Reshaping Space Policies to Meet Global Trends

With more countries and private companies expanding their activities in space, the US government must reshape its space agencies and policies. Cooperation and catalysis will be key.

The space sector is undergoing a major transformation. Fifty years ago, the United States and the Soviet Union conducted the only significant national space programs, and only a small number of commercial entities were involved in space activities. Since then, the space sector has grown to include more countries, and it has diversified to integrate technologies and innovations from other sectors. Private funding for space-based ventures has increased dramatically over the past decade, and there has been a rapid growth of a private space sector, which now includes familiar companies such as SpaceX and Blue Origin, as well as less familiar but equally innovative ones, such as Planet Labs, Mapbox, and Spire, among others. As a result, major parts of the space sector are changing, from being largely driven by government and several large commercial enterprises to being more segmented—and therefore more open to participants—and globally integrated. These changes are electrifying for many people, raising new hope that the vision of incorporating the solar system into the economic sphere may finally be feasible. But the changes are wrenching for the old guard that created and nurtured the first government-led wave of the space enterprise.

What do these trends mean for the US government agencies and departments that spend in excess of $43 billion annually on space-based activities? At the request of the National Aeronautics and Space Administration (NASA) and the Office of the Director for National Intelligence, my colleagues and I at the Science and Technology Policy Institute analyzed this question, and our report, Global Trends in Space, explores some of the implications.

A first message is that the space enterprise is not an island. Most developments afoot in the sector are driven by external factors. In the early years of the space age, technologies were developed in and for the space sector and spun out into other sectors, photovoltaics and thermionic conversion technologies being principal examples. Increasingly, though, the reverse is occurring, and technologies are spinning into the space sector from others, principally from information technology (IT), and often in the form of commercial off-the-shelf products. Falling costs and dramatic improvements in areas such as processing power, data storage, camera technology, solar array efficiency, and micro-propulsion have fed into a variety of space-related areas, including Earth observations, telecommunications, and even space science and technology and exploration.

As technological advancements outside the space sector feed into the space sector and business model innovations occur, newer and lower-cost applications of space are emerging, making investing in space more beneficial and lucrative. Smaller, lighter, and more capable satellites are able to perform Earth observation and remote sensing functions, and are within the reach of countries, corporations, and even individuals. SkyNode, a service provided by the Google subsidiary firm Terra Bella, for example, will enable customers to directly task a satellite to download imagery within 20 minutes.

These innovations aren’t occurring in just the Earth-observation sector. In the satellite communications sector, for example, use of high-throughput satellites can provide high-speed data communication that is 20 times faster than with traditional satellites, fast enough to match the data rates obtained using terrestrial fiber optic networks at comparable prices. In the launch sector, using newer technologies such as three-dimensional printing and new business models, the company SpaceX is offering lower-priced launch services that are disrupting the market originally controlled by heavyweights such as United Launch Alliance and Arianespace. Firms such as AGI are providing space “situational awareness” (SSA) services that are improving our ability to view, understand, and predict the physical location of objects in space, with the goal of avoiding collisions such as the one that occurred between two communication satellites in 2009. Such services previously were firmly in the domain of governments, especially defense-related agencies. The trend toward smaller satellites is even enabling space science and technology and exploration, with CubeSats developed by private firms being used to conduct heliophysics, planetary science, and astrophysics research, with even more activities planned.

Low-cost or new technology is core to these developments. For example, a single OneWeb satellite weighs 330 pounds, compared with older telecommunications satellites, such as those used by Dish Network and HughesNet, that weighed more than 13,000 pounds. The new applications also have lower price tags. According to Surrey Satellites, a global leader in satellite manufacturing, the cost of launching, insuring, and operating a satellite that provides images with 1-meter resolution is now around $160 million, almost an order of magnitude lower than what used to be.

A final driver of emerging developments in space is government funding and policies. Government agencies in the United States and around the world are under pressure to re-examine policies restricting the commercial development and sale of space goods and services, as illustrated by the debate in the US Congress on the use of commercial rockets or space-based imagery. There is also pressure on agencies to begin to view and regulate space as a mainstream economic endeavor, and not see it solely as a strategic national security-relevant sector. This shift in emphasis is especially evident in the United States and Europe, where commercial solutions are increasingly being used to meet government needs, technology export controls are being liberalized, and regulations are being relaxed to allow the private sector to provide services such as high-resolution imagery and SSA that were previously restricted to the government.

