Emerging Economies Coming on Strong

The Council on Competitiveness released its flagship publication, Competitiveness Index: Where America Stands, last November. While the United States remains the global economic leader, the Index makes the case that its position is not guaranteed. The data and our analysis clearly point to a changing global environment, confirming the need to revisit how the United States will sustain its past position of economic strength and dominance under these new circumstances. The growth of emerging economies will reduce the U.S. share of the global economy, but it is unclear exactly how this will affect U.S. prosperity.

Two issues in particular must factor into the calculus as we proceed:

• Knowledge is becoming an increasingly important driver of value in the global economy. A larger share of trade is also captured by services, and a larger share of assets and investments is intangible. This shift to services, high-value manufacturing, and intangibles creates more opportunities for the United States with its traditionally strong position in knowledge-driven activities and an already high stock of tangible as well as intangible assets.

• Multinational companies are evolving into complex global enterprises, spreading their activities across value chains over different locations to take advantage of regional conditions and competencies. This process creates more competition as regions now must prove their competitiveness in order to attract and retain companies and investments. For the United States, it begs a fundamental rethinking of how states and localities strategize and execute economic development activities.

The United States will almost inevitably be a smaller part of a growing world economy due to the structural changes under way across the globe. However, there is no reason why the United States cannot retain its position as the most productive and prosperous country in the world.

The coming economy will favor nations that reach globally for markets, and those who embrace different cultures and absorb their diversity of ideas into the innovation process. It will be fueled by the fusion of different technical and creative fields, and thrive on scholarship, creativity, artistry, and leading-edge thinking. These concepts are U.S. strengths. These concepts are the nation’s competitive advantage. These concepts are uniquely American—for now.

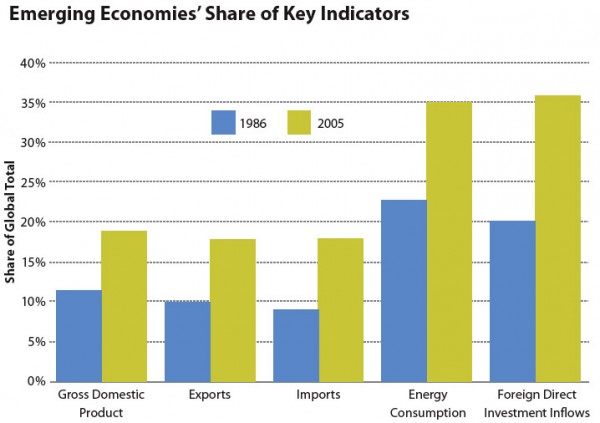

Growing share of the global economy

In the past five years, China, India, and Russia, together with other fast-growing economies mostly in Asia and Latin America, have averaged almost 7% growth compared with 2.3% in rich economies. According to Goldman Sachs, by 2039, Russia, India, China, and Brazil together could be larger than the combined economies of the United States, Japan, the United Kingdom, Germany, France, and Italy. China alone could be the world’s second-largest economy by 2016 and could surpass the United States by 2041.

Source:World Bank, UNCTAD, U.S.Department of Energy, EIA

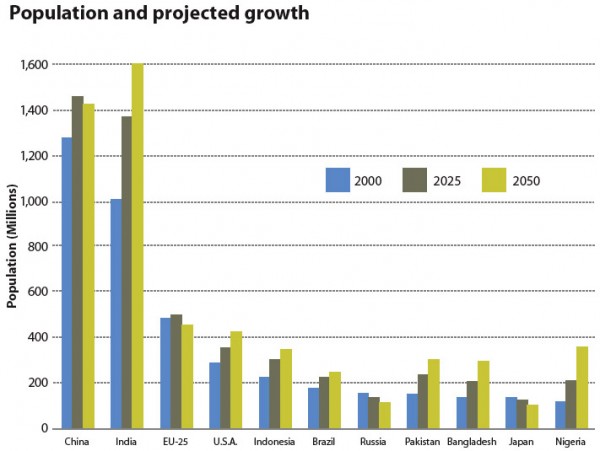

Most populous and still growing

Fast-growing populations and economies are translating into a large worldwide increase in middle-income consumers. While industrialized countries will add 100 million more middle- income consumers by 2020, according to projections by A.T. Kearney, the developing world will add more than 900 million, and China alone will add 572 million.

