Renewing Economically Distressed American Communities

Deep recessions can put some places in a tailspin for decades. Some modest policies can help speed the recovery.

All communities do not fare equally well after recessions and other economic shocks. Some bounce back fairly quickly. Others suffer more and take longer to recover—sometimes decades longer. A sluggish return to growth is not always necessary, however. There is evidence that well-targeted policies may be able to speed the pace of recovery.

Buffalo, New York, is one example of a community that has suffered for far too long after an economic shock. In 1950, Buffalo was the nation’s 15th largest city, boasting nearly 600,000 residents. It was a nexus of manufacturing and automobile and aircraft assembly and home to the world’s largest steel mill. Buffalo’s boomtown prosperity radiated out across Great Lakes shipping lanes and railway hubs, and attracted migrants from around the country. In 1970, the president of Bethlehem Steel, the operator of the steel plant, said of the city, “You can’t help but believe that a tremendous decade lies ahead.”

But three harsh recessions between 1969 and 1982 pushed Buffalo and many other manufacturing-based cities off the path to prosperity. During each recession, manufacturing employment in the United States plummeted by between 9 and 15%. These were not temporary layoffs; jobs disappeared, shifts shrank, and plants closed. Buffalo’s steel mill, which had employed 20,000 workers in 1965, was shuttered completely in 1982. That year, unemployment in the Buffalo area, which had been well below the national average for at least a decade, topped 12%. Local income, which was more than 6% above the national average in 1970, is today 9% below the average. When jobs disappeared, so did workers—in droves. By 2000, Buffalo’s population had fallen by half. Property values dropped, and neighborhoods crumbled into disrepair, pocked with abandoned homes. More than a quarter of the city’s residents lived in poverty.

Today, Buffalo remains distressed, and poverty in the central city is still very high, but the situation is improving. The Buffalo metropolitan area’s unemployment rate of 7.6% is below the national average. Employment rates have increased, and income, although still below average, is no longer falling even further. New businesses have moved in. Developers, drawn to low property prices, have started to enter the local real estate market. Families have followed. In 2010, Forbes Magazine called Buffalo one of “America’s Best Places to Raise a Family,” based on factors such as the cost of living, prevalence of homeownership, median household income, commuting time, crime, and high-school graduation rates.

No city should have to suffer the persistent distress that Buffalo and other cities have endured. It should not take 40 years for a city to recover. But the slow pace of recovery in the wake of the recent Great Recession, compounded by ongoing restructuring in the U.S. economy, raises the troubling prospect of newly distressed communities that will languish for a long time.

Here we draw on economic research to argue that a national economic strategy to aid distressed communities is both appropriate and necessary. There are many opportunities to develop and implement policies that can deliver more success stories and quicker recoveries, even in the wake of a rapidly changing economy. We recognize, however, that every community is different and that there is no one-size-fits-all solution for the challenges facing economically distressed communities. We therefore propose a basket of options that could begin the process of restoring good jobs to local workers. Each option follows three approaches: attracting new businesses, aiding displaced workers, and matching workers to jobs.

The problem of distressed communities

Workers and their families living in especially hard-hit communities face a number of challenges. Unemployment in persistently distressed areas often arises from plant closings or mass layoffs associated with declines in specific industries and businesses. Unlike other types of joblessness, these losses can result in a permanent reduction of job opportunities as well as the erosion of local workers’ marketable skills. In addition, evidence suggests that local economic shocks have long-lasting effects on local labor markets.

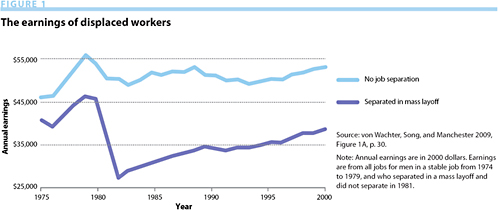

Losing a long-held job does not just result in temporary unemployment. It often leads to permanent income loss because workers earn lower wages upon reemployment. Figure 1 summarizes a study completed by Till von Wachter, Jae Song, and Joyce Manchester that compares the earnings trajectories of workers who lost their jobs in a sudden mass layoff in the early-1980s recessions and workers who maintained their jobs throughout those recessions. Before the recessions, both groups’ earnings followed a similar pattern. After the recessions, however, displaced workers faced devastating long-run earnings losses. Even in 2000, almost 20 years after the 1980s recessions, a sizable earnings gap remained. According to the study, a displaced worker with six years of job tenure faced a net loss of approximately $164,000—more than 20% of his or her average lifetime earnings. Long-run earnings losses in fact dwarf income losses resulting from a period of unemployment.