Signposts of change

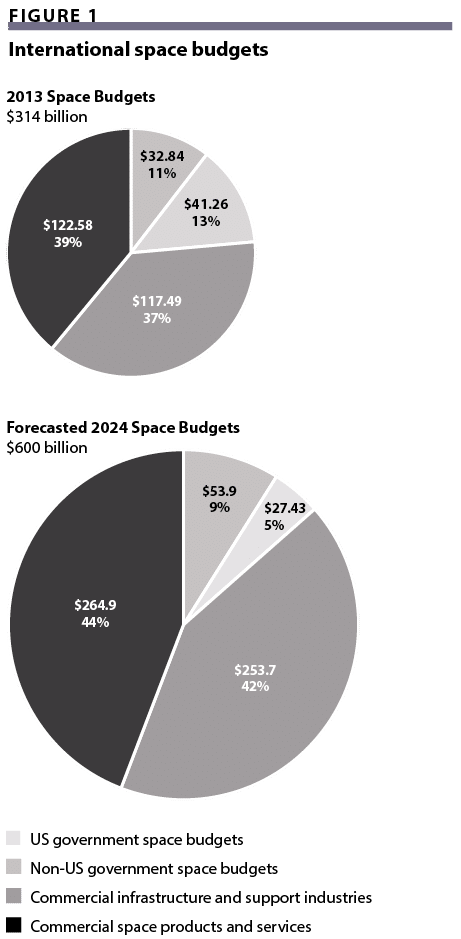

That space is changing is evident in many measurable ways. Although there have been government cutbacks in the United States, globally there has been an increase in funding of space activity. Global investment in space-based activities increased at an annual rate of 6% between 2009 and 2013. In the broadest picture, almost 170 countries have some level of financial interest in satellites, up from 20 in the 1970s. And of the more than 80 countries engaged in space-based activities in 2015 (that number has grown from two in the 1950s and 20 in the 1970s), 60 have invested $10 million or more in space-related applications and technologies, twice as many as in 2004. The increase has been especially noteworthy in countries such as Saudi Arabia (60% increase since 2009) and Brazil (40% increase). Overall, global activity in space is expected to almost double in the next 10 years (Figure 1).

It is not just the major space-faring nations that have ambitious plans. Countries such as India have entered the fray, and they are showing growing expertise in space exploration as well as technology development. Others, such as Israel, Singapore, South Korea, and the United Kingdom, have begun to specialize in niche areas, such as avionics, alternative approaches to launch, and data analytics, among others. South Korea has aggressively pursued satellite manufacturing despite beginning its government space program only in the late 1980s. The United Arab Emirates has plans to build a Mars probe and the first space research center in the Middle East, all the more impressive since the nation began its space activities only in the 1990s. Leveraging commercial products and services, including those from the United States, these and other countries stand poised to become major space players, and within several years they may well rival more established countries, particularly given the enduring perception that a presence in space brings prestige, geopolitical advantages, and economic opportunities.

The private sector is not much behind governments. It is important to note that the presence of private companies in space is not a new phenomenon. Companies such as North American Aviation and McDonnell Aircraft Corporation were heavily involved in Project Mercury in the 1950s and Apollo in the 1960s. But they operated under a different model where investments went into a long-term, capital-intensive, monolithic industry dominated by government contracts, legacy fixed satellite services, and big-iron hardware. Now, the investments are less capital intensive, with new investors spurred by new markets they see emerging, and the sector has attracted new companies, especially from the IT sector. In fact, if services such as Direct TV are included, private revenues exceed government expenditures by three-fold.

