The U.S. Energy Subsidy Scorecard

In his State of the Union address on January 31, 2006, President Bush called for more research on alternative energy technologies to help wean the country from its oil dependence. The proposal was not surprising: After all, R&D investment has long been a staple of government efforts to deal with national challenges.

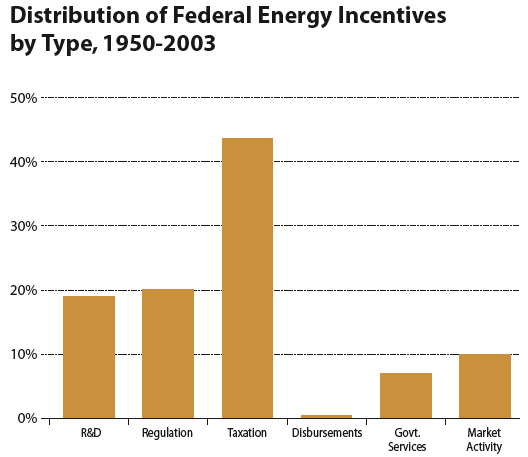

Yet despite its prominent role in the national debate, R&D has constituted a relatively small share of overall government investment in the energy sector since 1950. According to our analysis, the federal government invested $644 billion (in 2003 dollars) in efforts to promote and support energy development between 1950 and 2003. Of this, only $60.6 billion or 18.7% went for R&D. It was dwarfed by tax incentives (43.7%).

Indeed, our analysis makes clear that there are diverse ways in which the federal government has supported (and can support) energy development. In addition to R&D and tax policy, it has used regulatory policy (exemption from regulations and payment by the federal government of the costs of regulating the technology), disbursements (direct financial subsidies such as grants), government services (federal assistance provided without direct charge), and market activity (direct federal involvement in the marketplace).

We found that R&D funds were of primary importance to nuclear, solar, and geothermal energy. Tax incentives comprised 87% of subsidies for natural gas. Federal market activities made up 75% of the subsidies for hydroelectric power. Tax incentives and R&D support each provided about one-third of the subsidies for coal.

As for future policy, there appears to be an emerging consensus that expanded support for renewable energy technologies is warranted. We found that although the government is often criticized for its failure to support renewable energy, federal investment has actually been rather generous, especially in light of the small contribution that renewable sources have made to overall energy production. As the country maps out its energy plan, we recommend that federal officials pay particular attention to renewable energy investments that will lead to market success and a larger share of total supply.

The power of tax incentives

Policies that allowed energy companies to forego paying taxes dwarfed all other kinds of federal incentives for energy development. Tax policy accounted for $281.3 billion of total federal investments between 1950 and 2003, with the oil industry receiving $155.4 billion and the natural gas industry $75.6 billion.

Source: Management Information Services, Inc.

The dominance of oil

The conventional wisdom that the oil industry has been the major beneficiary of federal financial largess is correct. Oil accounted for nearly half ($302 billion) of all federal support between 1950 and 2003.

Source: Management Information Services, Inc.

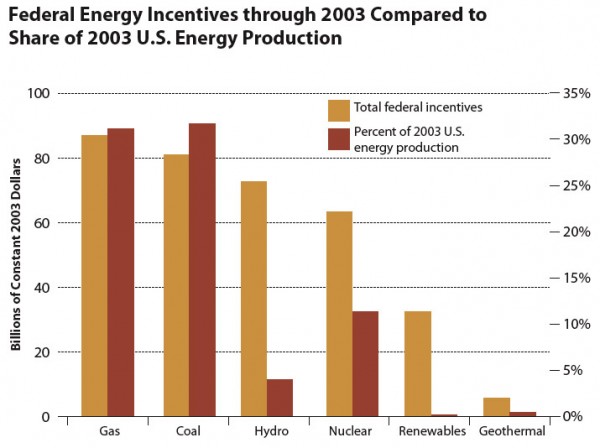

Renewable energy not neglected

The perception that the renewable industry has been historically shortchanged is open to debate. Since 1950, renewable energy (solar, hydropower, and geothermal) has received the second largest subsidy—$111 billion (17%), compared to $63 billion for nuclear power, $81 billion for coal, and $87 billion for natural gas.

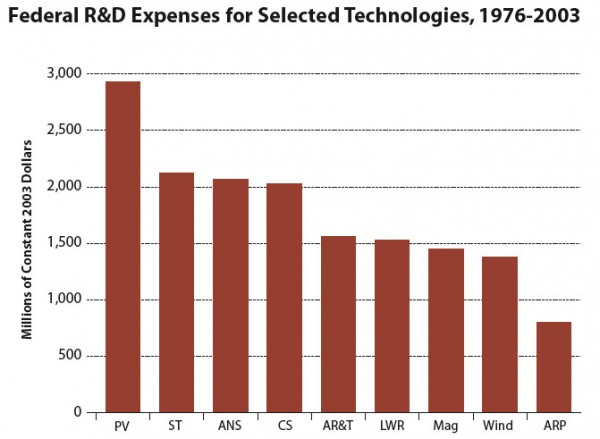

LEGEND: PV: Photovoltaic (renewable); ST: Solar Thermal (renewable); ANS: Advanced Nuclear Systems; CS: Combustion Systems (coal); AR&T: Advanced Research and Technology (coal);LWR: Light Water Reactor ☢; Mag: Magnetohydrodynamics (coal); Wind: Wind Energy Systems (renewable); ARP: Advanced Radioisotope Power Systems ☢.

Source: Management Information Services, Inc.

Cost/benefit mismatch

Considerable disparity exists between the level of incentives received by different energy sources and their current contribution to the U.S. energy mix. Although oil has received roughly its proportionate share of energy subsidies, nuclear energy, natural gas, and coal may have been undersubsidized, and renewable energy, especially solar, may have received a disproportionately large share of federal energy incentives.

Source: Management Information Services, Inc.

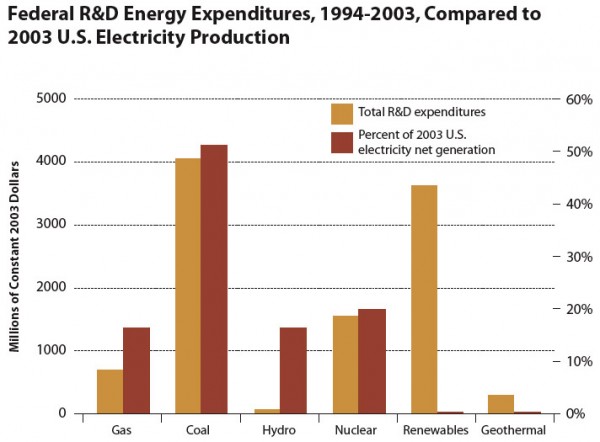

Skewed R&D expenditures

Recent federal R&D expenditures bear little relevance to the contributions of various energy sources to the total energy mix. For example, renewable sources excluding hydro produce little energy or electricity but received $3.7 billion in R&D funds between 1994 and 2003, whereas coal, which provides about one-third of U.S. energy requirements and generates more than half of the nation’s electricity, received just slightly more in R&D money ($3.9 billion). Nuclear energy, which provided 10% of the nation’s energy and 20% of its electricity, was also underfunded, receiving $1.6 billion in R&D funds.

Source: Management Information Services, Inc.