Job loss also has calamitous effects on workers’ health and families. In the year after they lose their jobs, men with high levels of seniority experience mortality rates that are 50 to 100% higher than expected. Elevated mortality rates are still evident 20 years after job losses. Children of jobless workers also suffer income loss. They not only have a tough time finding jobs when the unemployment rate is high in their local labor market, but also earn considerably less than their peers elsewhere once they have entered the market. Earnings gaps persist even 10 years after these young people have left school.

A sharp economic shock permanently affects communities just as it affects workers. For communities experiencing the largest economic contractions during recessions, the impact on employment and income can be extremely persistent. The data show that unemployment rate differences between distressed areas and the rest of the country dissipate within a decade, but this is largely because of workers leaving distressed areas rather than a resurgence of job opportunities.

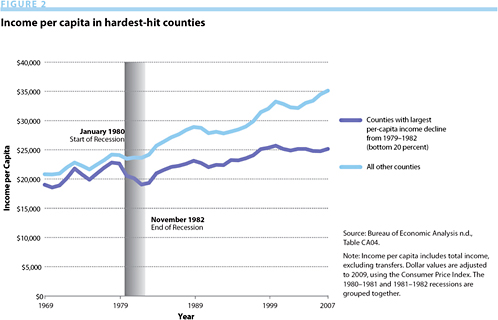

Figure 2 shows income for the 20% of counties that experienced the largest drops in inflation-adjusted income per capita during the early-1980s recessions. About 10% of U.S. residents live in these counties. Before the recessions, average incomes in these counties (indicated by the purple line) moved in lockstep with incomes in the rest of the country (indicated by the green line). During the recessions, however, incomes in these counties plunged by 14% more than did average per capita incomes elsewhere.

For most of the country, it took less than two years after the end of the 1982 recession for average incomes to return to their pre-recession levels. But for the hardest-hit communities, it took more than six years. Figure 2 shows that, after the recessions, incomes in these counties began to grow again but at a slower rate than in the rest of the country. Instead of catching up, these communities lagged farther behind. Today, almost 30 years later, there is a gap of almost $10,000 in average per-person income.

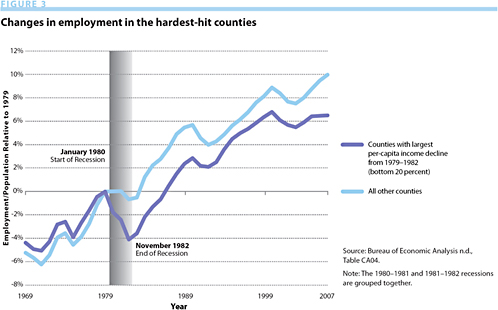

A different but still disconcerting pattern holds true for employment. Figure 3 illustrates the path of employment (defined as the share of local residents with a job) relative to where communities started in 1979, just before the recessions. Employment in the hardest-hit areas plunged: Roughly 4% of their respective populations lost jobs. Although employment growth eventually returned and roughly followed the trend in the wider economy, the gap has still not closed. There are simply fewer working adults in the most distressed areas even today.

During the past 30 years, average earnings in the hardest-hit communities grew by only 12%, or about one-quarter the national rate. Employment as a share of the population increased by much less there than elsewhere, and populations grew more slowly. Because workers left these communities and took their families with them, demographics changed too; there were fewer young people and more retirees. As a result, demand for housing was weaker and home prices increased more slowly than elsewhere. Falling home prices and lower rents may help workers stretch their budgets, but they are unlikely to offset the decline in workers’ income.

An optimistic view is that these changes—falling wages and land prices—will ultimately spark renewal by attracting new businesses and providing new residents with better homes at lower cost. Indeed, in cities such as Buffalo, economic factors such as these are attracting businesses and families. But stabilization takes many years. That a recession could temporarily have dire effects is not surprising. But for its toll to be even greater by some measures a quarter-century later is sobering.

Concerns about distressed communities are particularly salient today. The Great Recession and ongoing restructuring in manufacturing, construction, and other industries have affected some communities much more than others. There is a serious risk that new communities will face long-lasting economic hardship even as existing distressed communities continue to struggle.