In total, there was almost twice as much venture investment in space in 2015 as in the previous 15 years combined. As of the last count, there are at least 124 new space-related firms that have started just since 2000. Private firms are also taking on a greater proportion of space-based activity. Between 2009 and 2013, for example, businesses contributed less than 8% of the 127 nano/microsatellites launched. In comparison, they are expected to be responsible for 56% of nano/microsatellites launched between 2014 and 2016. An interesting phenomenon in the space sector is that some of the new actors are not driven solely by a profit motive. Companies such as SpaceX, Blue Origin, and Bigelow no doubt intend to make money. However, their founders seem to be driven by a zeal—and a time-horizon—that transcends a typical venture investor. These are the “lost children of Apollo”—individuals who as children watching the space program in the 1960s thought there would be moon colonies by the time they were adults. Perhaps feeling let down by their leaders, they decided to invest their personal wealth in their dreams. It is also worth noting that most of the billionaire philanthropists investing in space are from the United States.

Another new stakeholder has also appeared in the space sector—one that did not exist when space was a strategic, government-owned sector—and that is consumers, who are showing a growing demand and the willingness to pay for ubiquitous Internet access and near real-time situational awareness. Twenty years ago, less than 3% of the world’s population had a mobile phone and less than 1% had access to the Internet. Today, more than two-thirds of the population has access to a mobile phone, and one-third of it can communicate on the Internet. These consumers are now contributors to the growing private sector. Add to this the emergence of crowdfunding and citizen-led space activities, and the number of stakeholders in the space sector is dramatically higher than a decade ago.

These diverse actors, within governments, academia, and the private sector, are following a varied set of approaches to developing their space enterprises. Governments in less-industrialized countries, as would be expected with a commoditized technology, are increasingly not investing in developing indigenous systems, but rather are using technology transfer and partnerships to build capabilities in specific areas of interest. It is no longer necessary to build a satellite in order to operate one or even just get data from one. Not only is there no need to develop indigenous technology, there is also a shift from buying technology and products to buying services.

The private sector, especially what is often called NewSpace, is increasingly engaging in novel approaches. Participants in this sector are focusing on cost innovation, following a philosophy of developing products that are good enough rather than perfect, and prioritizing low cost over performance or reliability. This approach is reflected in the increased use of streamlined and simpler processes, cheaper components (non-radiation-hardened components can be a hundred to a thousand times cheaper than the traditionally used radiation-hardened ones), open source hardware (such as microcontrollers or 3D printing) and software (Android operating system), agile manufacturing, and a production model (as distinct from the production of one-off products). The trend is most evident in the small satellite sector. The CubeSats developed by Planet Labs, an Earth observation startup, have gone through more than 12 generations of design since the firm was established in 2010. Also, the company, and others in this sector, conceptualizes risk and reliability differently than does the mainstream aerospace sector. For Planet Labs, a fifth of the CubeSats can fail in orbit without losing a meaningful amount of imaging capacity. Most interestingly of all, in a break from older space-sector firms, many of these firms see space as “just another place” where data are collected. Firms such as Spire see and pitch themselves not as aerospace firms but as IT or media companies, and investment in these firms is viewed as being in data products and services, not space. They are takeover targets not of traditional aerospace firms such as Lockheed Martin or Boeing, but of technology giants such as Google or Facebook.

Transitioning into the mainstream

A country’s capabilities in space used to be based on indigenous technology development. This dependence on indigenous capability meant that countries followed a reasonably predictable trajectory toward advancing their level of participation in the space sector. This is now changing. As already noted, a country can now own space assets simply by purchasing them from turnkey solution providers. They can also buy data and services rather than manufacturing and operating satellites, or partner with countries willing to provide assistance. For example, in 2015 the Turkmenistan Ministry of Communications contracted with the Italian/French multinational company Thales Alenia Space to build a satellite called TurkmenÄlem52E/MonacoSat. It was launched by the US-based firm SpaceX, and is operated by the Monaco-based satellite operator Space System International-Monaco.

Developing nations are also not locked into the traditional aerospace industry structure and may have advantages, in part because they can adopt the best historical practices while allowing their industries to develop under current conditions rather than refocusing legacy institutions and companies. A modern analogy is Africa and telephony; nations skipped straight to wireless communication rather than duplicating a landline infrastructure first.

