need to be convinced. What is striking is the implied judgment that this illicit behavior has been and will continue to be decisive to the advance of China’s innovative capability. There are few, if any, voices raised to say that significant improvement in Chinese innovation should be expected with the growth of China’s economy and the increased maturity of its indigenous science and technology infrastructure without any illicit behavior.

Summing up, I believe the comparative advantage of China will continue to be in build-to-print manufacturing and its efficient supply chain. The US strength will continue to be its customer focus and developing new technologies for widespread application. The story of China’s production of photovoltaic (PV) modules is illustrative. China has global leadership in low-cost manufacturing of PV modules based on conventional silicon solar cells. The impressive drop in average sale price and accompanying demand growth is due to manufacturing overcapacity stimulated by Chinese provincial, not central, government subsidies. Up until 2017 Chinese PV firms had not enjoyed profitability. In contrast, the United States maintains its lead in creating advanced PV technologies and developing production equipment and technology, which Chinese firms import and on which they rely. In a joint study, the Department of Energy National Renewable Energy Laboratory and the Massachusetts Institute of Technology examined China’s advantage in low-cost PV manufacturing, concluding that the “price advantage of a China-based factory relative to a US-based factory is not driven by country-specific advantages, but instead by scale and supply-chain development.” On the other hand, it is very unlikely that China will dominate the United States in key innovation areas such as artificial intelligence, robotics, machine learning, and genetic editing using a technology called CRISPR, at least for the next several decades. The pattern of China’s manufacturing strength and US strength in creating new technology opportunities is likely to continue in the future, at least for the next decade or so, because of the relative strength and maturing of each country’s innovation infrastructure.

Implications for US policy

The current relative strength of US innovation should be appreciated but not taken for granted. If the United States is to maintain its innovation leadership relative to China, it cannot stand still. The United States must adopt policies that both respond to China 2025 and strengthen the US innovation capability. Actions required include:

First, the United States’ bilateral trade discussions with China should go beyond tariff negotiations to matters that directly affect innovation: market access, cross-border investment, and technology transfer.

Second, the United State must continue to monitor and expose illicit Chinese activities such as IP theft, especially by cyber penetration, patent infringement, export of counterfeit goods, widespread use of unlicensed software, and forced transfer of technology from foreign firms operating in China. The US government needs to track each documented incident and establish a process for confronting China in each case and to enforce US law by assessing penalties on violating firms. Present and former administrations have taken steps to protect the country from these illegal efforts, but much more needs to be done.

Third, the United States must develop a new policy for engaging China on cross-border investments in high-technology firms and activities. This recommendation is motivated by two realities. First, the United States and China have very different motivations for cross-border investment. US firms are primarily interested in offering goods and services to China’s large and growing domestic market. These firms fear China’s practice of high-jacking technology in order to establish competitive indigenous capability. Chinese investments in the United States are primarily in firms with capabilities in the advanced technologies outlined in China 2025. Increasingly these investments will be in start-up companies and in joint ventures that are creating key technologies for future innovation.

The second reality is that many of the key technologies, notably artificial intelligence and robotics, are inherently dual use, with important applications in both the commercial and national security sectors. The US multiagency Committee on Foreign Investment in the United States (CFIUS) has a long history of reviewing transactions that could result in the control by a foreign entity in order to determine the effect of such transactions on US national security. The original CFIUS mandate required it to focus “solely on any genuine national security concerns by a covered transaction, not on other national interests.” But over time CFIUS has been pressed to examine transactions that are perceived to affect US economic competitiveness, including foreign transactions that involve “critical technologies” or that might entail industrial espionage.

The United States must develop a new policy for engaging China on cross-border investments in high technology firms and activities.

CFIUS is ill-equipped to assess the implications of start-ups and joint ventures in rapidly evolving key dual-use technologies of uncertain future application or success. If the United States wishes to reduce the ease with which China (and possibly other countries) can acquire US advanced technologies to fuel its innovation initiative, it is necessary to adopt controls that restrict access.

These controls should begin by requiring that all investment by Chinese entities in US enterprises—start-up companies, joint ventures, and venture capital funds—in a defined set of key advanced technologies be registered with one of the CFIUS agencies; prohibiting China from holding a 100% interest in US advanced technology enterprises; and mandating that any enterprise in which China holds a majority create an independent security supervisory board similar to those sometimes required by CFIUS to monitor and report all offshore technology transfer. Federal agencies that fund technology development would be permitted to award contracts or grants only to Chinese enterprises that had operating subsidiaries in the United States.

