Asian Successes vs. Middle Eastern Failures: The Role of Technology Transfer in Economic Development

The differences between the two regions in their openness to trade, investment, and new ideas could not be more striking, nor could the economic consequences be more stark.

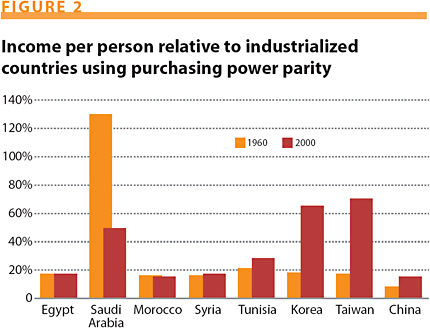

In 1960, Korea, Taiwan, Syria, Tunisia, Morocco, Jordan, and Egypt were in roughly the same economic position. Average per capita income was about $1,500 in 1995 U.S. dollars, and none of these countries had significant manufacturing capacity or exports. China and India were much poorer than any of these countries. Today, the discrepancies between the Middle Eastern and more advanced Asian nations are quite striking, and identifying the source of these differences is critical to understanding the dynamics of economic development.

Korea is the home to Samsung, LG, Hyundai, and other notable technology-driven firms. Phillips, the major European consumer electronics firm, could enter the flat panel TV market only through a joint venture with LG. Taiwan is the base for Acer, which recently acquired Gateway, a major U.S. computer company. Four decades ago, Samsung, LG, and Hyundai were small firms. Acer, Logitech, and other large Taiwanese high-tech firms did not exist. Newer industrializing nations such as China and India are also improving their technological base. China is home to Lenovo, the largest laptop manufacturer in Asia, which now owns IBM’s former laptop division, and India possesses a thriving software industry. Egypt, the most industrially developed Arab economy, exports largely simple textiles and clothing.

Scholarly understanding of the mechanisms of economic development has shifted over time. One of the earliest influential hypotheses in analyzing economic development was by Alexander Gerschenkron, who asserted the “advantages of relative backwardness,” the ability of poor nations to benefit from accessing existing, more productive technology from the rich nations. Rather than having to develop them de nouveau through the R&D process, with all of the huge expenses and false roads inevitably encountered, borrowing was much less expensive and risky. Other scholars emphasized the need for absorptive capacity: the existence of a minimum level of domestic institutional and industrial capacity to enable late starters to take advantage of the potential for catching up. This local capability depended on public and private competence: infrastructure, education, the financial system, and the quality of government institutions. Simon Kuznets, a Nobel Laureate, argued that the rapid economic growth in developed nations had stemmed from the systematic application of science and technology to the production process.

The role of technology transfer reentered the mainstream of discussion about the engines of growth in developed nations as a central point of endogenous growth theory set forth in the 1980s. But this welcome improvement largely emphasizes science and innovation on the frontier of knowledge rather than the transfer of existing technology to poorer regions. I will focus on the role of technology transfer in the economic growth of countries, contrasting some of the economies of the Middle East with those of successful Asian nations such as Korea and Taiwan. The divergence in experience between the Asian nations and Egypt, Jordan, or Tunisia as exemplars of non-oil rich Middle Eastern countries can be explained by many factors, including differences in the quality of leadership and economic policy. But a crucial distinction in these cases was the willingness and ability to tap external knowledge to exploit the technology gap.

Since the publication of the World Bank’s East Asian Miracle in 1993, there has been a general consensus about the proximate sources of rapid growth in the Asian economies. These include: high rates of investment in physical capital such as roads, buildings, and machinery; growing levels of education; a stable macroeconomic policy that controlled inflation; and an emphasis on exports that motivated firms to compete in global markets, thus generating a demand for international technology transfer. The policies generating this performance included maintaining stable foreign exchange rates set to provide some mild incentives to export. Underlying these policies was a general consensus that economic growth was a primary goal of government. A competent bureaucracy, insulated from populist pressures, implemented the growth-oriented policies of the political leaders. This insulation reflected the authoritarian nature of the governments, but it is important to note that although not democratic and occasionally harsh, the governments were not the brutal dictatorial regimes that characterized much of the developing world in the 1960s through the 1980s.