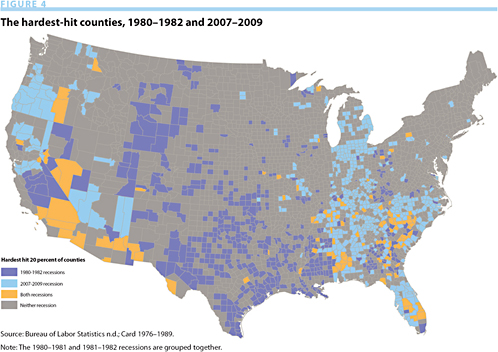

The impact of the Great Recession (see the hardest-hit counties in Figure 4) reflects the geography of declining manufacturing activity in the Midwest and Southeast and the burst housing bubble in states with the greatest run-up in home prices. Unemployment is concentrated in the industrial Midwest—Michigan, northern Ohio, Indiana, and western Pennsylvania—as well as in states that have significant manufacturing operations, such as Alabama. It is also high in states where home building had been an important source of economic growth, such as California, Nevada, Arizona, and Florida.

It is particularly troubling that the geographic pattern of unemployment tends to reflect the pattern of employment in specific industries. Unless these industries return to full capacity or new industries move in, distressed communities could face long-lasting economic hardship.

The Great Recession’s geographic impact is very different from that of the 1980s recessions. Relatively few counties appear in the bottom 20% in both periods. In the 1980s, oil-and gas-producing states such as Texas, Oklahoma, Louisiana, and Wyoming were hit hardest. The fact that these two patterns of distress differ so much is important because it tells us that the shocks that communities face vary from recession to recession and the risks that materialize are idiosyncratic and relatively unpredictable.

Why national policy is needed

Because industries are not spread evenly across the country, problems in one industry can translate into a local disaster. This is especially true in manufacturing, because individual plants frequently employ hundreds or even thousands of workers.

The need to encourage national benefits but also mitigate idiosyncratic and large localized costs suggests one rationale for federal involvement: providing insurance against unforeseen risks. A number of state-based programs, including unemployment, disability insurance, and Medicaid, insure against unforeseen risks for individuals. We believe that there are also reasons why the federal government should consider policies specifically directed at distressed communities. At their core, these rationales recognize that communities are greater than the sum of their individual parts.

Perhaps the strongest argument for federal involvement is research showing that economic adjustment takes longer and is harsher than previously recognized. In many distressed communities, the post-recession rate of economic growth remains below that of the rest of the nation for decades. This suggests that there are substantial barriers to recovery and that overcoming them requires substantial help. There are four rationales for the federal government, in particular, to play a strong role in aiding these communities. These include its ability to:

Promote agglomeration economies. Studies show that people and companies are more productive when they cluster, especially when they work in the same industry. Improvements in manufacturing processes and other efficiencies tend to diffuse to neighbors: When one company does better, in other words, others also improve. The private market does not capture these spillover benefits, however, and so businesses do not take into account these potential gains when deciding where to locate. They need encouragement to gather together—encouragement that government can provide.

In the case of distressed communities, an economic shock that directly affects certain businesses may result in unforeseen costs to nearby businesses. Targeted programs to attract new businesses could help offset these costs. The rationale for intervention in this case is not to help a specific company but to generate spillovers that benefit many local businesses. Policies should thus distinguish between cases where location subsidies generate broader growth and renewal effects and cases where subsidies benefit the recipient only.

Avoid tipping points. Research suggests that persistently elevated unemployment can have a devastating impact on crime, teenage pregnancy, mental health, and other social problems. In The Truly Disadvantaged (1990) and When Work Disappears (1996), William Julius Wilson argued that many social problems are fundamentally the result of jobs disappearing. He and others argue that concentrated areas of economic distress and joblessness result in a breakdown of other social structures.

In one version of this theory, when unemployment reaches a certain level or tipping point, negative consequences become much more severe. For example, an increase in the unemployment rate from 14 to 15% might be much more detrimental for a community than an unemployment increase from 4 to 5%. This differential suggests that there may be gains from reducing unemployment in particular areas, even at the expense of employment elsewhere. To be sure, empirical evidence is mixed on the existence and significance of tipping points.

Facilitate skill acquisition. There is promising evidence that education and training pay off in higher future earnings. But unemployed workers, younger workers, and workers in distressed neighborhoods may not be able to afford the upfront cost of such an investment. The private market is less willing to make loans for training and education than for cars or homes, in part because workers cannot use future earnings as collateral. This provides a major rationale for the federal student loan program.

In distressed communities, workers displaced from long-held jobs often have skills that are best suited to industries or occupations in decline. This is why they tend to earn less even if they manage to find new jobs. Evidence suggests that some of these workers would benefit from retraining, but that many tend to underinvest in additional schooling. Besides facing barriers to educational loans, they often lack good information about the returns from undertaking training programs. Government investments in the right kind of training for certain displaced workers could yield benefits greater than the costs of that training.