Developments such as these reveal that many of the subsectors of space, including Earth observation, space science and technology, exploration, and even space situational awareness, are beginning to diverge into two segments. The first sector is a government-driven one that develops devices with exquisite capabilities (the James Webb Space Telescope or the Space Launch System rockets) that require hundreds of millions if not billions of investment dollars. The second is a less-capable but also less-expensive consumer-oriented sector. Examples include small launch companies such as Rocket Labs or small satellites such as those being developed by Planet Labs and Spire. This latter segment is often underestimated, as often happens with disruptive innovations. It is, however, globalizing rapidly, making space assets a commodity, focusing on services (as distinct from products and technology), and turning space into just another sector. As more subsectors of space go mainstream, there will be growing numbers of global enterprises, supply chains, partnerships, and competition. This change will have some very specific implications for the United States.

The entrance of new players into space brings an assortment of new challenges that were unimaginable at the height of the Cold War. These challenges are both domestic and international.

Domestically, for example, the emergence of a host of new Earth-observation companies presents unprecedented challenges to organizations such as the National Oceanic and Atmospheric Administration, which implements the Commercial Remote Control Licensing Regime developed when the United States was launching a small number of satellites annually. Now with SpaceX, OneWeb, and other companies planning to launch constellations comprising thousands of satellites, the same system will not work.

Globally, the challenges will be even more complex. The reality of almost 1,400 satellites orbiting the Earth and an increasing launch rate translates into an increasingly “congested, contested, and competitive” space that comprises not just the satellites but also hundreds of thousands of objects larger than one centimeter and several million that are smaller. The guidelines surrounding space debris are currently nonbinding but are interpreted as legitimate standards despite the difficulty in enforcement. Further compounding the challenge of handling space debris is the cost of debris mitigation, potentially staggering for a less-wealthy nation, and the concerns of sharing debris mitigation technologies among other nations.

Today’s space community must also address the hitherto unknown challenges of the loss of electromagnetic spectrum and its effect on rapid data transmission; the lack of global standards and regulations for activities related to serving satellites or other objects on-orbit; the development of deep space mining or in-situ resource utilization; the rise of cyber terrorism; and the legacy of pollution from launches. These challenges, only some of the many now confronting global space powers, require an appropriate response.

Looking further, the sheer number of actors and the diversity of approaches in the sector will ensure that the pace of innovation will accelerate. With the ready commercial availability of an array of hardware and software, and the expansion of satellite manufacturing industries globally, the private space sector is staged for growth. This will make it more difficult for most governments, not just in the United States, to manage the space sector. With countries following varying pathways for space-based activities, common metrics used for assessing the capabilities of a country, such as investment in developing indigenous capabilities, may lose some meaning. As a result, it will be more difficult than ever to assess or predict national capabilities. With more countries and private sector firms operating in space and seeking to take on additional roles by participating in international space organizations, both the domestic and global governance landscapes are becoming more complex. As a result, not only will the United States and other traditional space-faring countries have diminishing control of global decisions related to space activities, but there will likely be greater pressure on them to accommodate the needs of the private sector and emerging space-capable countries.

Policy prescriptions

Assuming that current trends hold—and they may not—within the next 10 to 15 years the US government may no longer be the principal hub of the space community. Given the pace of innovation and its geographic diversity, government may not always be the owner of the most innovative technology, approach, or architecture. There is already evidence of innovation not just abroad (more advanced radar satellites and optical remote sensing in Europe), but also within the US private sector (commercial firms developing SSA algorithms that rival government ones). In addition, as capabilities, resources, and ambitions outside the United States continue to grow, the US government’s traditional approaches to working with partners might have less traction, with fewer partners agreeable to following the US lead unquestioningly. Indeed, they may choose instead to partner with other nations that have begun to develop capabilities comparable to those of the United States. The overarching implication here is that although the United States will likely keep its innovative edge in some areas, in many others it will find its role transitioning. It will sometimes be a customer, at other times a consumer, and almost always a partner.

In light of these implications, US agencies involved in space activities have three choices. They can accept the trends as inevitable, get ahead of them, and pre-position the nation to benefit from them. They can actively fight the trends, by attempting to reverse the situation by starving the emerging private sector to keep the government as the key hub in the space ecosystem. Or they can drift, doing nothing at all, and react on a one-off basis to the trends that immediately affect a particular agency.