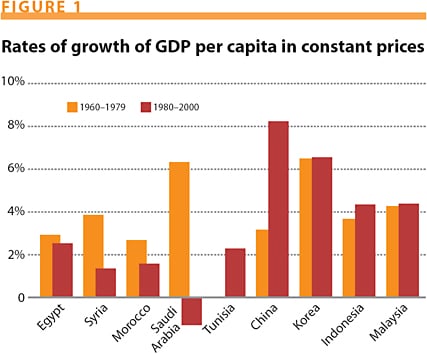

The Arab economies generally had limited economic growth and exhibited behavior considerably different from that of their Asian counterparts: less investment; an orientation to the domestic economy rather than openness to foreign trade and international technology transfer; and less effort to build a high-quality education system. A full discussion of the Middle Eastern nations is provided in a recent book that I coauthored with Marcus Noland. Although the Middle Eastern countries began where the Asian countries began in 1960 and possessed many favorable characteristics such as proximity to European markets, their economic growth trailed far behind that of their Asian counterparts from 1960 to 2000 (Figure 1). On the other hand, they were hardly the hopeless cases often depicted in western media. Egypt, Morocco, and Tunisia experienced per capita income growth of 2% for a good part of the period. Oil-rich nations such as Kuwait and Saudi Arabia enjoyed a rapid ascension in the 1970s, when oil prices rose rapidly, followed by a precipitous decline beginning in the mid-1980s, when oil prices fell. The fortunes of the two groups of economies, the oil-rich and the oil-poor, are closely linked by large remittances from workers who emigrate from the latter to the former. And in the current oil boom, the oil-rich Arab countries are investing heavily in their poorer neighbors, in part because of a reluctance to invest in western economies since 9/11. Yet even in the past four years of a new oil price boom, most of the Arab nations lag their lower-middle-income peers in the rest of the developing world.

In 2000, per capita income in the oil-poor countries of the Middle East such as Egypt, Morocco, and Syria was less than 20% of the income in the industrialized countries, about what it was in 1960. But in Korea and Taiwan, per capita income had risen to more than 60% of the levels in the industrialized world (Figure 2). Part of the difference in income growth is explained by better productivity growth in Asia. In turn, this differential is partly attributable to Asia’s greater inflow of international knowledge and the ability to effectively absorb it. Although many factors contributed to productivity growth in the Asian countries, I will focus on measures of technology inflow and the quality of education, where the contrast with the Middle East is particularly pronounced.

Technology transfer

For poorer nations with low levels of domestic innovation, new technology is primarily imported. Some of the technology is embodied in the imports of physical goods such as steel with improved characteristics and new machinery that incorporates improvements in speed, quality-control mechanisms, and energy efficiency. Ideas not incorporated into material inputs, usually referred to as disembodied knowledge, are also critical. Modes by which such knowledge is transferred include foreign direct investment (FDI) by multinational corporations, technology licensing agreements that provide access to new products and processes, and the employment of consultants from the industrialized nations. Occasionally, knowledge transfers are the unpaid for and unanticipated byproducts of commercial transactions; for example, knowledge provided by Western retail purchasers of Asian exports.

Other sources of ideas include the use of nonproprietary information or reverse engineering and the advice of foreign consultants, who can suggest improvements in firm and factory organization ranging from quality control to machine settings to accounting systems that improve productivity. These latter modes, although well documented in studies of the history of individual industrial firms, do not lend themselves to easy measurement because by their nature they are not disclosed. All of these vectors of technology represent an attempt to move toward international best practice by assimilating technologies available abroad. Although in principle domestic efforts can generate improved technology, in most poor nations there is limited effort in this sphere.