Minimize adjustment costs. Adjusting to economic distress often involves incurring costs. History suggests that the movement of families to new places is a primary way for communities to adjust to economic shocks. But moving is costly and potentially wasteful. The costs of moving go beyond the costs of selling a home and shipping furniture. Families often develop strong bonds in their communities. When a family moves, children have to be uprooted from their schools, and friends, social routines, memories, and local knowledge are left behind. It takes time and effort, moreover, to learn about a new community and become integrated members of it. There are few ways to avoid or mitigate these costs and no insurance policy against them. In other words, people can’t protect themselves against the risk that a local employer will fail or that a vibrant industry may become obsolete.

A similar argument can be made about infrastructure. It is impossible to ship roads and bridges to follow movements in population. When a city or community declines, it leaves behind a base of infrastructure meant to serve a larger population. The reverse is also true: Immigration and population growth may lead to congestion and require new infrastructure investment.

Even when there are significant benefits to moving, there may be barriers that prevent people from relocating to a community with better job prospects. In this case, moving is an investment in future earnings, just like an investment in education. And just like unsecured educational loans, loans to facilitate moving are difficult or impossible to get, leaving workers unemployed or underemployed when they could do better elsewhere.

Approaches to helping distressed communities

Addressing the economic and social costs associated with persistent localized economic distress requires a different set of policy tools from the ones the country has been using. Most existing policy and most social insurance spending are directed to people, not to places. This includes policies such as unemployment insurance, health insurance for children of unemployed or underemployed adults, food stamps, and other forms of assistance. These programs are, moreover, intended to be temporary solutions for short-term problems. Unemployment insurance in normal times lasts only 26 weeks, and other programs include time limits. In addition, most are conditioned largely on unemployment rather than on underemployment. They protect against poverty caused by job loss, but not against lower wages. In short, these policies do not directly address the causes and costs of long-term economic distress for workers, their families, and their communities.

There are alternative approaches that could promote economic recovery and shorten the depth and duration of economic distress by directly targeting residents, workers, businesses, and infrastructure in distressed communities. In the current fiscal and economic environment, it is even more important than usual that the benefits of these programs exceed costs. Furthermore, these programs should be targeted at communities that meet objective criteria for persistent distress, such as high rates of unemployment or low rates of income growth over several years.

We recommend a three-pronged approach to aiding distressed areas that is motivated by the fundamental mismatch between the skills of local workers and the demand for their work from local businesses and industries. This approach involves:

Attracting new businesses that can provide jobs, raise wages, and provide local services. Distressed communities usually present a poor environment for business investment. Plant closings and mass layoffs result in increased poverty as well as lower consumption. Detroit provides a particularly poignant example. There is no longer a single national grocery chain with an outlet in that city. In addition, shrinking tax bases can lead to cuts in key services—smaller police forces, lower-quality schools, and poorly maintained physical infrastructure—and even basic services such as waste disposal and snow removal. Having fewer municipal services effectively raises the costs of doing business. Finally, of course, residents may not have the skills new companies are seeking.

Communities have tried many approaches to attract businesses, with mixed success. A typical approach has been to provide subsidies or tax breaks for new businesses. Policies based on this strategy have been tried for decades, but evidence of their effectiveness is weak. Tax cuts reduce overall business costs, but they may not compensate for the cost of establishing a new business. Businesses may also be wary of investing their own resources in programs such as job training that may not benefit them exclusively. They certainly cannot be expected to improve public infrastructure.

Attracting businesses to revitalize distressed communities requires a holistic approach that targets all of the major problems these communities face. Tax cuts may be especially effective when combined with expansions in public services and infrastructure investment. On-the-job training can help make labor costs in distressed communities more competitive. Other options include supporting programs that provide direct consulting assistance to employers.

Timothy J. Bartik, a senior economist at the W. E. Upjohn Institute for Employment Research, has proposed one version of this approach. In his paper “Bringing Jobs to People,” written for The Hamilton Project, Bartik argued for a return to the original Empowerment Zones created in the 1990s, which combined tax cuts for businesses with grants to state and local governments for public services. Additional grants would help businesses invest in training that is tailored to meet their specific needs. Bartik also argued for expanding the Manufacturing Extension Program, which offers subsidized consulting services to small- and medium-sized manufacturers and helps them to improve their productivity and profitability. Recognizing that the body of evidence on the efficacy of place-based policies is mixed, Bartik’s proposal included methods to evaluate programs as they are scaled up, so that policymakers can determine which ones are the most successful.