Source: U.S. Census

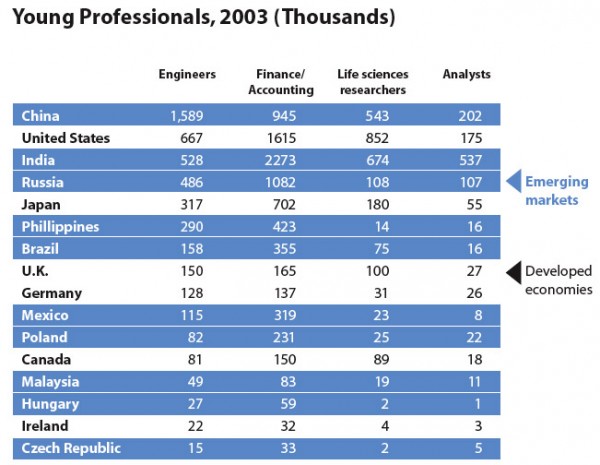

Large professional workforce

In a sample of 28 low-wage countries, the McKinsey Global Institute found about 33 million “young professionals” (university graduates with up to seven years experience), compared to 18 million in a sample of eight high-wage countries, including 7.7 million in the United States. However, McKinsey found that only 2.8 million to 3.9 million of the 33 million in low-wage countries had all the skills necessary to work at a multinational corporation, compared to 8.8 million in high-wage countries.

Source:McKinsey Global Institute, The Emerging Global Labor Market: Part IIÑ The Supply of Offshore Talent in Services (June 2005)

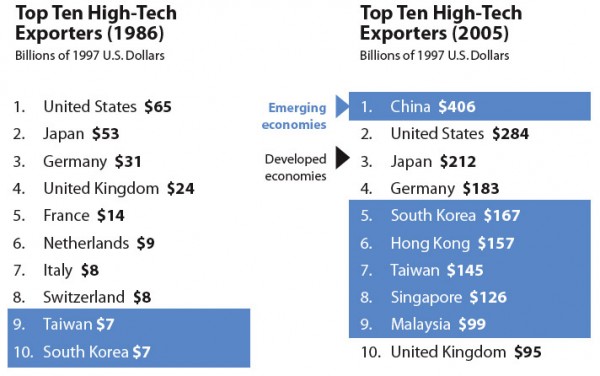

Technology export leaders

Foreign multinationals have played a critical role in the development of advanced technology capabilities in emerging economies. For example, 90% of China’s information technology exports come from foreignowned factories. The United States, still the world’s largest overall producer of advanced technology, now has a trade deficit in this area, in part because U.S. technology firms have expanded production globally to meet both foreign and domestic demand.

Source: Global Insight, Inc.

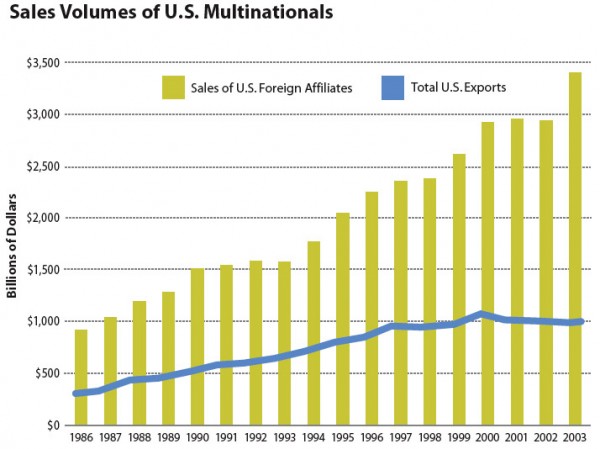

U.S. foreign operations outpace exports

Despite their global expansion, the activities of U.S. multinationals are still overwhelmingly based in the United States. The U.S. share of their total employment, investment, and production has changed relatively little even as globalization has accelerated. The primary motivation for moving production offshore is to search for new customers. Overall, 65% of U.S. foreign affiliate sales are to the local market, 24% to other countries, and only 11% are exported back to the United States. Foreign multinationals have played a critical role in the development of advanced technology capabilities in emerging economies. For example, 90% of China’s information technology exports come from foreign-owned factories. The United States, still the world’s largest overall producer of advanced technology, now has a trade deficit in this area, in part because U.S. technology firms have expanded production globally to meet foreign and domestic demand.

Source: U.S. Bureau of Economic Analysis

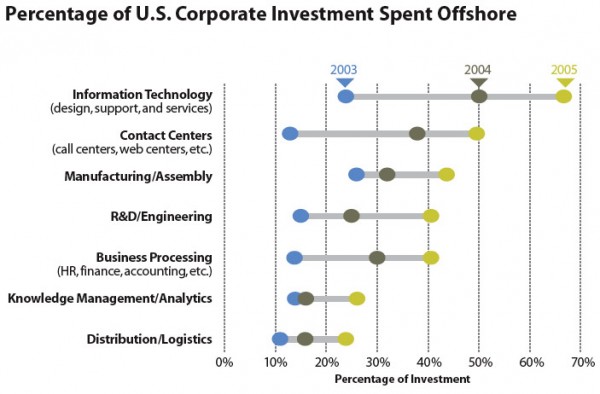

Steady increase of offshore investments

For decades, multinational corporations have set up foreign subsidiaries to perform manufacturing and assembly for overseas markets. In recent years, this model has evolved, as companies have developed global infrastructures that allow them to locate other business activities—from customer services and computer programming to R&D—nearly anywhere in the world.

Source: A.T. Kearney, Foreign Direct Investment Confidence Index (2005)