Countries need not employ all of the potential vectors of new technology, but they need to utilize at least some. During the 1950s, Japan relied heavily on technology licensing while discouraging FDI. In the 1960s and 1970s, Korea also largely excluded FDI but used technology licensing, consultants, and imported equipment and intermediates as sources of technological advances. Countries such as Malaysia and Thailand pursued several paths simultaneously. The overarching orientation in the Asian countries was openness to foreign ideas, some embodied in physical inputs, others conveyed by manuals, blueprints, and know-how. More recently, technology transfers through émigrés who either return home or collaborate with former colleagues has become an important source of technology transfer, but this is obviously dependent on a prior “brain drain” of university graduates from the home country.

To identify and apply such knowledge transfers requires a highly educated domestic labor force that is critical in the identification, modification, and absorption of foreign technology. They may, in addition, generate purely local innovations through their own R&D. Technology inflows and domestic absorptive capacity are complementary, a feature noted four decades ago by Richard Nelson and Edmund Phelps. More recently there has been considerable analysis of why new technologies are complementary to skilled labor. During the industrial revolution, it was skilled artisans who most often opposed the introduction of new technologies. Now it is their modern counterparts, computer scientists, electrical engineers, or MBAs, who benefit from the skill-intensive nature of new technologies. The productivity of education in industry and advanced services is increasing because operating entirely new manufacturing processes and producing new products requires well-trained workers and managers. Although the highly educated labor force within a country may generate some purely indigenous innovations, they can be more productive if they are able to use their talents on a proven body of knowledge that is being introduced into the country for the first time. Local R&D inevitably has failures, whereas gaining a mastery of technologies that have proven their effectiveness in other countries has few dead ends.

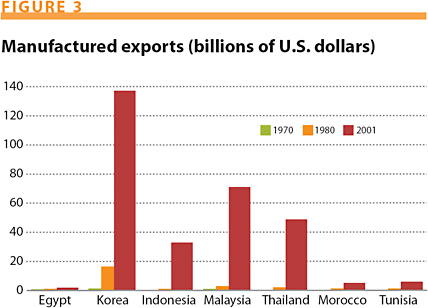

In contrast to the Asian experience, most Middle Eastern nations have been refractory to involvement in international technology transfer through any of these mechanisms. This stance reflects their more general insularity from the world economy except in energy exports. Despite the huge increase in international trade in manufacturing in the period that etched “globalization” into general consciousness, most Middle Eastern nations barely participated in this growth (Figure 3). This reflected the adoption of economic policies that discouraged imports and had the unanticipated consequence of simultaneously reducing exports. Given no need to compete in export markets, firms could ignore those potential technology transfers that facilitated gains in productivity that were so avidly exploited by the Asian nations. Not only did the Asian nations increase their manufactured exports to an extraordinary degree, they increasingly moved to production of high-technology goods (see Table 1). This has augmented the demand for imported equipment and know-how that is necessary to produce goods of the requisite quality for advanced country markets.

We thus have a simple guide to some of the key dimensions that determine the difference between the Asian and Middle Eastern countries. In the latter, investment rates were lower, education, though improving, was inferior to that in East Asia, economic policies did not encourage firms to enter international trade, and one consequence of the domestic orientation of the economies was the neglect of the knowledge of technology that was available from other countries.

TABLE 1

High technology exports (billions of U.S. dollars)