Aiding displaced workers. As we have said, for people whose jobs disappear, a period of unemployment tends to be less costly than potentially permanent earnings losses on reemployment. These long-term losses can exceed $100,000 over a lifetime and are not addressed by any programs.

One option to consider is wage insurance, which would pay an unemployment insurance–like benefit to workers even after they find new jobs if their new wages are much lower (say, 30% lower) than their previous wages. Wage insurance might fill 25% of the earnings gap.

Another alternative is to help displaced workers improve their job skills. Evidence suggests that job training through community colleges can boost displaced workers’ earnings and help restore their incomes. A study in Washington State showed that the equivalent of a year of community college increased displaced workers’ earnings by 9% for men and 13% for women—a sizable return. Even taking just a few courses increased earnings substantially.

The benefits of retraining, however, vary widely. They depend, in particular, on the types of students who retrain and the kind of courses they take. Quantitative subjects, science classes, and health care courses boosted earnings by 14% for males and 29% for females, gains that come close to offsetting the losses from displacement. Success was greatest for younger workers and those with a good academic record.

There are potential gains from retraining programs that include several high-return courses and from supporting institutions that provide these courses. It is especially important to support retraining during economic downturns, when cuts in government budgets often mean cuts in education.

In “Retraining Displaced Workers,” a working paper written for The Hamilton Project, Robert LaLonde of the University of Chicago and Daniel Sullivan of the Federal Reserve Bank of Chicago proposed increasing federal funding for retraining by extending Pell Grant eligibility to training-ready displaced workers even after they are reemployed. They also argued that there should be a federal mechanism for distributing aid for education and retraining during recessions in order to counteract the tendency of state and local governments to cut education budgets. To encourage training in fields with higher returns, LaLonde and Sullivan suggested that extra support should be provided for courses in technical fields and health care, which are often more costly for community colleges to offer. Both investments in community colleges and subsidies for retraining should be accompanied by financial aid policies that encourage students to complete their training. New policies should also evaluate the returns from different programs, establish standardized curricula, and disseminate information to help students make informed choices.

Matching workers to new jobs. The country needs to improve how it matches workers with jobs they are suited for. Losing a job is a harrowing experience for workers and their families. Some are able to adjust without government aid. These workers are generally well-educated and have substantial savings. Other displaced workers lack these advantages. Faster and better job matching would have national economic benefits, reducing the waste of resources from prolonged unemployment and underemployment.

One approach would be to augment one-stop career centers. In a 2009 Hamilton Project paper, “Strengthening One-Stop Career Centers: Helping More Unemployed Workers Find Jobs and Build Skills,” Louis S. Jacobson, a senior fellow at the Hudson Institute and visiting professor at Georgetown University, noted that improving the job search assistance and counseling services that one-stops offer—in particular, steering workers toward high-return training—could help workers improve their skills and match up with better jobs.

Another approach is to help workers relocate to communities with greater job opportunities. Moving can be a good way to find work but involves costs that are sometimes difficult to bear, especially during hard times. The slowdown in mobility that typically occurs during recessions has been even more pronounced during the Great Recession. Residential mobility rates in the United States are currently at a historic low as compared with past recessions. In fact, they have reached their lowest levels since World War II.

To give job seekers the resources to move for work, Jens Ludwig of the University of Chicago and Steven Raphael of the University of California at Berkeley called for creating a loan program to finance employment-related moves. As discussed in their Hamilton Project paper, “The Mobility Bank,” monthly loan repayments would depend on reemployment earnings. The mobility bank would be accompanied by increased use of national job banks that help people search more broadly for jobs. If workers have better job opportunities elsewhere, and a mobility bank to loan them the money to move, they would be more likely to leave distressed communities. This could improve their long-term earnings while also speeding recovery in distressed areas by reducing the glut of jobless individuals.

Improving policy by learning what works

Local development strategies in the past have included many kinds of programs, but policymakers lack good evidence for which programs work. Sometimes outcomes are not tracked at all. In other cases, there is no rigorous attempt to separate program effects from other economic and policy trends. Programs often are not designed with evaluation in mind, even when slight modifications would make them easier to study. The lack of evidence about efficacy undermines support for even those programs that may be working and creates a perception that local development projects are not cost-effective investments.

Every new policy to speed up recovery in hard-hit communities should be accompanied by constant and rigorous evaluation so that the most promising approaches can be scaled up. This means a financial commitment and the political will to distinguish between good programs and bad ones using the most credible empirical methods feasible. With knowledge of what works, the nation will be able to help future distressed communities avoid or shorten the decades-long period of adjustment that previously distressed communities have endured.