China should be allowed to support research activities in US universities, provided that research results are made publicly available. Chinese firms supporting research on US campuses would not be permitted preferential or exclusive licenses to any intellectual property produced.

Much effort is required to define precisely each of these suggested measures and a supporting administrative structure. The justification for such protectionist measures is to respond to China’s innovation initiative whose announced intention is to dominate world markets and whose progress depends to a significant degree on illicit technology transfer.

Fourth, the United States should not place restrictions on US universities and research centers. Restrictive proposals include preclearing publication of research results supported by the Department of Defense, applying the classification category of “sensitive but unclassified” on some government-sponsored research, and placing restrictions on foreign graduate students joining “sensitive” research projects and on presentations of research at international meetings. Each of these measures conflicts with the open structure of admission, research, and publication that keeps the US innovative ecosystem fresh, exciting, and agile.

Efforts by the federal government to control university research would be ineffective because its agencies are unlikely to balance properly the benefit of a proposed restrictive measure with the adverse impact on the quality of research; university faculty and administrators are ill-equipped to administer such restriction; and a restrictive environment will inevitably slow the flow of students from China and other countries who are needed by US industry. If the government imposes restrictions on research it sponsors, it will weaken its link with the universities that have been so central to US innovation. The risk of technology leakage is minor compared with the losses that will be incurred by restricting inquiry on university campuses.

It would be futile for the United States to try to maintain its competitiveness and its lead in early-stage innovation by trying to keep others out of US universities or to keep ideas in. The only effective response to China’s growing capability is to strive to master the new intellectual frontiers and to continue to recruit the most talented workforce able to translate new ideas into practice. In this regard, the United States should continue to welcome Chinese and other science and engineering graduates to US universities and liberalize immigration green card requirements to assure adequate supply for US industry.

Fifth, the United States must dramatically increase its innovation effort, especially in manufacturing, to bring the key future technologies to market. The United States should not adopt, as China has, a single national strategy. Nor should the United States rely simply on increasing federal R&D support from traditional agencies. US innovative activity is tremendously dynamic, with individual entities applying new technical applications in unique ways. This dynamic process, distinctive to the United States, is possible because of its formidable innovation infrastructure and strong tradition of customer and application focus. The approach depends on the open and free character of US society; it is difficult to imagine such productive vitality existing in communist China, where freedom of expression and association is so restricted.

The three prongs of US innovation—the federal government, industry, and academic research centers—need to follow distinct pathways to achieve a higher level of national innovation.

Individual industry sectors have the most important role in bringing new technology and business practice to market. Industry associations need to convince members of the urgency of increasing the pace of innovation and to provide them with case studies of successful unconventional new innovation.

The United States should continue to welcome Chinese and other science and engineering graduates to US universities and liberalize immigration green card requirements to assure adequate supply for US industry.

Universities and research centers have two important roles: to increase the flow of researchers with the motivation and experience to achieve innovations, and to expand work on key technologies. Both roles serve to enhance the dominant US innovation infrastructure.

The federal government’s role is to enable enhanced innovation in several ways. R&D support should place priority on proposed work that stresses innovation (without endangering early-stage fundamental research) and should explore different mechanisms for providing support, such as the Department of Energy’s ARPA-E program. Management of technology demonstration projects is a critical aspect of federal support for innovation. The Office of Management and Budget should undertake a thorough review to identify regulations that slow innovation in the areas of patents, security registration, tax provisions, and federal acquisition regulations, and then recommend changes that streamline the innovation process. The president should form an interagency council charged with overseeing the innovation efforts of different agencies and share best practices; among its efforts, the council should study and track the implications of an increasingly digital-based economy on the future of work and changing educational needs. The federal government must also continue to combat illegal theft and hacking of technology and know-how from China and other countries, as outlined above.

Finally, Congress should establish a national commission comprising political, industry, university, and public interest groups to communicate the nation’s need for advancing innovation and to report progress. The Unites States’ approach to improving its innovation capability is based on the core strength of its innovation infrastructure and the diverse and dynamic entrepreneurial enterprises that are incentivized to succeed. All elements of the public have a role to play in the process but should share a high-level vision of the importance of the task. If the United States attains its potential improvements in innovation performance, China’s great leap forward will likely be, at best, just a few steps toward closing the innovation leadership gap that the United States currently enjoys.