| 1990 | 1995 | 1998 | 2001 | 2004 | |

|---|---|---|---|---|---|

| Egypt | — | 6 | 2 | 12 | 15 |

|

|

|||||

| Korea, Rep. | 10.8 | 29.6 | 30.6 | 40.0 | 75.7 |

|

|

|||||

| Indonesia | .1 | 1.7 | 2.2 | 4.4 | 5.8 |

|

|

|||||

| Malaysia | 6.0 | 25.4 | 31.6 | 40.9 | 52.9 |

|

|

|||||

| Thailand | 3.0 | 10.1 | 13.5 | 15.2 | — |

|

|

|||||

| Tunisia | .05 | .07 | .1 | .2 | .4 |

|

|

|||||

| Morocco | — | .01 | .4 | .4 | .7 |

Source: World Bank, World Development Indicators, 2006

A closer look

Although not all information on technology transfer is easily available, numerous indicators provide evidence of the paucity of technology transfer activities by the Middle Eastern countries in contrast with the variety of actions taken by high-performing Asian countries. Current measures of the disparities in technology transfers and education levels for the two regions reveal occasionally startling differences. Some of the disparities are a result of earlier growth in income, and causality is not easy to demonstrate statistically. It is not always possible to extend these indicators backward in time to ascertain their evolution. Where it is possible, it is clear that the Asian nations were initially at low levels in many of the relevant dimensions of technology transfer but achieved dramatic growth, and this growth was the handmaiden if not the ultimate source of growing productivity.

On any one or two measures, some of the Middle East and North African (MENA) countries will look almost as good as their Asian counterparts. But as will be seen in the comprehensive picture, the overwhelming pattern is one of an absence of international technology transfer in the Middle East. Moreover, the international interaction of the Asian countries has been a consistent feature for three or four decades, whereas the slight recent improvement in MENA has still left the countries behind where the Asians were in the 1970s.Clearly, current indices of technology transfer do not permit insights into ultimate causality because the technology inflows reflect many factors. For example, much of the demand for productivity-improving technology in Asian countries stemmed from the need to compete in international markets, which was driven by successful export-oriented policies whose results are reflected in Figure 3. This required local firms to improve their efficiency by staying abreast of international best practice by using consultants, licenses, and improved equipment. Exporting generates a demand for technology. But the growing success in export markets could not have occurred without the increasing application of western knowledge. There was a virtuous circle as new technology facilitated further export growth, which in turn provided still further incentives, and the foreign exchange, to seek more foreign technology.

Most of the data provided reflects current international inflows of technology because there are very limited historical data. A causal interpretation is supported by innumerable case studies that provide a rich history of many Asian firms, and the recent data are a contemporaneous snapshot of this process. The aggregate data are consistent with these case studies that have been done of individual Asian firms.

Greater imports of raw and intermediate goods increase the productivity of plants. For example, manufacturers of machinery can import steel that has more appropriate properties than domestically produced steel and thus allows finer tolerances during the production process. Newer imported machinery is faster and safer, allowing greater output per hour. Both intermediate goods and machinery embody large amounts of R&D undertaken by the firms in the industrialized countries, and the research evidence confirms that greater amounts of foreign purchases yield greater productivity in the purchasing nation.

The most comprehensive indicators of interactions that lead to the transfer of technology are imports of intermediate manufactured goods that enter into further processing, MI/GDP, and imports of capital equipment relative to GDP, ME/GDP. The Asian countries generally have ratios of MI/GDP that are 50% more than those in the MENA nations. And the typical Asian countries in 1990 had much higher ratios than the MENA countries exhibited a dozen years later. For the few countries for which data are available, the Asian pattern by 1970 exceeded that of the Arab nations in 2002.

A similar picture unfolds when imports of machinery relative to GDP are considered. In general, the ME/GDP levels of the MENA countries as late as 2002 are less than those in the high-performing Asian economies in 1990. Moreover, data for earlier years suggest similar ratios in the Asian countries as far back as the 1970s for Korea and Taiwan. Moreover, by 1990 several of the Asian countries had an extensive domestic machine-producing sector producing western designed equipment, and this reduced the need for imports. The absence of the technology transfers of the largest type, embodied in intermediate goods and equipment, explains part of the disparity in the success of the nations in raising productivity.