The first option is preferable: US policymakers should embrace these trends and thus position the nation to maximally benefit from the transformation under way. In this scenario, the United States would be well served by considering three goals: better leveraging the growing and independently capable private sector and markets outside government; better integrating the growing capabilities and demand outside the United States with US plans; and taking a leadership role in addressing the emerging new challenges. The US government and its space agencies can best reach these goals by making a subtle, but important, shift in posture. Instead of seeing themselves as the leaders in space with all other entities as followers, space agencies would be well-served if they see themselves as catalysts rather than performers, seeding innovation in-house or outside, growing the space economy, and then leveraging outcomes to meet their objectives.

It is important to note that the US government already works extensively with the commercial and global entities outside its realm—and always has. The change that the emerging global trends are prompting is that the government would not just be engaging these outside entities as contractors to help achieve its own goals, it would also be working together more collaboratively to meet everyone’s goals. This will mean that the outside entities come to the table with resources and that they have more power and influence on the future direction of the space enterprise. Many departments and agencies, of course, already leverage external capabilities. NASA, for example, already uses creative contracting mechanisms to engage the private sector in a cost-effective manner to carry cargo to the International Space Station. The challenge is to balance legacy and emerging practices, and to scale up practices that are working well but in isolated “silos,” in order to make them mainstream approaches.

Choosing when and how to leverage outside players is not a trivial matter, and each agency involved in such experimentation would need to establish an overarching rationale for any outsourcing or partnering. Government agencies could, for example, with certain exceptions for strategic reasons, identify external capabilities to do what is more efficient to do outside, such as to launch crew and cargo into low-Earth orbit. They could also use outside capabilities to do what is difficult to do in-house, such as employing a private firm to use a high-risk modular architecture for a journey to Mars. It goes without saying that both would be difficult shifts at agencies with a strong culture of resisting ideas “not invented here.”

As government agencies take on the role of catalysts and leverage outside skills, it is possible that many in-house skills would become redundant when superior skills are found outside, whereas others would become more desirable. Many agencies would need to evolve from being technology-driven to acquisition-driven, becoming entities in which the skill set required is that of scouting for talent and ideas rather than doing the work. This would make them similar to various other mission agencies, such as the Defense Advanced Research Projects Agency and the National Institutes of Health. As a result, many of the agencies would need to evaluate how to best reorganize their structures to fit with their new roles.

To be effective catalysts and force multipliers, space agencies will also need to change the way they find these outside entities or work with them. To find them, the agencies may need to look in new places and to new performers, and invent new mechanisms to work with them. To be able to partner effectively, since now the other sides hold more power, partnerships would need to be on a more equal footing, with government knowing that the other entities (cost sharing or otherwise, companies or governments) would insist on playing roles that fall on the critical path. Agencies would also not be able to create and dissolve partnerships as easily as they could in the past.

In addition to these general insights, we have identified three specific opportunities that would have relevance for all domains and priority areas. First, to leverage funds outside the government, a space agency or department may wish to establish a global space technology incubator (loosely, a focused area of attention) with multiple units. These would include a program for early-stage technology development; an arm to develop innovative systems solutions; a unit to develop and conduct prize competitions and grand challenges to spur innovative efforts; and a venture unit to seed early-stage, emerging space companies. What will make this organization—or sets of organizations, if they are created separately—different from current efforts is that it will include contributions and participants from countries, academia, and private sectors from outside the United States. Designing such an organization, which may even be virtual, may raise challenges in areas such as intellectual property sharing, export control regulations, and taxpayer value, but such challenges have been identified and addressed by other government organizations and can be resolved.

Second, and in the same vein, given growing availability of outside resources, and the core role that the government plays and would continue to play with respect to provision of infrastructure, space agencies or departments should consider developing partnership and funding models so that the best participants in the worldwide space community are attracted to come to the United States, work at its world-class facilities and centers, and participate collaboratively in the design and conduct of science and technology activities. For this organization, the European Organization for Nuclear Research, or CERN, an institute funded by member states that provides particle accelerators and other infrastructure needed for high-energy physics research, is a model.