Disembodied knowledge

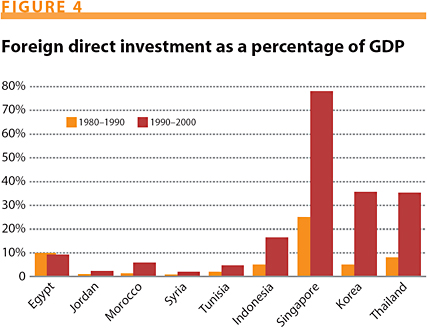

A detailed analysis or the transfer of disembodied knowledge through FDI or technology licensing reveals a similar pattern. Multinational corporations (MNCs) setting up plants in developing economies or buying existing firms and revitalizing them import new equipment, implement advanced managerial practices, and provide a marketing network. These skills are particularly valuable because they are difficult to purchase in arm’s-length transactions, although consulting firms can help. Improvements in logistics, manufacturing technology, and information technology in the past quarter century allow multinational firms to disaggregate their production process into separable activities, each of which can be undertaken in a different nation. Although estimates vary, about 70% of international trade among countries in the past decade took place as a result of the activities of multinational corporations, underlining the importance of FDI. Singapore and China have been key participants in this type of trade, but Arab nations have not availed themselves of this option nor have they intensively utilized other modes of transfer.

FDI makes it possible to complement local factors with foreign knowledge and specialized human and physical capital. Although there is no immediate productivity augmentation of local firms, their productivity will increase if foreign firms introduce new technologies or management methods that leak out to domestic companies. For example, workers initially employed by MNCs may be hired by local firms or establish their own enterprises, thus disseminating proprietary knowledge that is not possessed by local firms.

The level of FDI shown in Figure 4 shows the enormous differences. Singapore is the poster country for the role of FDI as a critical factor in catalyzing otherwise good economic policies into rapid and sustained growth, but more recently China has been a major recipient. The MENA countries have received very little FDI. During the 1990s, Thailand, which is roughly the size of Egypt, received more FDI than all of the MENA countries combined.

A considerable part of the FDI that does occur in MENA countries has been in sectors such as natural resources and tourism in which the transfer of knowledge to other firms is low relative to that in manufacturing or modern services. One cannot easily explain the low levels of manufacturing FDI in the MENA countries. It depends on how the country’s economic and investment climate are viewed by potential investors as well as the receptivity of policymakers and the local business community to FDI. In some countries, such as India, there was a conscious effort for many years to suppress FDI, which stemmed from the reigning view among influential politicians that FDI was a new form of colonialism. Many countries, including Japan, Korea, and recently China and India, abandoned earlier policies that discouraged FDI. Even though Arab intellectuals and policymakers have never advocated an anti-FDI position, FDI in critical industries has been rare in Arab countries, though it has begun to grow slowly.

Licensing proprietary technology can serve as a substitute for FDI. If foreign firms cannot export to a country because of its tariff barriers or if they believe the policy environment is too uncertain to undertake major plant investment, they may be willing to license their technology for a set fee or a percentage royalty. This allows the licensing firm to earn a profit in the local market, but it entails a greater risk of losing control of the knowledge, particularly in countries with less stringent intellectual property rights legislation and enforcement. Although technology licensing may be especially helpful as countries shift to technology-intensive sectors, even in the early stages it can be useful. Firms in Japan and later in Korea and Taiwan used technology licensing in their early industrialization efforts. Yet the MENA countries did not avail themselves of this alternative source of foreign knowledge until the 1990s, when Egypt and Morocco initiated the still tiny efforts.

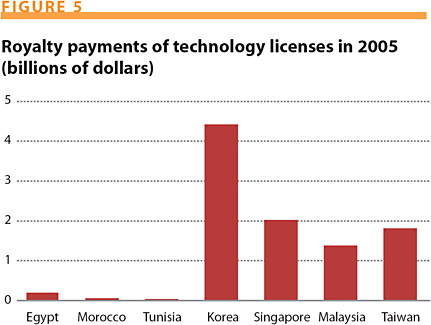

Figure 5 provides an estimate of royalty payments for a small group of countries for 2005. Compared to data on FDI, the data on royalty payments are more uncertain in scope and definition and are available only for shorter periods of time. Data for 2005 do not provide definitive evidence of the causal relation between technology transfer and growth insofar as the size of royalties for the Asian nations partly reflects their previous success and their effort to diversify into new product areas that are most easily entered via licensing. The virtual nonexistence of royalties in the Arab nations even in 2005 is evident. Moreover, even in the 1970s and 1980s, Korea and Taiwan already had a large number of technology contracts. For example, in the five-year period centered on 1980, both nations were paying around $90 million per year (roughly $300 million in 2005 prices), and these numbers were growing rapidly. This can be contrasted with Egypt’s $180 million and Morocco’s $45 million in 2005. Moreover, the current period of increasingly competitive international markets requires greater technological sophistication than in 1980. This difference explains part of the slower growth of productivity in the experiences of the two regions and is simultaneously an indicator of the very limited shift to new industrial sectors.