Finally, and in perhaps the simplest action to initiate, the US government should scale up its space agencies’ and departments’ current ad hoc global technology monitoring functions. Two priorities stand out. As innovation grows around the world, the United States should consider engaging in more automated “horizon scanning,” similar to efforts by the Department of Defense (DOD) and other groups within the intelligence community, to identify where technologies are emerging and how the nation might customize them for space applications. The government should also undertake more “technology forecasting,” especially in specific high-priority areas such as solar or nuclear electric or thermal propulsion. To aid such efforts, the government should look to automation for help. Humans who are expert in individual fields will continue to be expected to be cognizant of the leading efforts in their fields. But given the potential expansion of the diversity of expertise globally and the likelihood that future missions will need to combine expertise in varying and ever-shifting ways, it will be increasingly necessary to develop and use automated tools to identify emerging capabilities and how they might be combined to fulfill mission requirements. Such tools will supplement the deep knowledge resident in government personnel. A community of practice has already emerged, and space agencies and departments should be core members of this community. A model may be within the DOD’s Office of Technical Intelligence, which was created to develop and apply automated analytic tools to analyze global science and technology activities to inform department investments in workforce, laboratory, and research funding.

Learning from the past, ready for wildcards

Taking the steps outlined here would lead to a radical evolution of the space sector. There is a popular pearl of wisdom, attributed to various sources, that reminds us that predictions are difficult to make, especially about the future. In the 1990s, for example, there was much clamor about the development of constellations of satellites to provide telephone and data services. However, beyond a couple of demonstration satellites, none of these systems came to fruition, killed by the telecom bust at the end of the 1990s that sent most of the companies involved into bankruptcy protection and reorganization. Predictions have gone the other way, too. In 1980, the consulting firm McKinsey & Company predicted a cellular phone penetration rate of 900,000 by 2000. The prediction was low by a factor of more than 100.

As efforts to develop and implement policy changes proceed, it will useful to ensure that any changes are alert to “wildcards” that might overturn these trends. Wildcards could be related to technology developments. A dramatic breakthrough, such as perfecting the ability to reliably and cheaply reuse multiple stages of rocket engines or developing specialized carbon nanofibers that make technologies such as space elevators feasible, could dramatically reduce the cost of access to space. Wildcards can also emerge from geopolitical developments. Drastic changes or responses to the Outer Space Treaty or other international rules governing space, or an aggressive weaponization of space, can affect how liberal the US government will be with respect to international collaborations. Other wildcards could come into play. A debilitating space weather disaster or cyber-event that cripples space-based services for an extended period, a space-debris cascading event that degrades use of space, or even the discovery of a large asteroid or comet headed toward Earth may upend the current trajectory.

Even if no wildcards enter the picture in the short term, or policies are designed to be responsive to multiple alternative futures, quick change is not advised. Just because capabilities become available outside the government does not mean that it must necessarily use these outside capabilities. Policymakers need to assess which capabilities are so important that they should not be outsourced, procured, or purchased from the outside regardless of their availability. This strategic thinking would also include examining and planning for the consequences of these decisions. Decisions about whether to “make” something in-house (or with outsiders using traditional contracting mechanisms) or to “buy” a service from outside are likely to be complex and iconoclastic, and will probably have workforce reduction consequences and hence political implications.

Change in the wind

Even if the future isn’t totally predictable, some things are clear. The space sector will continue to undergo transformation as it increasingly, if gradually, breaks free from the confines of the military/government sector restricted to a few space-faring countries. More governments worldwide can be expected to act on their space aspirations by participating in space activities in different ways, and a globalized private sector (even if mostly centered in the United States) will want to provide more space-based products and services. As the number of actors increases, the space sector will likely see increased competition and overcrowding, both literally and metaphorically. This, in turn, will serve as a driver for more products, services, and governance structures that can support the needs of the ever-expanding sector.

It is also clear that this tectonic shift will require the US government to adapt—in particular, by reshaping its space departments and agencies and by leveraging developments beyond their conventional boundaries. Toward this end, the government will need to harness its vision, openness, agility, and risk tolerance; incorporate a well-matched mix of centralized planning and decentralized execution; and expend the required resources to implement these changes.

Luckily, other sectors, such as computing and information technology, have undergone similar changes and may offer some lessons. The integrated circuit, for example, was developed by the military in the private sector (at Texas Instruments) to guide the Minuteman ICBM. Today, the commercial sector controls the integrated circuit market, and the military is, in large part, happy to buy products commercially at low cost and high volume. The space sector would be well-served if lessons from these sectors could be incorporated in its future development.