Finally, case studies suggest that the cultivation of manufacturing outsourcing relationships between local firms and multinationals, with or without a local presence in the market, can also serve as a channel of knowledge flows. Research in Korea and Taiwan indicates one mechanism through which productivity growth in manufacturing was enhanced. In both countries, detailed interviews with firms find that considerable knowledge of production engineering and of new production processes came from foreign companies that purchased goods from Korea and Taiwan. Sears Roebuck & Co., K Mart, and J.C. Penney supplied knowledge of production engineering and quality control prevailing in the United States to their suppliers in Asia. They often specified the equipment to be acquired, set out the production process for new products, and provided detailed help on management practices such as quality control. These customers were not altruistic; the improvement in the quality and cost of their suppliers had a positive impact on their profitability. Knowledge about changing product demand or about new products conveyed by importers enabled Asian companies to shift more quickly from products with declining prices to new products still in the early part of the growth cycle. This type of informal knowledge transfer will occur only when a firm is actively exporting, and very few Arab firms had taken this critical first step.

The human dimension

In recent years there has been considerable attention to the key role of returning nationals in the development of the Indian software sector. Expatriates have also been critical in the development of high technology in Korea and Taiwan. A key ingredient in this process is the presence of strong educational institutions in the home country. In order for young people to be able to go elsewhere for graduate training or work, they must first acquire a good education at home. The Arab countries have few good engineering institutions and therefore send relatively few young people to work in high-technology companies or to study science and engineering in other countries. Although there has been considerable emigration, particularly to Western Europe, few of these emigrants are employed in high-technology sectors in the West. Far fewer Arab than Asian graduate students were studying at U.S. universities in 2000—and that was before 9/11. Thailand and Egypt, with roughly similar populations, had 7,000 and 1,400 students, respectively. There simply have not been enough Arab engineers to create a significant emigration-education-repatriation cycle that could result in technology transfer.

If technology is changing slowly, the payoff to even elementary school education will be low. For example, a Korean cotton spinner in 1960 who was an elementary school graduate but tended spindles not much different in design from those of 1900 would not have benefited much from her education. In contrast, her education would have led to an increase in productivity relative to a less-educated spinner if she had to adjust to the complexities of newly developed open-end spinning. Flexibility and problem-solving abilities conferred by more education yield a reward when technology is changing, but education may have little payoff in the absence of technological change. Thus, the Asian nations derived a huge benefit from the complementarity between their improving education system and their large technology imports. Technological inflows depend on the ability to identify relevant foreign technologies, decide how best to access and negotiate for them, and finally how to incorporate technologies new to the firm or the nation within the productive routines of local firms. A well-educated populace is a valuable asset for a nation dealing with rapid change.

With respect to higher education, there are no systematic time series on tertiary enrollment and the percentage of those students who are enrolled in science and engineering programs. But data that are available for 1995 indicate the large difference in achievement between Korea, typical of the fast-growing Asian nations, and a number of Arab countries. More than 20% of university-age students in Korea were receiving tertiary education in science and mathematics compared to fewer than 5% in most of the Arab countries. Although some of the technical education observed in 1995 was obviously a response to the huge growth in per capita income and the technological sophistication of the societies, even in the 1980s, Korea, Taiwan, and Singapore had large percentages of students pursuing a technical education. Moreover, such measured differences understate the true differential because many of the Asian universities such as Seoul National, National Taiwan, and National University of Singapore are internationally recognized for their quality, whereas no Arab university is ranked among the 500 top research universities in the world.

It could be argued that young people in the Arab countries were nevertheless acquiring many relevant skills through more basic education and that these were relevant to utilizing the small amount of foreign technology that was entering the countries. After all, average educational attainment in the Asian nations was far below Western standards in the 1960s when these countries started making rapid economic progress. Today, young people in the Arab countries receive more education than their Asian counterparts did in the 1960s. But the quality of the education available in Arab countries still leaves much to be desired. In international comparisons of eighth grade student achievement in science and mathematics, students from Hong Kong, Korea, Singapore, and Taiwan are among the world leaders, whereas Egyptian, Jordanian, and Tunisian students score well below the global mean. It appears that Arab countries are still not giving their young people the cognitive skills necessary to succeed in a modern industrial labor force.

Domestic knowledge generation can partly substitute for foreign technology. Two reliable indicators of domestic innovation activity are R&D expenditures and patenting activity, but once again the Middle East trails way behind Asia. Arab nations’ R&D spending as a percentage of gross domestic product is very low; in fact, they are spending less on R&D than Taiwan did a quarter century ago. It should therefore be no surprise that they receive few patents. Egyptians were granted fewer than six U.S. patents per year on average between 2001 and 2005, whereas Malaysians received 74 per year and Koreans and Taiwanese each earned thousands. And as early as 1981, Taiwanese residents applied to Taiwanese authorities for 5,800 patents, far more than the 264 applications in 2005 by Egyptian residents to Egyptian authorities. Whatever the imprecision in these indicators, there is no way to avoid the conclusion that no significant domestic innovative activity of a formal type is taking place in the MENA countries. It is possible, of course, that some efforts toward enhancing productivity are occurring but do not get reported in formal statistics. However, there are no case studies, as there were of early efforts in the Asian countries, to suggest that this global statistical picture is not valid.

The role of openness

The data support the view that the Asian nations prospered not solely because of higher investment in physical and human capital but also as result of their export orientation. This resulted in a great demand for technology transfer on the part of firms, and this was not discouraged by any perceived threat to political, social, or religious interests.

But are there deeper explanations that go beyond economics for the different intensity of technology transfer between the two regions and the industrialized economies? One interpretation would be that the tradition of openness in Asia has a long historical precedent. For example, in the late 19th century Japanese textile manufacturers sent their own engineers to work with British equipment manufacturers to gain knowledge that would help them to design machinery that took account of the local conditions in Japan. Lee Kuan Yew, Singapore’s prime minister from 1959 to 1990, encouraged a favorable attitude to FDI in the 1960s and 1970s when many other poor nations viewed FDI as an extension of the colonial past. Taiwan depended heavily on advice from U.S.-based expatriate Chinese economists in the 1960s and 1970s. In contrast, several recent Arab Human Development Reports have documented how the Middle East has been insulated from international ideas. One telling measure is the tiny number of books in other languages that have been translated into Arabic.

But clearly the Middle East is hampered not simply by an aversion to or hesitance about foreign ideas but also by economic policies that have led to growth that emphasizes shielded domestic markets to the detriment of exports. Protected from foreign competition, Arab firms can neglect the advances in machinery, imported material inputs, and licensed technology that are available from abroad. In turn, the emphasis on domestic markets may reflect fears on the part of governments that more adventurous efforts would expose local firms to great competitive pressure that could engender an increase in unemployment that would provide a fertile ground for the growth of religious extremism. And FDI in the Arab world is undoubtedly discouraged by the threat of terrorism in a number of the countries as well as the perceived high probability of violent political change.

Nevertheless, recent changes in some of the oil-rich kingdoms such as Dubai and Qatar provide tentative grounds for hope. New western-led universities, hospitals, and globalized firms are following the path of successful Asian countries. Whether such innovations can be diffused to the larger resource-poor nations from Syria to Morocco remains to be seen. But unless the latter change their economic policies and political climate to become more open to foreign technology, their growth prospects are not good. And that is hardly good news for the rest of the world.